The last two year saw fixed rates for home loans fall to historic lows and a surge in borrowers fixing their interest rates in 2020 and 2021. The implication of this is that a large number of borrowers who took advantage of the low fixed rates will have their fixed rate terms ending in 2023, if not already. Many of these borrowers will be rolling onto variable rates that are likely to be much higher than they may have anticipated.

Firstly, just how high will interest rates go?

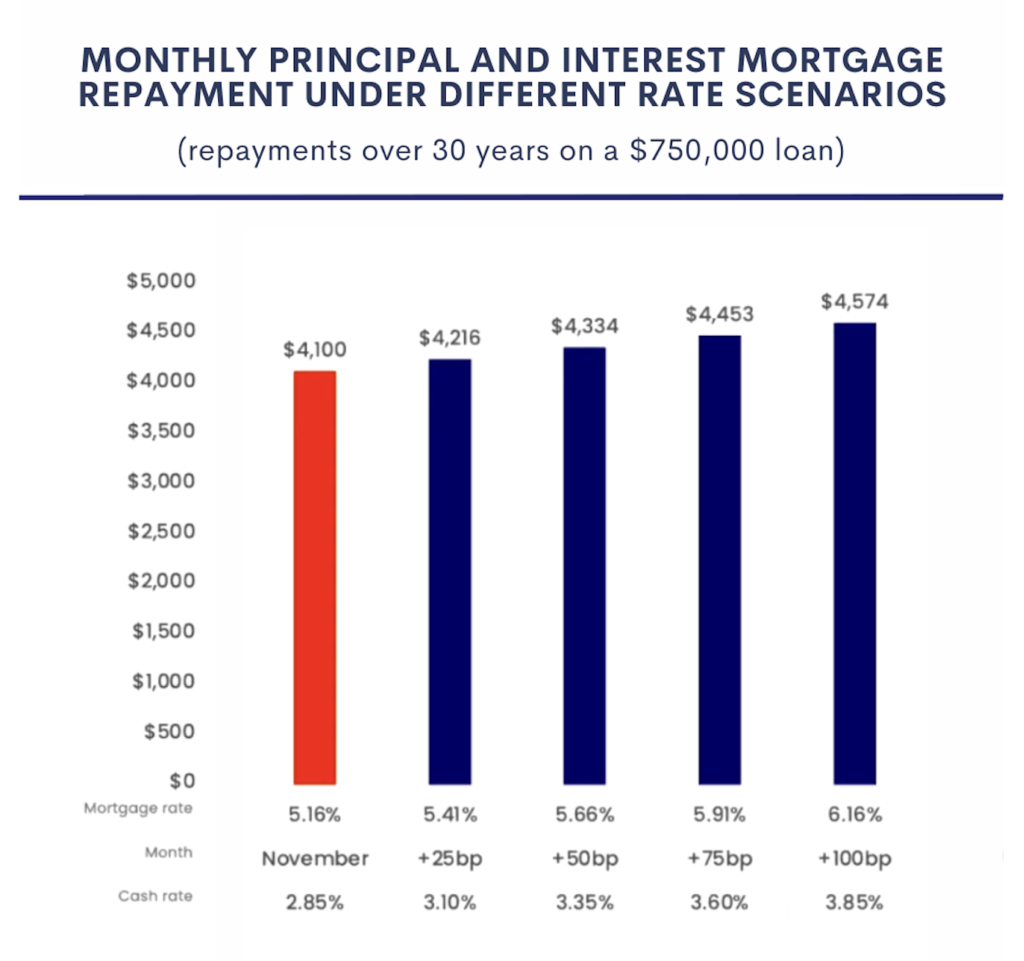

As at December 2022, the cash rate target rose by another 0.25 % to 3.10%. As discussed in the recent National Housing Market Update by CoreLogic’s Head of Research Tim Lawless, a 3.10% cash rate implies an average variable owner occupied rate of 5.41% for new borrower and 5.85% for existing borrowers.

The financial markets’ are forecasting the peak cash rate to reach 3.10% to 3.85%. If the cash rate did rise to the maximum forecast peak rate, borrowers would face an extra 0.75% to be added to their existing rates in the next few months.

For existing borrowers, if your fixed rate was 2.49% pa when you first took out the loan in 2021, a variable rate of 5.85% means you would be paying an additional $1,500 in repayments per month for a principal amount of $750,000 on a 30-year loan term.

In our previous blog post, we discussed ways to proactively manage your cash flow in the current rate rise environment. One of these is to restructure your loans through an internal or external refinance. By setting the loan term to the full 30 years or to re-set P&I repayments to interest only, you would be able to reduce monthly repayments.

While this is one way to mitigate the pain of rising interest rates for borrowers on variable rates, there are steps you can take if you are one of those who fixed your home loan rates during 2020 and 2021.

How Your Mortgage Broker Can Help You

As your mortgage broker, we are here to help you understand what your options are in the current rate rise environment. Mortgage brokers have an unrivalled duty to act in the best interests of our clients (and not of the banks!). We have a legal duty to act in your best interest. We do this by helping you to negotiate the best rates for your existing lender or by refinancing to a product that suits your needs and that is in your best interest.

Things you need to consider if your fixed term is expiring

Negotiate your interest rates with your lender – revert of roll-off rates are inherently high, so always negotiate the variable rates you’ll be rolling off to post fix expiry. Your mortgage broker is best placed to help to negotiate your variable rates, so that you will be paying the lowest possible rate the lender is willing to offer you. By this doing, you will also have a full review of your options, should you find a more competitive offer from a different lender. It is this pitching that keeps lenders competitive.

Refinance your loan with a different lender – if your current lender is not able to offer a competitive rate for you, do speak to your broker about refinancing your loan with a different lender. As part of the refinancing discussions, your broker can explore potentially restructuring (re-setting) your loan term to 30 years or even changing loan repayments to interest only to manage cash flow. There’s a couple of considerations before you refinance:

- What the true cost is to switch lenders – there are many cashback offers in the market to attract borrowers to switch lenders. If a different lender is also offering a lower interest rate, there will be a strong case to switch. However, what borrowers need to consider also is the true cost of switching, particularly if there is no change in the structure of the loan which you can benefit from potentially. These costs include discharge fees from the incumbent lender, establishment fees with the new lender, and not to mention the time you need to invest in for decision making, loan docs signing and bank accounts set up should you go down the route of a refinance. Your broker will be able to advise you what these costs are going to be in your situation.

- What the turnaround time is with refinancing – a further consideration if you are already seriously considering refinancing away from your existing lender, is the actual time it will take to discharge your existing loans. Different lenders have different discharge (besides loan settlement) time frames. This aspect is something that you should speak to your broker about, especially if you’re expecting a fast turnaround for your refinance.

- Negotiate your existing rates even during decision-making phase – in any case, whatever your plans might be, for the time being we would always recommend that you (with the help of your mortgage broker) negotiate the most competitive interest rates for your existing lending. This is so that during the waiting period, you are not paying anymore than you should be.

Re-fix your loan to achieve stability of repayments – fixed rates offer certainty and stability of repayment amounts, and this is also useful in a rapid rate rise environment. If stability is important to you, borrowers have the option to re-fix their loans, for a short term. While longer term expected rate rises may already be built into current fixed rates, there might still be some fixed rate products in the market that are priced just slightly above current variable rates with the same lender. Your experienced broker can help you find the right product for you.

Want to talk to a broker?

We hope this short piece has given you some things to consider if you have fixed terms expiring in the near future. If you need the help of a mortgage broker with any of the above tips, please do not hesitate to reach out to us.