Introduction

In this article, we outline the impact on mortgage holders as a result of the Reserve Bank rate cut decision last week.

We answer the most common questions borrowers are asking on how they can make the most of the rate changes announced by the major banks.

Please refer to our summary of rate change announcements from CBA, ANZ, NAB, Westpac, St George, Macquarie and ING.

Your questions answered

Which home loan rates are changing?

Home loans with fixed rates*.

All the major banks have reflected the RBA move in their interest rate settings, offering home loans customers with lower fixed rates.

Fixed rates for four- and in some cases five-year loan terms are now in the sub-2% territory.

There is no change to variable base rates.

*For new loans and new fixed terms. If your existing loan is already on a fixed rate, your interest rate will not change.

Why aren’t variable rates changing?

Banks are not reducing variable base rates in order to preserve profit margins given they will not be able to reduce deposit rates much further.

If my bank is not passing on the rate cut to my loan, should I refinance?

Typically, borrowers refinance because they want to achieve a specific goal or find a solution to a problem e.g. release equity for the next purchase or debt consolidation.

To refinance because of interest rate changes is worthwhile only if the benefit is material i.e. if the rate savings and cash rebates more than cover lender switch costs.

Most importantly, refinancing requires a full assessment which may or may not be favourable to you.

Your current lender may also be able to offer you a competitive rate to retain you.

Having said this, we acknowledge Governor Lowe’s suggestion during the Press Conference on 3 November 2020 that borrowers should switch lenders if their existing lender cannot offer a more attractive rate.

All in all, we are happy to look at your scenario and find the best solution and deal for you.

If I am already on a fixed rate, how can I get a reduction in my rate?

If you are already on a fixed rate, you will have to wait until the fixed term ends, to re-fix your loan.

The value of fixed loans lies in the certainty of the repayment amounts over a certain period of time.

If you break the fixed term to switch to another fixed product or discharge your loan early, a break fee applies and this can be a significant cost (4-5 digit).

What is a break fee?

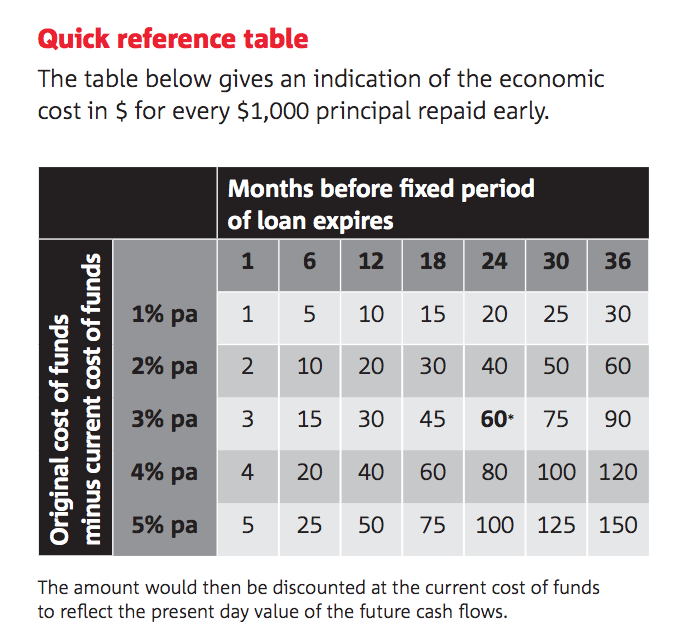

The break fee (also referred to as Early Repayment Fee by some banks) is a fee calculated and charged by the bank in the event a borrower discharges or changes the loan prior to the end of the contracted fixed term.

This fee compensates the bank for the loss incurred for breaking the fixed funding facility it would have entered into with a third party to fund your fixed loan.

For illustration purposes, say you have entered into a 5-year fixed loan, for $600,000 paying 3.99% pa and there’s still 9 months remaining. Breaking this fixed loan now to enter into another 5-year fixed term at 1.99% pa, would cost you a fee of $9,000. A small admin fee may also be charged by the bank.

Here is a quick reference table from a Big 4 bank to calculate the cost of breaking (or repaying) a fixed loan.

Borrowers can request their lender to calculate their break fee at any point in time. This then is weighed up against the upside of switching to another loan product/lender.

How can I benefit from the rate cut?

If you have an owner occupied loan with a variable rate, and don’t have any foreseeable changes in the medium term, you can consider switching to a fixed rate loan to take advantage of rate savings available.

We note that during the fixed term, the loan cannot be paid down by more than the regular monthly repayments or a penalty applies. A fixed rate loan typically does not have an offset feature.

Fixed rates are not for everyone and you should consider your finance objectives before fixing.

Your bank or broker will be able to assist you.

I have an investment loan, how am I impacted?

Macquarie is the only major bank that dropped investment fixed rates as a result of the RBA rate cut. None of the other majors did. As mentioned, no major bank reduced their variable base rates.

If you are paying a variable rate for your investment home loan, please ensure it is negotiated from time to time so that it remains competitive.

Can I fix my home loan without losing the offset feature?

The short answer is no, because most fixed products do not offer an offset feature. There are exceptions such as ANZ’s one-year fixed product, TMB’s fixed loan product and Bankwest’s partial offset feature for fixed loans.

This is one important trade-off to consider with fixing your loan.

What do I need to do to fix my variable home loan?

Confirm with your bank or broker that a fixed loan suits you. Decide the amount you want to fix as well as for how long.

Before fixing a loan, we would suggest that the client clear the redraw balance to $0 by transferring out the funds to another account. We’d also suggest planning elsewhere to park any offset funds.

In most cases, borrowers on a wealth package will not have to pay a switch fee. However, we will advise you if the lender charges a fee.

Our brokers can guide and assist you with the switch process.

What can I do if I have a variable home loan, but I don’t want to fix it?

If your interest rate hasn’t been negotiated for more than 6 months, please get in touch so that we can assist you.

What is a split loan?

Also known as part-fixing, a variable loan can be split into two portions, and one of these portions is then switched to a fixed loan.

This structure gives certainty to the loan repayments over a period of time while the borrower can still benefit from usual offset/redraw features and make additional repayments on the variable portion.

Contact us for further assistance

If you have further questions, please get in touch now with our team or email us on to discuss your scenario with a broker or seek assistance with your loan.