Are you a Business Owner who is currently renting your business premises, and thought to yourself – What if I could buy my own Commercial Property? Perhaps you’re thinking – If I can afford to pay the rent, surely I can afford to buy the property! While the ability to pay the rent is a major consideration, it is not the only consideration. In this post I answer the question – How can I get a loan to buy my business premises?

Here I outline the key criteria you need to satisfy before applying for a Commercial Property loan:

- How much deposit is required for a commercial property?

- Can you afford the loan repayments given a shorter loan term of a commercial property loan?

- The bank applies a higher assessment rate when assessing your loan application and to test whether you can continue to afford loan repayments.

- The bank also wants to know if you can continue to maintain existing personal debts after taking out the commercial property loan.

1. Deposit requirements for a Commercial Property

From my experience, the first item that stops a business owners from purchasing a Commercial Property is the size of the deposit required.

Unlike a home purchase, which can require a deposit of 10% or less, the deposit required for a Commercial property typically starts at 20% but is more like 25-35% for a standard commercial purchase. This can even be as high as 50% for a highly specialised or remotely located asset.

Taking a $2M property and a 25% deposit as an example, many business owners also think that the upfront cash required is only $500,000.

This is not correct.

You will also need to budget in the transaction costs. So for a $2M purchase you will also need to incur these upfront costs:

- Stamp Duty of $95,000;

- Valuation & Legal Fees of $5,000; and

- Lender Establishment Fees of up to 1.0%.

These all add to the initial outlay of buying a Commercial Property, which make a $2M property cost $2.115M!

You may also have to pay GST if the property is bought with vacant possession. You should speak to your accountant or lawyer, so you can understand if you need to budget these upfront costs into the property purchase.

2. Loan Repayments for a Commercial Property

The second factor to consider before applying for a loan to buy your business premises is whether you can actually afford the repayments.

While it is generally true that an Interest Only loan repayment may be comparable to the current rent that you are paying, a Principal and Interest (“P&I”) loan repayment may not be!

This is especially the case due to the shorter term nature of Commercial Property Loans.

Access our Repayment Calculator to work out the Interest Only or P&I repayments on your next commercial property loan.

Where a bank may give you 30 years to repay your home loan, a Commercial Property loan set to P&I repayments may only be 25 years, 20 years or even less!

This means for a Commercial Property Loan, you have less time to to repay the same amount of money compared to a normal Home Loan.

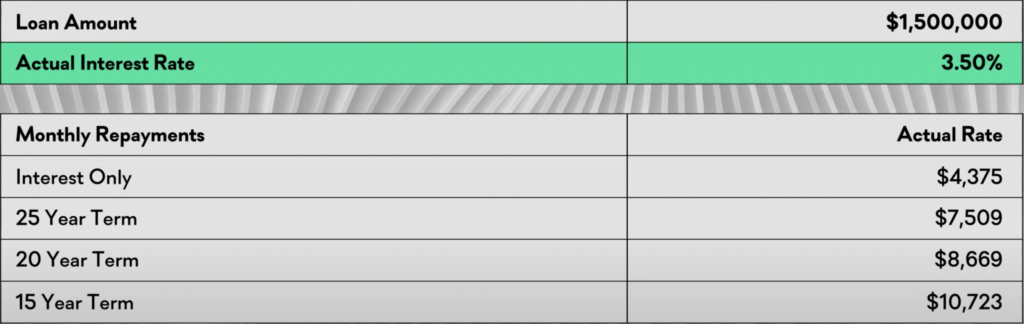

Going back to our example, assuming a 3.5% Interest Rate:

- The Interest Only repayments on $1.5M are indeed quite affordable at $4,375 per month

- However, the P&I repayments assuming a 25 year loan term are $7,509 per month

- And on a 20 year loan term are $8,669 per month

- And even higher on a 15 year loan term.

So when deciding if you can truly afford the loan repayments for a Commercial Property, you need to consider these factors:

- Whether you are only maintaining the loan, that is, paying Interest Only;

- Or you are paying down the loan and owning the property outright over time, that is, paying P&I;

- As well as the time you will agree to pay back the loan e.g. 25 years, 20 years or 15 years.

3. Assessment Rate

The third factor when considering getting a loan for your business premises is your Assessment Rates.

Just because you think your business can afford the loan repayments, doesn’t mean the bank thinks the same.

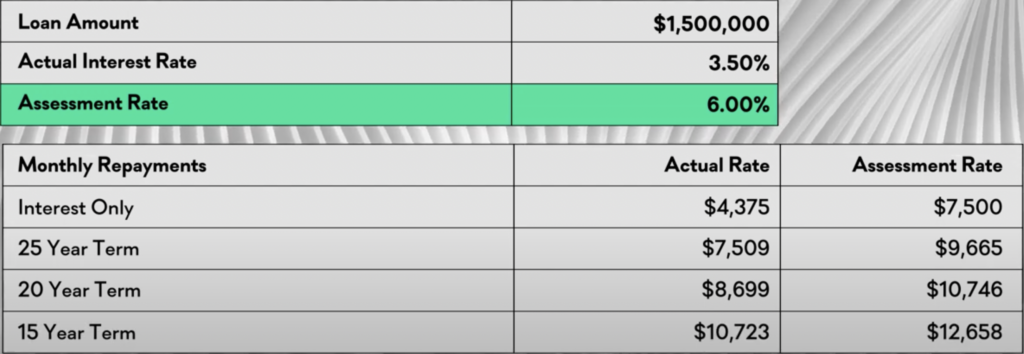

This is because a bank adds a loading to your actual interest rate to test your loan servicing and what they call “Assessment Rate”. This is typically 2-3% higher than what your actual interest rate will be.

The bank does this to make sure you can continue to afford making your loan repayments should interest rates rise, as well as to protect the bank should you experience a downturn in your business.

So applying an Assessment Rate of 6%, which is a 2.5% loading to the previous interest rate of 3.5%, you can see how your loan repayments are tested at a higher amount when looked through the eyes of the bank.

- An Interest Only repayment is now $7,500 per month

- A P&I loan repayment on a 25 year loan term is now $9,665 per month

- For a 20 year loan term, $10,746 per month

- And for a 15 year loan term: $12,658 per month.

4. Existing Debts

The fourth and final consideration when taking out a Commercial Property Loan, is can you continue to also pay your existing debts?

Similar to how a business loan impacts your personal borrowing capacity, your personal loans, including your home loans, can impact your business’ borrowing capacity.

As we’ve seen in previous videos, as a Business Owner, your income and your Business’ profits are so closely connected that you can choose to use the profits of your business to pay down your personal debts should you choose to.

This means the bank wants to make sure that when you take out a Commercial Property Loan, you are not impairing your ability to make your home loan repayments, or impairing your ability to pay any existing loans within your business for that matter e.g. car loans, equipment loans or any overdraft facilities.

Basically, the bank does not want to see you on the street for the sake of a Commercial Property!

If you want to read up more on getting into Commercial Property, head over to my guide titled “How to Invest in Commercial Property“.

Speak to a broker

Thank you for reading and please stay tuned for more finance tips for business owners.

If you have questions or comments on this topic, you are more than welcome to get in touch with me on <> or the SF Capital broking team.