Introduction

A construction loan is one set up for the purpose of building a new home or substantially renovating an existing home where structural renovations are required. The financing of the purchase and construction of a property takes place in two steps, because there will be one loan for the purchase of land and another loan for the construction work.

Building a new home has its complications, and our goal as your broker is to make the process as simple and hassle free as possible for you. In this article, we outline the essential steps to obtaining construction finance. However, it is important to seek the advice from your banker or broker first, because of the documents relating to the building plan that will be required to make a loan application.

Loan 1. Financing the purchase of land

The steps to purchase and finance the land are the same as buying an established property. That is the same supporting documents, approval and settlement processes apply. The loan for the purchase of land is known as the “land loan”.

If the property being built is an investment property, it is important to note that the projected rental income cannot be used for servicing where a vacant block of land is being purchased.

The construction loan is applied for after the land loan has settled and is a separate loan. The only exception to this is where a “house and land package” is being sold. In this instance, the land loan and construction loan may be financed by the same loan.

Loan 2. Financing the construction of the property

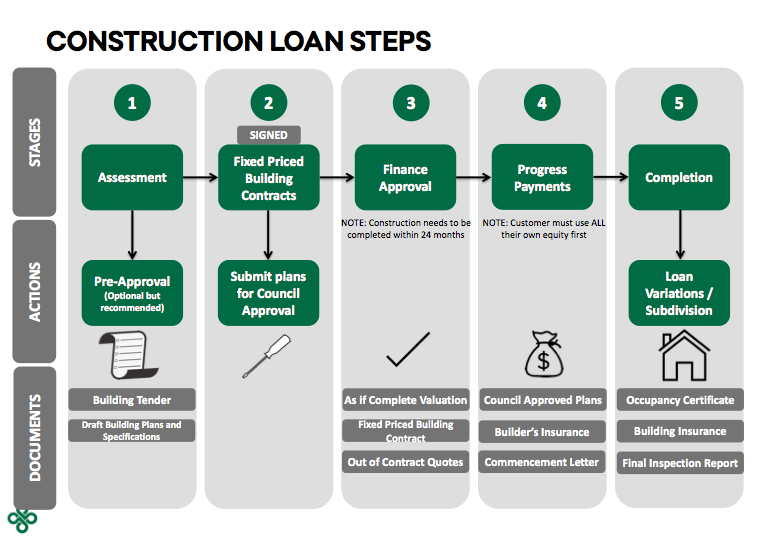

There are 5 steps to financing the construction of a home i.e. setting up the “construction loan”.

Step 1. Loan Submission

The bank will assess whether you can afford the construction loan and whether you have a large enough deposit to contribute towards the construction costs.

Like a home purchase, this deposit is typically 20% to avoid LMI and the bank will require this to be contributed first before it will fund the remaining construction costs.

In addition to standard supporting documentation, the bank will also request:

- Building tender i.e. builder’s fixed price proposal to you

- Building plans

- Building specifications e.g. laminate vs granite benchtops

- Out of contract items – quotes for any works not covered by the builder e.g. landscaping, driveway, swimming pool

Step 2. Conditional Approval and As-if-complete Valuation

If satisfied with the documentation, the bank will issue Conditional Approval and order a valuation “as if” the property was complete.

Here an independent valuer looks at the land and adds the plans to calculate the “as if complete” value.

Please be prepared that some valuations come in slightly lower. This is ~5 – 10% in our experience unless the land has been held for a long period of time.

Any shortfall in valuation will need to be made up from personal funds.

Step 3. Finance Approval

Once the valuation is returned and other conditions are resolved, the bank will issue Formal Approval.

At this stage, loan documents will be generated and will need to be signed and returned to the bank.

With the return of signed loan documents, the bank will also request:

- Signed and dated fixed price building contract, containing the progress payment schedule

- Council approved plans – this is usually the hold up before commencing construction

- Builders Insurance – this is standard documentation which the builder should easily provide

Once these documents have been satisfied, the bank will issue to the builder a Commencement Letter and will be ready to fund construction.

Step 4. Progress Payments

As mentioned earlier, the first 20% towards the construction is funded personally, not by the bank. There are cases where less than 20% can be contributed, such as when the land has risen in value to reduce the overall LVR below 80%.

After paying the first 20%, the builder will begin to invoice for additional work completed according to the fixed price payment schedule in the building contract.

At each stage, SF Capital will prepare an authority form for you to sign. Once signed this is provided to the bank who will then fund the progress payment.

With each progress payment the loan increases, and repayments on an interest only basis will start to be paid on the loan.

Step 5. Completion

The property is officially complete when the last progress payment is paid and an Occupancy Certificate is released.

A final valuation is ordered before the bank pays the final progress payment.

Once the Occupancy Certificate is released and the loan is fully funded, you or a tenant can move into the new home.

At this stage the loan can be switched to principal and interest or another loan product if preferred.

Important Notes

Fixed Price Building Contract – the builder must present a fixed price building contract with a compliant progress payment schedule to fund the construction loan. There is a standard form building contract which will be provided to you.

Out of Contract Items – quotes need to be provided at application stage to be considered by the valuer, otherwise there is a risk that these items will not be funded by the bank

Valuation – again, there is always a valuation risk with newly constructed homes. This is difficult to control, so it is recommended a 5 – 10% contingency be budged for in case the valuation comes in lower than expected

How to contact us for more information

We have helped many clients to obtain construction lending for their new home, many of which are first homes. We would be more than happy to assist you with the end-to-end loan process, as well as the applications to first home owner government grants you may be eligible for.

To discuss your scenario with a broker, please do not hesitate to contact Priscilla Tan or our team at .