We understand how it may be hard for business owners or entrepreneurs to get a loan approved. This Finance Myth Busters series is here to help you overcome any hurdles in getting finance approved. We will provide the tips to getting a loan, so that when you actually need the funds, your bank will give it to you. It helps to know the best time to get a loan as a business owner.

Why did my bank reject my loan this time?

Have you ever wondered whether your bank will lend you the money when you need it most? Or have you applied for finance at a time you actually needed a loan and got rejected? Maybe it was for a new home, a new car or perhaps an overdraft facility to grow your business. You might have even thought the bank’s decision was unfair – you’ve been with the bank all your business life, never had a default in your life, and you still had your loan declined.

The reason for this is outcome that banks as providers of capital, in particular debt capital, are conservative in nature. Being conservative, the future is uncertain, and the “best” way for the bank to determine your borrowing capacity is to use your historical income.

A Finance quote that applies here is that “History might not repeat itself, but it does Rhyme”.

How does the bank decide whether to lend me the money?

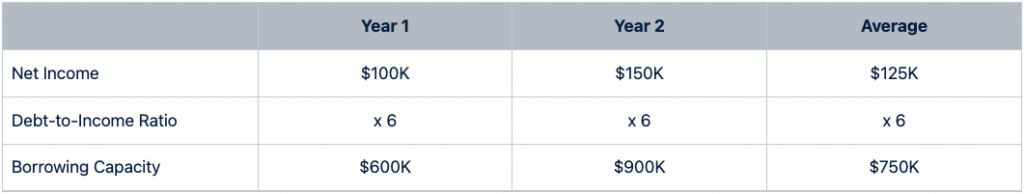

The best way to understand this is with an example. Say you are a sole trader, and the net income for your business over the last 2 years was: $100K in Year 1 $150K in Year 2 – with Year 2 being your most recent year. You’ve had a great year and grown your business profits by 50%!

So how does this translate into your borrowing power. Let’s assume you are applying for a loan today. In the current environment, your bank is willing to lend you 6 times your income. That is $600K based on Year 1 $900K for Year 2 $750K based on the average of the 2 Years. An aggressive bank may look to lend you $900K using your latest year’s income, but applying conservative principles most bank’s are likely to lend you the average, or $750K.

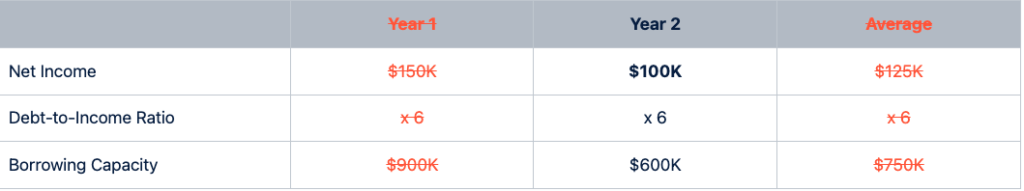

But let’s say, the figures are in reverse. Your latest year is worse and net income fell by $50K. In this case, while the average is the same, most banks are going to apply your lowest year’s income to assess your borrowing capacity.

In other words, the bank will only lend you $600K, and unfortunately, your bad times are often when you need finance the most.

So when is the best time to get a loan as a business owner?

If you are in the middle of purchasing a new home, or undertaking a major business acquisition, it is not that easy to get a loan approved! This is a bad outcome if you did not plan to contribute a larger deposit, or even worse if you do not have the extra funds available.

My tip as to the ideal time to get a loan as a business owner is this – prepare for a rainy day and consider applying for a loan when you don’t need one. That is – consider seeking finance when your business is performing well and your financial results are strong, not in a downturn when you actually need a loan. This is not because banks are evil, but simply how the game is played. And timing matters.

I hope this helps you better time your loan applications to get better results. If you are a business owner and planning ahead, speak to you broker or bank to discuss the timing of applying for a loan.

If you have any questions or comments of this topic, you are more than welcome to get in touch with me or our broking team.