There’s a famous business quote, that says “nothing breeds success like success!”. And indeed, at SF Capital we find this to be true. Our most successful business clients are often the most prolific, founding many successful ventures in addition to their core business. However, there is a dilemma that our clients face. While some of these new businesses help our clients with their loan application, others actually hurt their loan application. They run into extra questions, wasted time, and even declines when seeking finance. Many business owners believe that as long as their core business is profitable, they will be able to borrow money. While this is usually true, the amount they can borrow may dramatically change. What also matter is the stage and scale of their other businesses.

In this piece, we will be looking at these topics:

- How the bank finds out about your side businesses?

- What does this mean for your loan application? Will the side businesses hurt the loan application?

- What can you do to optimise your borrowing outcome?

1. How the bank finds out about your side businesses

You can’t get away from the bank finding out about your other businesses simply by not telling them. This is because there are several ways for the bank to identify these entities as well as your relationship to them.

i) Credit Check – The most common way is a Credit Check. A Credit Check is a report that the bank requests that states your previous loans applications, your conduct on any existing loans, as well as any company Directorships that you hold. The Credit Report will also state the ACN of that company, the name of that company as well as the date of your appointment to that directorship, therefore showing your ties to any other businesses.

ii) Financial Statements – The second way is from your Financial Statements. Often new ventures are funded by way of loans or distributions from your core business to the new venture. These transfers are often revealed in your financial statements, thereby prompting further questions from the bank.

iii) Common Sense – The third way is simply common sense! A savvy credit officer can quickly Google your name or look up your LinkedIn profile. If news articles and blog articles come up about your other businesses, or you list all of these businesses in your LinkedIn profile – this can be another giveaway to the bank.

2. What does this mean for your loan application

Just because the bank finds out about these entities, doesn’t mean the end of your loan application. It’s more important to know how the bank treats these entities in the assessment and what it means for your borrowing capacity.

i) Group Assessment – the main implication of these other entities, is that it leads the bank towards a group assessment – something we looked in a previous video.

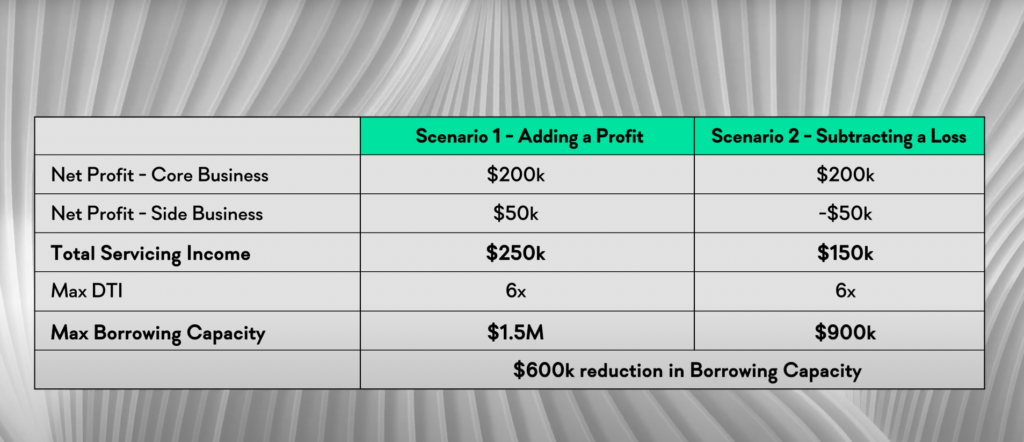

For example, say your core business made a profit of $200,000 and a side business made a profit of $50,000. Your total servicing income would become $250,000 – increasing your overall borrowing capacity.

However, if your side business made a loss of $50,000, your total servicing income would reduce to $150,000 – thereby decreasing your borrowing capacity.

ii) More Questions – another implication of these additional businesses, is that you should expect to face more questions and more requests for information. You should be “mentally prepared” to handle these questions, as well as collect the required information for the bank. An experienced broker, however, will know how to address any key issues upfront, therefore reducing any unnecessary enquiry from the bank.

iii) More Time – the third consideration is that assessing more entities simply takes more time and this is extra effort for your broker, for your accountant, and of course the bank. This extra work is likely to slow down your time to approval, so you should budget extra lead time when seeking finance for a complex loan scenario.

3. What you can do to optimise your borrowing outcome?

So you’re now more prepared to handle more questions but what can you do to make the process more efficient or even increase your desired capacity? Here are my tips.

i) Be Prepared – The First is being Prepared. This means working with your accountant to have your financials ready before applying for a loan, and being forthcoming with this information to your broker. An experienced mortgage broker, will know how to assess this information to understand your group structure, your “flow of income”, and help you determine how to best position this information to the bank to get your loan approved.

ii) Accountants Letters – The Second tip is to provide an Accountants Letter as part of your loan application. Where relevant an accountants letter can be helpful in closing off early stage businesses so that they do not impact your borrowing capacity. A typical accountants letter can state these business:

- Are trading profitably;

- Can meet their commitments as and when they fall due; OR

- Are not trading at all – if these business are very early stage, or even dormant companies.

Your broker will be able to help you determine when an accountants letter is required, and can even help you draft the contents of this letter on your behalf to make sure the wording is right for the bank.

iii) Consider a Non-Bank Lender – The third tip is to consider a Non-Bank Lender if your group financial are not ready, or the “Return on Effort” is simply not worth it for a Group Assessment. The benefit of a non-bank lender is that they may only focus on the income of your core business, and be less concerned about how your other businesses are performing.

Refer to our previous post, Alt Doc Loans for Business Owners, to find out more about accessing non-bank lenders.

I hope that you now have a better understanding of how your side gigs may impact your home loan borrowing. If you have any questions or comments, please feel free to reach out to any member of the SF Capital team. And if you found this information useful, please follow SF Capital on YouTube and social media!

SPEAK TO A BROKER

Thank you for reading and please stay tuned for more finance tips for business owners.

As your finance broker, our job is to help you secure the finance that you need. So if you are a business owners, start-up founder, entrepreneur or a self-employed sole trader, we are more than happy to have a chat with you to discuss your requirements and find a solution for you.

If you have questions or comments on this topic, you are more than welcome to get in touch with Tommy Lim () or the SF Capital broking team.