Bridging loans might seem appealing but there are a range of factors and risks that most people don’t consider that usually end up landing them in hot water, especially when it’s far too late to change course.

In this post, I’m going to share with you everything you need to know about bridging loans – what they are, when to use them, how to access them and what the risks and considerations are.

Now you’ve probably heard the term bridging loan thrown around, so I think it’s important to firstly define what it is.

A Bridging Loan is a type of loan offered by a bank because of a timing difference between the property you are buying, and the property you are selling.

Under a Bridging Loan, a bank temporarily lends you more money than you can normally afford so that you can settle on your next home while you wait for your current home to be sold.

Now while a bridging loan might seem appealing by allowing you to purchase the property that you want sooner, banks place strict criteria on who is eligible for a bridging loan, and the risks of taking on a bridging loan are not for everyone.

So that leads to the question of – when is a bridging loan needed?

To answer this question, it’s best to consider a simple diagram and look at scenarios for when a Bridging Loan is not needed. From this diagram, the importance of timing also becomes apparent.

1) Simultaneous Settlement

This is where you’re able to perfectly line up the two settlement dates of the properties you are buying and selling so that there is NO timing gap. The funds from the sale of your old home are immediately applied to your NEXT home on the same day.

“Simultaneous settlements”, however, can be risky. There is the possibility that the buyer of your old home is not ready with the money, holding you up for your own purchase. This is known as “counter party risk”.

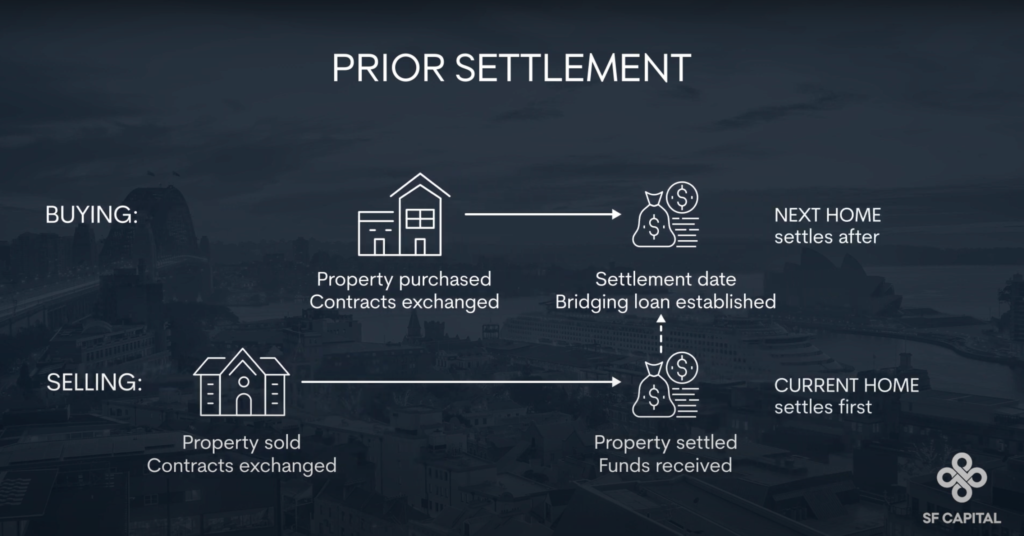

2) Prior Settlement

Alternatively, you can try to plan your property transactions to settle on the sale of your current home first.

This is the least risky approach to buying and selling, as it guarantees you have the funds to complete upfront, however it raises its own problems. For example. if you’ve sold your home, and have not settled on your new place, where are you going to live?

In practice, we find that clients combat this problem by:

- Moving in with family and friends

- Trying to rent from the new owner temporarily in a sale and leaseback arrangement.

- Staying in hotels or Airbnbs for a short period, treating it as a holiday.

3) Bridging Loans

So, from this diagram, you can now see that a Bridging Loan is needed when these dates are flipped.

The property you have bought is settled first, meaning you need substantial funds now.

But these funds are tied up in the equity of your old home, which will not be available to you until the property is sold at a later date.

That means you need a large but temporary amount of funds, in other words a “bridge” to get you through this period until your home is sold, and therefore, paying back the Bridging Loan.

What are the main criteria for a Bridging Loan?

So, knowing when a Bridging loan is required, the next question is.. under what circumstances will a bank approve a bridging loan?

Here are 5 key pieces of criteria:

#1 – The Loan to Value Ratio (LVR) must be less than 80%. This includes the combined LVR when both properties are taken as security. This means when the bank sets up your bridging loan, they take security over both your old AND new property.

#2 – You must show that you have sufficient savings to afford the interest payments during the Bridging Loan, or for some lenders, have enough equity to accrue what is known as “capitalised interest”.

This sometimes makes the maximum LVR on your existing home only 70% at the time of taking out the Bridging Loan.

#3 – When you sell your old home and close the bridging loan, you must demonstrate that you can service the leftover loan, known as the “End Debt” or “Residual Debt”.

#4 – The net proceeds of sale, meaning the remaining profits after all other costs from the sale of your old home is enough to pay down the bridging loan so that only the agreed End Debt remains

#5 – You must sell your old home, and close out the bridging loan within a maximum of 12 months. Meaning that this can’t drag out for more than a year.

Other costs involved in a Bridging Loan

Finally, we need to factor in the costs of a taking out a bridging loan. Basically, the most significant cost is honestly the interest incurred while the loan is open.

This can be a substantial amount because you’re temporarily taking on more debt than you can normally services, and the longer you have the Bridging Loan in place, the more interest you will pay.

There are also two ways that the interest can then be charged, depending on the bank that you go with:

The first method is on an Interest Only Basis, where you make a monthly repayment to keep the Bridging Loan in place based on the discounted variable rate you negotiate.

The second method is where Interest is Capitalised. This means that, you don’t need to make any monthly repayments. Instead, interest gets added to the loan balance itself and is cleared once your old home is sold and settled.

While incurring capitalised interest is more convenient, it can be more costly as the interest costs compound and get charged at an un-discounted variable rate.

The other costs to set up a Bridging Loan include:

- Extra valuation fees;

- Transfer, registration and set up fees – especially if you are refinancing to a new bank to access a bridging loan; and

- Any advice or application fees charged by your broker.

Other considerations when taking out a Bridging Loan

So, is there anything else you should know? Or rather, are there any risks you need to take into account?

Like I said at the start, a Bridging Loan isn’t for everybody and there are lots of considerations to make before you decide to use a Bridging Loan.

First, before you exchange contracts for your next home, you need to be confident that the bank can approve your bridging loan. Given the strict criteria, you should check off your eligibility with your Broker or Banker and seek pre-approval first.

Secondly, you need to be comfortable with the costs – and if your bank requires you to make monthly Interest Only repayments, you need to have a sufficient cash buffer to make these repayments for up to 12 months.

And finally, you need to be confident that you can sell your property and close the Bridging Loan on time, especially during tougher market conditions. This includes budgeting enough time to complete any renovations to prepare your property for sale, and marketing to secure the price you are after.

Speak to a Broker

Hopefully, this post has helped you decide whether you should keep or sell your property when searching for your next home.

If you have any questions or comments on this topic, you are more than welcome to get in touch with our broking team. Send an email to

For more tips on getting your next home, please stay tuned or head to our Youtube channel – “The Next Home Series“