If you don’t know how much you can borrow or what your property budget is, then how can you start the process of searching? With setting a property budget, there’s a fine balance between your deposit, serviceability and borrowing capacity. So where do you start when working this out?

In this piece, I’m going to show you how having a property budget helps you purchase your next home without any regrets. Whether you’re a first home or NEXT home buyer, you are ALWAYS limited by how much you can borrow OR how much of a deposit you have.

If you borrow too much or contribute TOO LITTLE of a deposit, you risk HIGH ongoing repayments that restrict your lifestyle and other financial goals. This is especially important during times of rising interest rates like we’re experiencing right now. BUT if you do the opposite and borrow too LITTLE or contribute too much of a deposit, you risk depleting your cash buffer to ride out any unforeseen circumstances.

So there’s a real balancing act to make sure you’re yielding the most out of your capital without either putting yourself under financial stress OR burning through too much of your cash.

So how on earth do you decide? Luckily, there are a few steps you can follow to ensure you set the right budget from the beginning.

Determine Your Non-Negotiables

The first step is to determine the things that are not negotiable, or in other words, your limits. These are YOUR PERSONAL repayment budget and your savings buffer.

Your repayment budget is the amount you feel comfortable repaying each month.

The higher the repayment is as a percentage of income, the less you have to maintain the lifestyle you want and save for other financial and investment goals.

Everyone has their unique circumstances and comfort levels. But generally when a household is spending more than 30% of their pre-tax income on their home loan repayments, it’s defined as mortgage stress.

On the other hand, your savings buffer is the amount of cash you want to have left over, after the purchase.

There is no set amount because again, everyone has their unique circumstances to consider, but a common rule of thumb is the 3 or 6 month rule, where you hold at least 3 to 6 months’ worth of expenses and repayments as a savings buffer.

Engage an Experience Mortgage Broker to Determine Your Borrowing Power

The next step is to engage an experienced mortgage broker, like us.

Brokers can confidently guide you through figuring out your borrowing capacity and the deposit required without submitting an application so there is no unnecessary mark on your credit file.

This is particularly useful because we often see that buyers are surprised to find that they are only able to borrow less than their originally calculated personal repayment budget.

This is because lenders assess in terms of the actual interest rate plus a buffer. And just for reference, the buffer at the time of writing is 3%, meaning if the actual interest rate is 5% then you are being tested at 8%.

The opposite can happen too though and you may be surprised you can borrow more than your personal repayment budget.

But as we said earlier, your repayment budget is a non negotiable, so if it is lower it would overrule the borrowing capacity.

Now that you know your personal repayment budget, and how that compares with your borrowing capacity, and you have locked in your savings buffer, the deposit you need will come naturally.

Let’s go through an example to show this advice in action.

Example 1 – Double PAYG Income, One Dependant

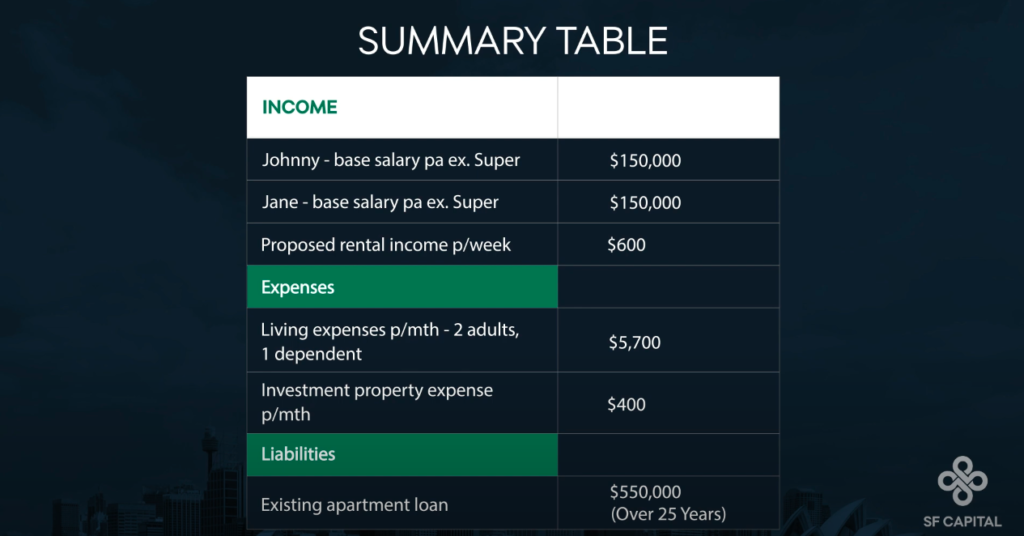

Johnny and Jane both earn a before tax salary excluding super of $150,000 each, so they have a combined household income of $300,000. They are married with one dependent, have $405,000 in savings and their goal is to upgrade their current apartment to a house. Their current apartment has an outstanding loan of $550,000 with 25 years loan term remaining. If rented out, the proposed rental income would be $600 per week. They have no other liabilities.

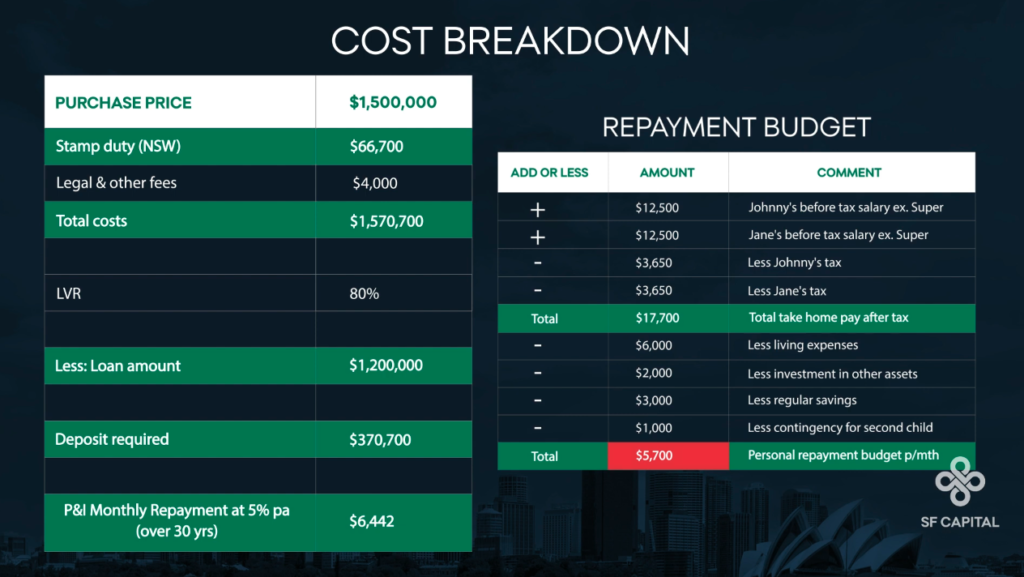

To calculate their repayment budget we start with their take home pay after tax which is $17,700 p/mth.

After factoring in $6,000 for living expenses, $2,000 for regular investment in other assets, $3,000 of regular savings, plus $1,000 contingency savings for their plans for a second child, they have calculated a personal repayment budget of $5,700 p/mth.

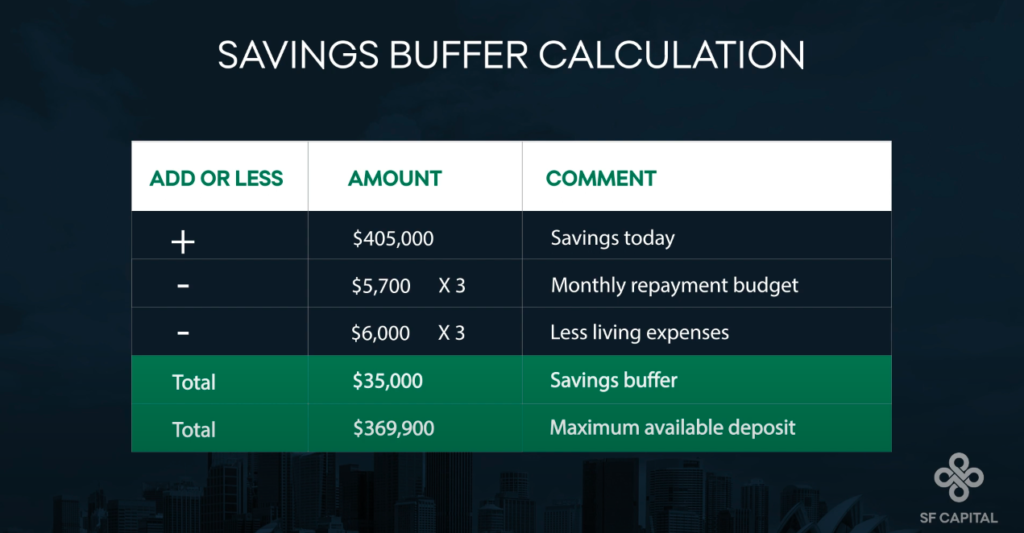

Johnny and Jane are both experienced professionals with stable employment. So they have decided they’re comfortable with a 3 month savings buffer.

To calculate this, they add their monthly repayment budget of $5,700 to their monthly living expenses of $6,000 and multiple by three which equals $35,000 – this is their savings buffer.

As they have $405,000 savings today, deducting the $35,000 savings buffer gives them an available deposit of just under $370,000.

Deriving the Property Budget

Next Johnny and Jane speak to an experienced broker.

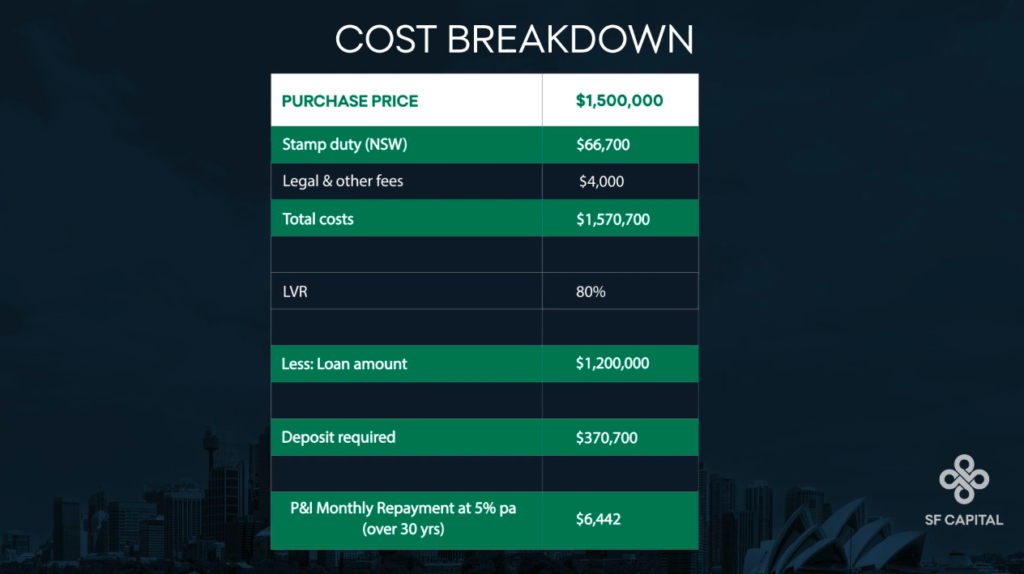

Johnny and Jane are advised their borrowing capacity is $1.2M to $1.35M depending on the lender, and assuming their current apartment is converted to an investment property.

With $1.2M of borrowing capacity plus an available deposit of $370,000, they could achieve a purchase price of $1.5M.

This is reconciled as the $1.5M purchase price plus stamp duty and solicitor fees less the $1.2M loan amount which equals a deposit they can just cover with their maximum available deposit of $370,000.

Adjusting the Property Budget to Match Repayment Budget

However, for a $1.2 million loan at the current average rate of 5% pa, the monthly repayments would be over $6,400 p/mth, this exceeds their repayment budget by more than $700 p/mth.

So instead, they revise the loan amount down to $1.043M which has repayments of $5,600 p/mth.

Together with their $370,000 deposit, they aim to purchase at up to $1.35M instead of $1.5M.

This is calculated as the $1.35M purchase price plus stamp duty and solicitor fees minus the $1.043M revised loan amount which equals to a deposit required just under their maximum available of $370,000 with a monthly repayment under 100 dollars their budget of $5,700.

Just like that, there is the property budget to purchase without any regrets! So, when you want to set a property budget, make sure to engage an experienced broker like SF Capital early in the process. We will help you determine your borrowing capacity and the deposit required, then put this into perspective with your personal repayment budget and savings buffer. Finally, we will match the right lender to these figures and your ideal property.

Happy property budgeting!

Speak to a Broker

If you have any questions or comments on this topic, you are more than welcome to get in touch with me () or anyone in our broking team.

For more tips on getting your next home, please stay tuned or head to our Youtube channel – “The Next Home Series“