A question we hear a lot from business owners is this, “Will the bank lend me money if I don’t pay myself a salary?” We hear this from business owners who are running a profitable business. One of the reasons why they paid themselves a low salary might be driven by tax advice from the accountant. There could be other reasons as well.

While this might sound like a reasonable assumption, the fact is, just because you paid yourself a low salary or even no salary in your own business, it doesn’t automatically mean the bank won’t give you a loan. In this piece, we will explain the reasons why.

For business owners, if you paid yourself zero salary or a low salary, it doesn’t automatically disqualify you from getting a home loan from banks.

This is because as a business owner, you’re able to take out income in more ways than just your salary including dividends or trust distributions. And because of this banks let you add the profits of your company back to your salary.

So what is most important is that you are running a profitable business, not just how much salary you are paying yourself.

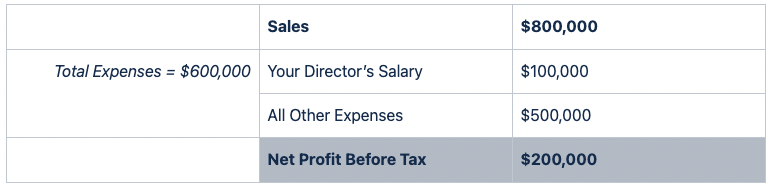

Example 1

Let’s take a look at an example. Say your business generates Sales of $800,000 and your Total Expenses are $600,000. Breaking this down your Director’s Salary is $100,000 and All Other Expenses are $500,000. Meaning your Net Profit Before Tax is $200,000.

In this case, let’s ignore add-backs here for simplicity.

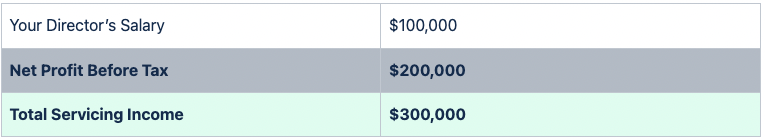

In this scenario, your servicing income isn’t your $100,00 salary, but the combination of your Salary and the Net Profit before Tax, which is $100,000 + $200,000 or $300,000 in total.

An important pre-condition of this view of servicing income is that you are the sole director and sole shareholder of your business, or at least hold a majority stake.

As the person who controls the business, you are able to increase your salary or decrease it, or take out your income in many different ways.

For example you could increase your salary or intentionally decrease the profits of your business; or you could leave your salary where it is and take your income instead as dividends or even trust distributions, thereby adding to you personal income anyway.

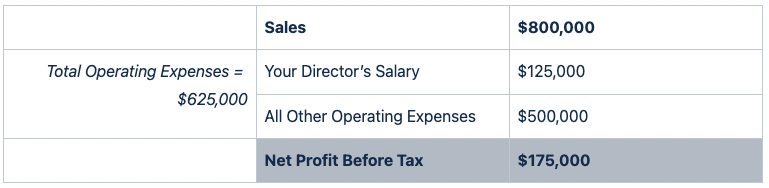

Example 2

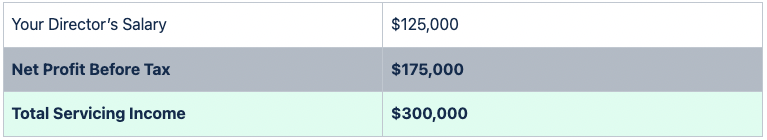

From our previous example, if you increased your salary by $25,000 to $125,000, profits would decline by a corresponding amount to $175,000.

However, because this $175,000 profit can be drawn as a dividend, your overall servicing income does not change, and remains at $300,000.

What if you are drawing a salary but your business made a loss?

So as you can see, the bank’s assessment of your servicing income doesn’t stop at your salary, but extends to the profits of your business as well. This should increase your borrowing capacity, and get a meaningful loan.

However, the reverse is also true!

If you are drawing a salary, but your business actually made a loss, this could negatively impact your borrowing capacity and overall reduce your loan amount.

In a previous blog post, we look at a relevant topic “Can I Still Get a Loan If My Business Recorded A Loss?“. If you are unsure about this, please speak to your broker or even your accountant to help you with these calculations.

Speak to a broker

Thank you for reading! I hope this explains why just because you didn’t pay yourself a salary, you can still get a home loan.

If you have questions or comments on this topic, you are more than welcome to get in touch with Tommy Lim () or the SF Capital broking team.