In terms of yield and cash flow, Commercial Property can offer greater returns compared to Residential Property investments. For investors looking who diversify their real estate portfolio, Commercial Property is an alternative asset class to Residential Property.

We have put together a guide on everything you need to know about investing in commercial property. We will explain:

- What is considered a Commercial Property

- What are the different types of Commercial Property for investment

- Is investing in commercial property right for me?

- Comparison between investing in commercial vs residential property

- What are eligible loan purposes for a commercial property loan?

- How are Commercial Property Loans Different from a Home Loan?

- Why should I use SF Capital for my next Commercial Property Investment?

1. What is considered a Commercial Property?

Commercial Property is basically anything that is not considered by a bank to be a residential property.

Typically it is a premise which some form of business is run out of, or alternatively, the rental operations are of a scale that it is deemed by the bank to be business in nature e.g. renting out a block of units.

Ultimately, council zoning will determine if a property is commercial in nature.

2. What are different types of Commercial Property For Investment?

While residential properties are classified as either houses or units, there are many categories of Commercial Property. The following are asset types common to real estate investors:

i) Common Types of Commercial Property

The most common types of Commercial Property include:

- Commercial Office – these are premises usually for professional services, corporate offices, or where goods sold are not bulky, and the business does not require pedestrian foot traffic to be found. They can also include educational institutions, societies or government organisations. Commercial office is usually graded into A, B or C Grade, and also categorised as CBD, CBD-fringe or suburban.

- Commercial Retail – these are showrooms and shopfronts, they can be in ‘strip mall’ locations such as Oxford Street in Paddington or King Street in Newtown. Alternatively they may be in small regional shopping centres or neighbourhood shopping precincts. Restaurant locations are usually classified retail in nature despite overlapping with hospitality. Retail spaces in large retail spaces such as a Westfield or Stockland are owned by large publicly listed companies or institutional investors. Bulky goods centres or large display rooms may double up as warehouses and tend to overlap with industrial property.

- Industrial Properties – Factories & Warehouses – these are premises that produce, store or display physical goods, either in large quantities or of a bulky nature. Industrial properties are typically storage facilities or large open areas which are either fitted out or laid out for a specific purpose – for example, a production line, the setting out of work stations, food processing, or palletisation & of finished goods. Industrial properties are usually found in precincts or clustered together away from residential dwellings, but close to main arterial roads and modes of transport.

- Blocks of Units or Developer Residual Stock – Residential loans can only be considered for a certain number of dwellings in the same unit or apartment block. Where the number of dwellings held exceeds that threshold (usually 4 – 6), banks deem the properties commercial in nature even though individually they are residential properties. This applies to small blocks of units held by the same owner or unsold apartments in large development, held by a developer.

- Mixed Use Properties – these are properties that have both residential and commercial tenancies but are on the same title. For example the ground floor may be a shopfront but the top floor may be rented out as a home. These properties overall are categorised as commercial by a bank.

ii) Specialised Commercial Assets

Commercial Property also features a range of specialised assets that cater to a specific purpose or customer base.

Specialised Commercial Assets can include:

- Hotels / Motels – premises that offer accommodation, and may also serve food and alcohol

- Pubs & Clubs – these are community premises that serve alcohol at a larger scale (e.g. beer on tap serviced by kegs), often have a bistro attached, and may also have poker machines available

- Childcare Centres – these are premises that care for children during work hours

- Petrol Stations – these are premises that sell petrol with a small retail offering attached. They may also offer motor vehicle servicing

- Churches and places of worship – these are religious buildings, or office or warehouse spaces re-purposed for religious worship

- Agricultural Properties – these are large premises, regionally located, where agricultural activities are conducted for the purposes of making a profit e.g. the raising and selling of livestock, growing of crops for sale.

Specialised Commercial Property can attract different policies from standard Commercial Property, and these policies are different across lenders.

3. Is investing in a commercial property right for me?

For many, buying a commercial property is the next step in their investment or business journey.

For Investors

Purchasing a commercial property is for experienced property investors who have typically:

- Built up a strong base of residential properties

- Accumulated equity in their property portfolio, or at least their home

- Looking to diversify their portfolio

- Seeking higher returns, and are willing to take on more risk to achieve it

- Looking to take on larger projects or build on their current property investing skills

For Business Owners

A business owner looking to purchase a commercial property typically:

- Has built up their business over many years – the business is established and profitable

- The business also is cash flow positive and has meaningful surplus cash flow to be able to afford taking on a Commercial Property loan

- They have built up equity in cash, their home or elsewhere – this could reside in the value of the business itself

- Wants to control their own destiny – they no longer want to negotiate with their landlord or have to move their premises again

- They may also be looking to take their business to the ‘next level’ by creating a unique fit-out, or purchasing a space they could ‘grow into’’.

4. Comparison to buying a residential property

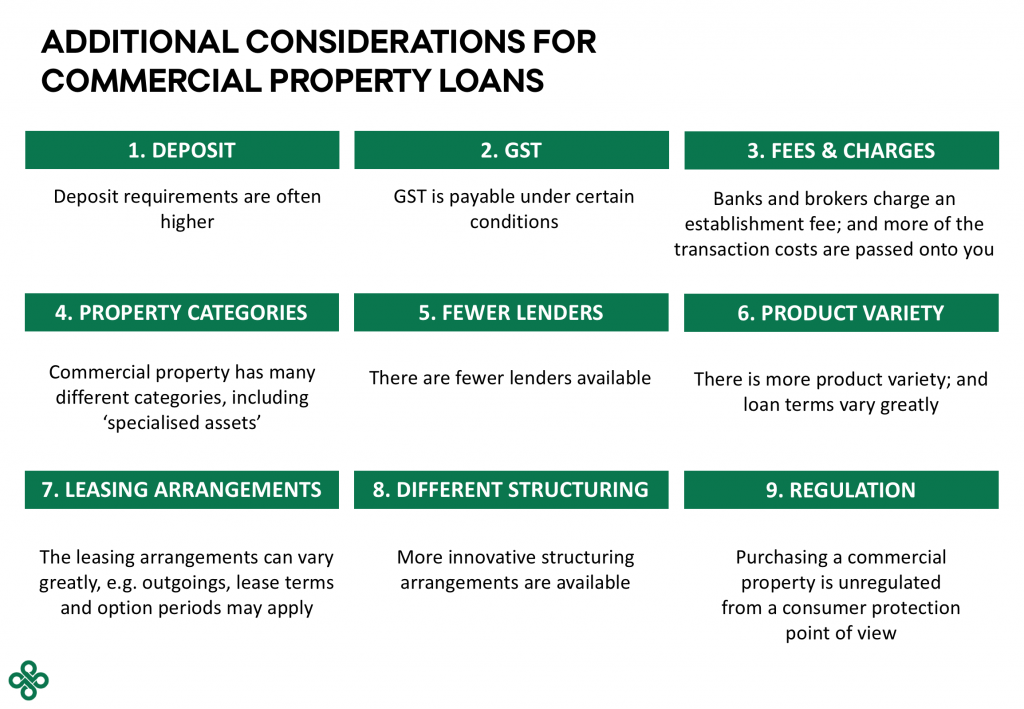

While the skill set and knowledge from buying a home or residential property is transferable, purchasing a commercial property has many additional considerations. There are 9 additional areas that investors need to take into account.

- Deposit requirements are often higher for Commercial Property

- GST is payable on a Commercial Property under certain conditions

- Banks and brokers charge an establishment fee to arrange the finance, and more of the transaction costs are passed onto you such as valuation and legal fees

- Commercial property as we’ve seen above, has many different categories, including ‘specialised assets’

- There are less lenders available who can finance commercial property, and making it even more important to get your ducks lined up and your application approved the first time

- While there are less lenders, there is more variety in loan products available, and loan terms vary greatly from anything from 6 months for a private loan to 30 years for a non-bank commercial loan

- The leasing arrangements for commercial property are very different – outgoings are subject to negotiation, lease terms are usually set in years, and option periods may apply

- More innovative structuring arrangements are available to you such as purchasing the property in a separate entity to your business, or your SMSF.

- Purchasing a Commercial Property is unregulated from a consumer protection point of view

We will go through these criteria in detail, in particular looking at the deposit requirements and costs of purchasing a commercial property. We will also look closely at different lending options available.

5. What are eligible loan purposes for a commercial property loan?

A Commercial Property loan can have multiple purposes. As long as a Commercial Property serves as security, a bank allows the loan to be used for a variety of purposes that relate to business or investing. These include:

- Owner Occupied Commercial Property – This involves purchasing the business premises from which you operate. Where a business is looking to purchase a property for occupation, banks are willing to be more generous with their terms, by lifting loan-to-value ratios and / or reducing serviceability requirements.

- Commercial Property Investment – As mentioned, experienced investors often look to commercial property to achieve a higher yield or for diversification in their property portfolio. Here the owner’s relationship to the property is to manage the property and collect an income stream. Because the investment is passive in nature, banks tend to impose tighter lending standards for Commercial property, especially in tight credit markets or a declining economy.

- Working Capital Loan – A business needs funds to operate while it waits to collect cash from goods sold or services provided. For example, while a business is waiting for revenue to be received as cash, it will need to pay staff wages and salaries, rent and the other running costs of the business (buying more inventory, marketing, staff expenses etc). This “working capital” requirement of a business can be funded in the short term from a loan, usually in the form of an Commercial Overdraft of Commercial Line of Credit. Banks are more willing to lend these facilities when it is secured by a Commercial Property or a home.

- Business Expansion – A business may have growth plans which requires additional funding to invest in or execute on those plans. Rather than seeking funds from the owners / shareholders, a loan can be secured against a Commercial Property, which will also have a lower cost of capital. Importantly, a bank will still scrutinise the business plan and the businesses existing cash flows must be able to support the loan i.e. the business must be profitable before taking on the new loan.

- Business Acquisition – Similar to Business Expansion, a Commercial Property Loan can be used to facilitate the purchase of another business. Unlike a business growth plan, where the returns are speculative an existing business will have historical financials which can be reviewed for loan servicing. The combined financials of the company and the business to be acquired can be assessed to support a loan.

- Consolidating business debts – A business may be constantly maxing out on short term debt facilities such as its Overdraft, Line of Credit or Business Credit Cards. This suggests that these loans have become long term in nature, otherwise known as “hard core debts” of the firm. A Commercial Property can be used as security to consolidate and refinance these debts onto better terms, usually with much lower interest rates and a longer loan term.

- Property Development – Construction Loans are also handled by the Commercial Property team within a bank.

- Cash Out for Investment – Equity in a commercial property can be extracted via a “cash out” and used to help build the personal investment portfolio of the property owner. Investments may include the purchase of another commercial property, residential property, investment in shares, or a general contribution into super.

One grey area is whether equity in a commercial property can be used to help buy your home. This is lender dependent, as some lenders are comfortable with this purpose and others are not.

6. How are Commercial Property Loans Different from a Home Loan?

As Commercial Property Loans are taken out by business owners and experienced property investors, they are more sophisticated than a standard Home Loan in many ways:

Deposit & Fees

Deposit – A commercial property purchase requires a larger deposit of between 20-50% depending on the security type and the strength of the borrower. Unlike a home loan, there is no Lenders Mortgage Insurance (LMI) in a commercial loan.

Fees – A Commercial Loan can incur more fees than a home loan. Usually the valuation fee and legal fees and are passed onto a borrower, whereas they are absorbed by the bank for a home loan. The bank will also charge an establishment fee to remunerate the lender for the extra work done to arrange a commercial loan. This is in addition to the interest rate and any ongoing fees charged.

Interest Rates – Commercial rates can be higher or lower depending on the type of deal involved and the strength of the borrower. For example, for a commercial owner occupied premises where the LVR on the property is low and the occupying business is highly profitable commercial rates can be lower than a home loan. By contrast, if the loan is with a non-bank or lender because the client’s tax returns are not up to date and a specialist loan or the loan is needed urgently, interest rates will be much higher than a home loan.

Line Fees – Commercial interest rates can also be broken up into three parts (1) the Bank Bill Swap Rate, noted as BBSY or BBSW (2) the bank’s “margin” on this rate and (3) a Line Fee. The Line Fee is an interest rate charge on the whole limit of a commercial facility, and charged by the bank for setting funds aside for a commercial property. It is charged regardless of whether the whole loan is drawn down, whereas the Bank Bill Swap Rate and Margin are only charged on funds used.

Loan Features & Product

Loan Term – Loan terms offered on commercial loans are usually much shorter than on home loans. Shorter term Commercial Loans are usually for 2, 3 or 5 years and are usually better priced than longer term loans, as the bank has more certainty on making the funds available to you at a known price. Most banks (usually the “majors” or “big four”) will charge a higher rate for loan terms that are 15, 20 or 25 years, especially if the loan is over $1 million. Smaller banks (e.g. ING or Suncorp) or non-bank lenders (RedZed, ThinkTank) are more inclined to offer longer loan terms of 25 to 30 years. Private Loans have very short terms of 12-24 months, and are often used as bridging loans before a property is sold or refinanced.

Lender Choices – While there are more home loan lenders in the market by number, the commercial lenders in the market serve a broader set of purposes. Similar to home loans, Commercial Loans have bank lenders (e.g. CBA, Westpac, NAB, ANZ, Macquarie, etc) and non-bank lenders (Liberty, Latrobe, Pepper etc). However Commercial Loans are also offered by Private Lenders where the money is lent by wholesale and sophisticated investors. Private Lending is usually for situations where funding is needed quickly, there is sufficient equity in the property to protect the lender, and there is a credible “exit strategy” for the loan either by selling the property or refinancing.

Loan Structure – Similar to home loans, commercial loans can be fixed or variable, interest only or principal & interest. However, the security structure can vary greatly. Usually a Commercial Lender will require personal guarantees from the Directors of a Business and a General Security Agreement (GSA) or “charge” over any businesses or entities related to the loan.

Loan Products – Commercial Loans have many classifications according to their purposes (as above). They can also be classified as Full-Doc, Lo-Doc, Alt-Doc or Specialist Loans, as well as Private Loans from Private Lenders. Commercial Loans can also be Term Loans which reduce or “amortise” over a period, Lines of Credits, or Commercial Bills which are repriced or “roll” ever 30, 60 or 90 days.

Loan Features – Unlike Home Loans, Commercial Loans usually do not have an offset account. However if they are a term loan, a redraw facility is usually available allowing the loan to be paid down in advance, and the funds drawn back out at a later date. If the loan is Commercial Bill, there is no redraw available.

Process & Timing – Commercial Loans go through a much stricter credit process, especially if the loan is full-doc with a major bank. When they are assessed, it is usually hard to have the loan approved the first time. There are usually rounds of question and answer by the credit officer, until the bank is satisfied that all credit concerns are resolved. This often makes Commercial Loans a lot longer to approve with a bank, and why some borrowers prefer to go with a non-bank or in some cases, Private Lender.

Other Considerations

Early Termination Fees – Some Commercial Loans can incur fees or penalties if the loan is closed out early. This is because the lender needs a minimum return on their money, in light of the work completed to establish the loan, as well as commitments given by the lender to their investors.

Regulation – Commercial Loans are typically ‘unregulated’ and do not fall under National Consumer Credit Protection (NCCP) Legislation. Usually a borrower will sign a declaration confirming that a loan is for a commercial purpose, thereby waiving their rights under NCCP.

7. Why should I use SF Capital for my next Commercial Property Investment?

At SF Capital, we will go the extra mile to help you with your Commercial Property needs. We offer several advantages and points to the bank yourself or considering other broking firms.

i) Expertise – We are passionate about business and specialise in helping business owners. We understand how to read complex financials, understand how businesses are structured, and work hand in glove with your accountant to get you the best result.

ii) Experience – We have settled many Commercial Property Loans of varying sizes and degrees of difficult. We have assisted with small office refinances to large commercial purchases, property development and residual stock loans. We are highly experienced in full-doc, alt-doc / specialist, and private lending.

iii) Process – We run a tight process that keeps you informed, and leaves nothing on the table to ensure you get the best deal for your Commercial Property loan. This involves firstly intimately understanding your financials, preparing a detailed credit paper which makes your case, and then brokering your loan out to our lender panel to obtain offers for you.

iv) Save Time – Our process saves you time, as we present all information a lender requires to evaluate your scenario upfront. We also manage the back-and-forth with the bank for you, so you can keep focused on running your business.

v) Secure the Most Competitive Deal – Our process also entices lenders to “compete” for your deal and offer the best terms. Essentially we run an efficient tender process which encourages lenders to put their best foot forward, as well as manage the negotiation on your behalf to secure you the most competitive loan terms.

Contact us for assistance

To speak to the SF Capital team about obtaining a commercial property loan, please contact us on +612 8004 1888 or .