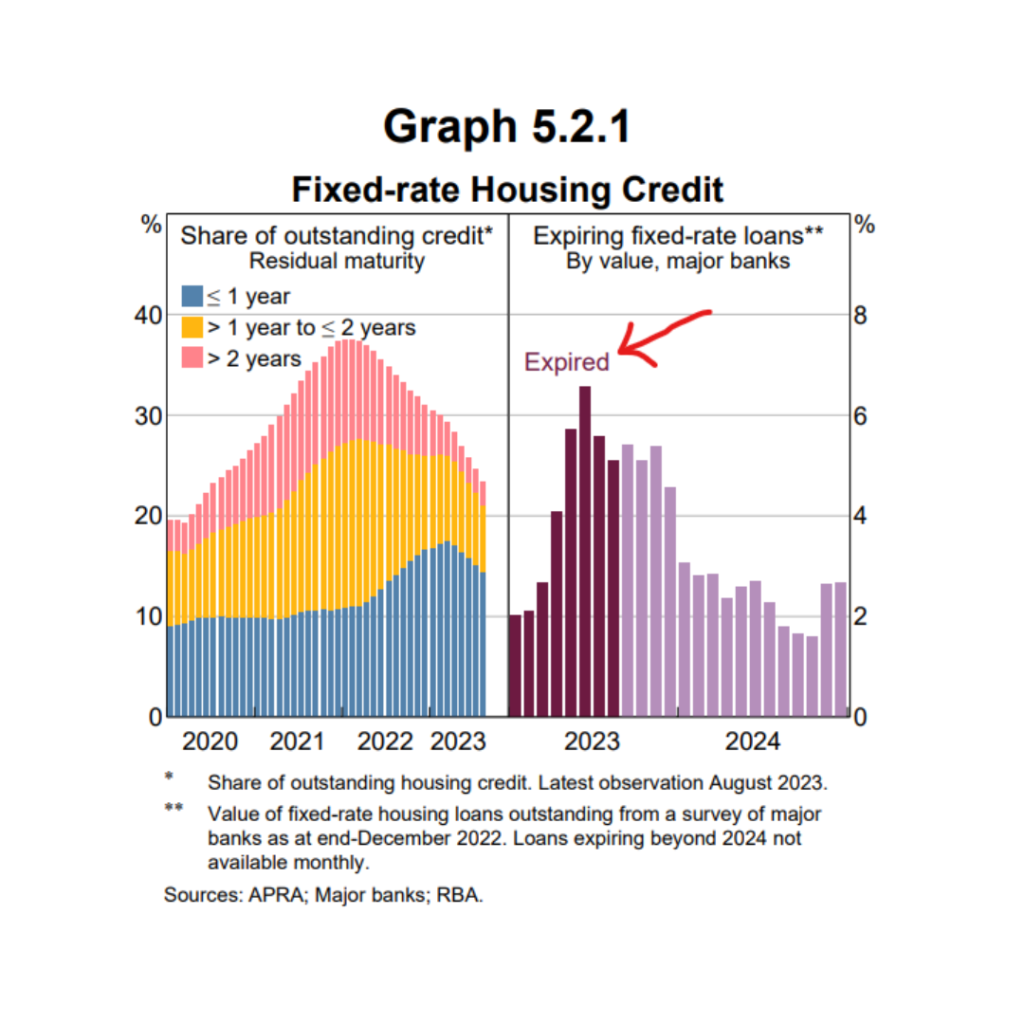

This month the Reserve Bank of Australia (‘RBA’) released its bi-annual Financial Stability Review, which provided an “Update on Fixed Rate Borrowers”. During the pandemic when interest rates were at their historic low, almost 40% of total household credit was on fixed rates. Since the first increase in interest rates in May 2022, 45% of fixed rate loans have roll off onto higher rates, the majority of which have gone onto variable rates.

This focus topic looks at how borrowers who have already come off fixed rates have managed the transition to higher rates, and assesses the risks for the remaining fixed rate borrowers.

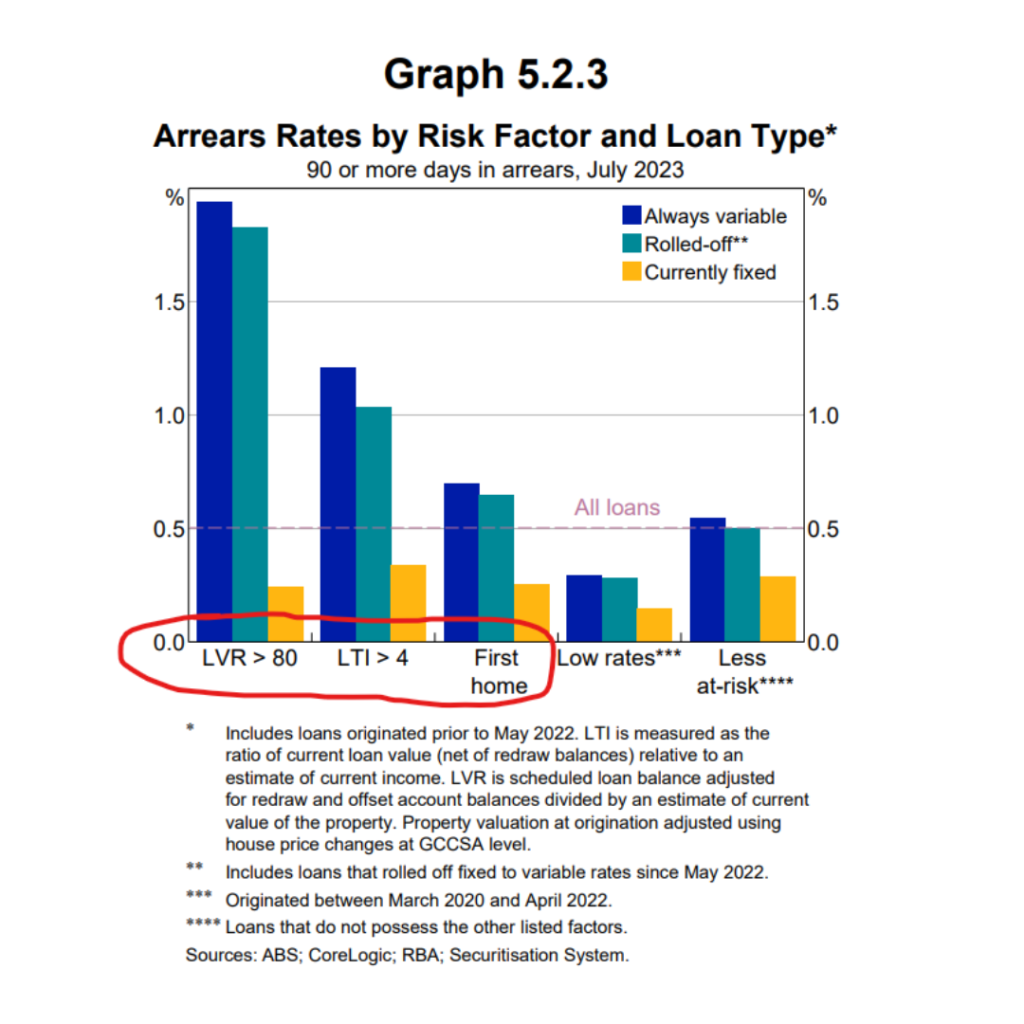

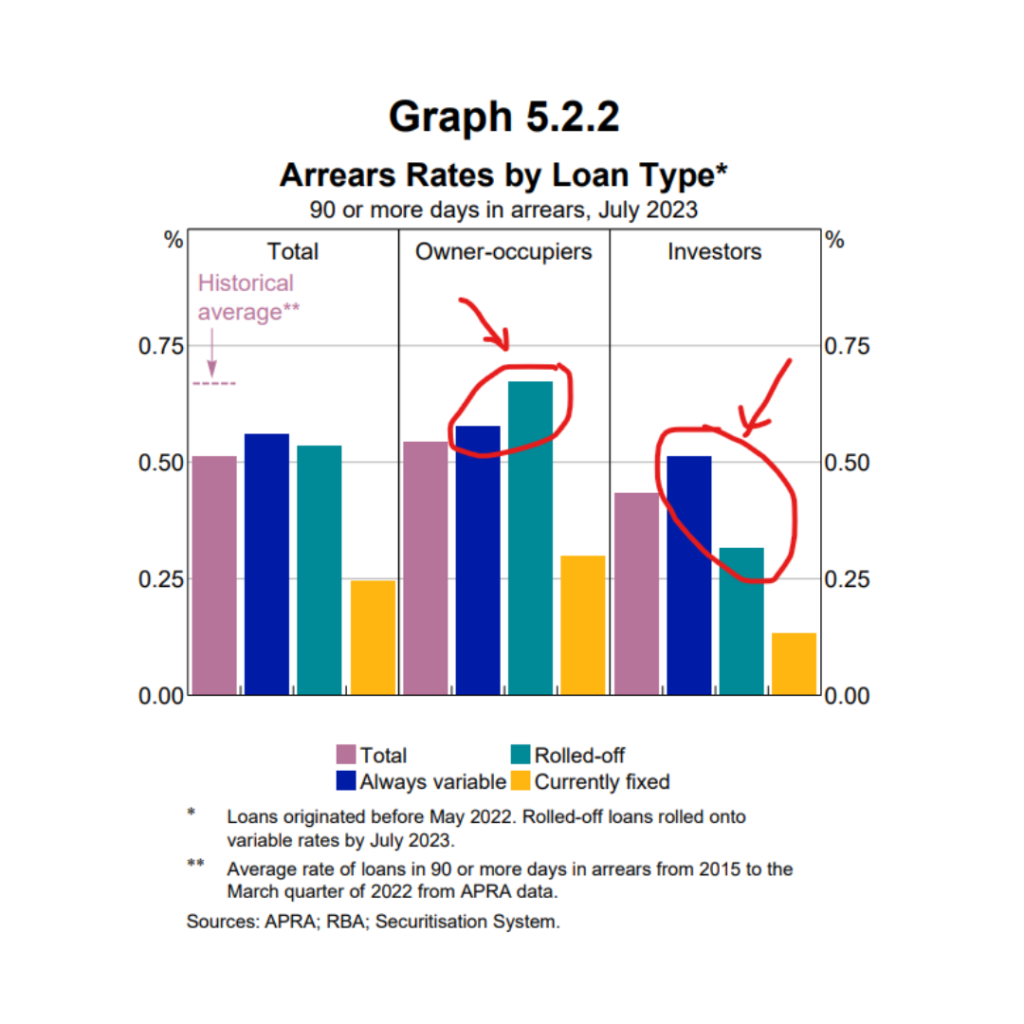

The latest data in this review affirms much of the RBA’s original analysis that in totality, the “Fixed Rate Cliff” will not threaten Australia’s Financial Stability, however there will be segments of borrowers that feel the pain, namely, high Loan-to-Value and high Loan-to-Income borrowers, which are predominantly newer mortgage holders and first home buyers.

The RBA finds that despite high interest rates, borrowers are generally still managing “well”; and expiring fixed rate loans don’t look “materially more risky” than their variable counterparts.

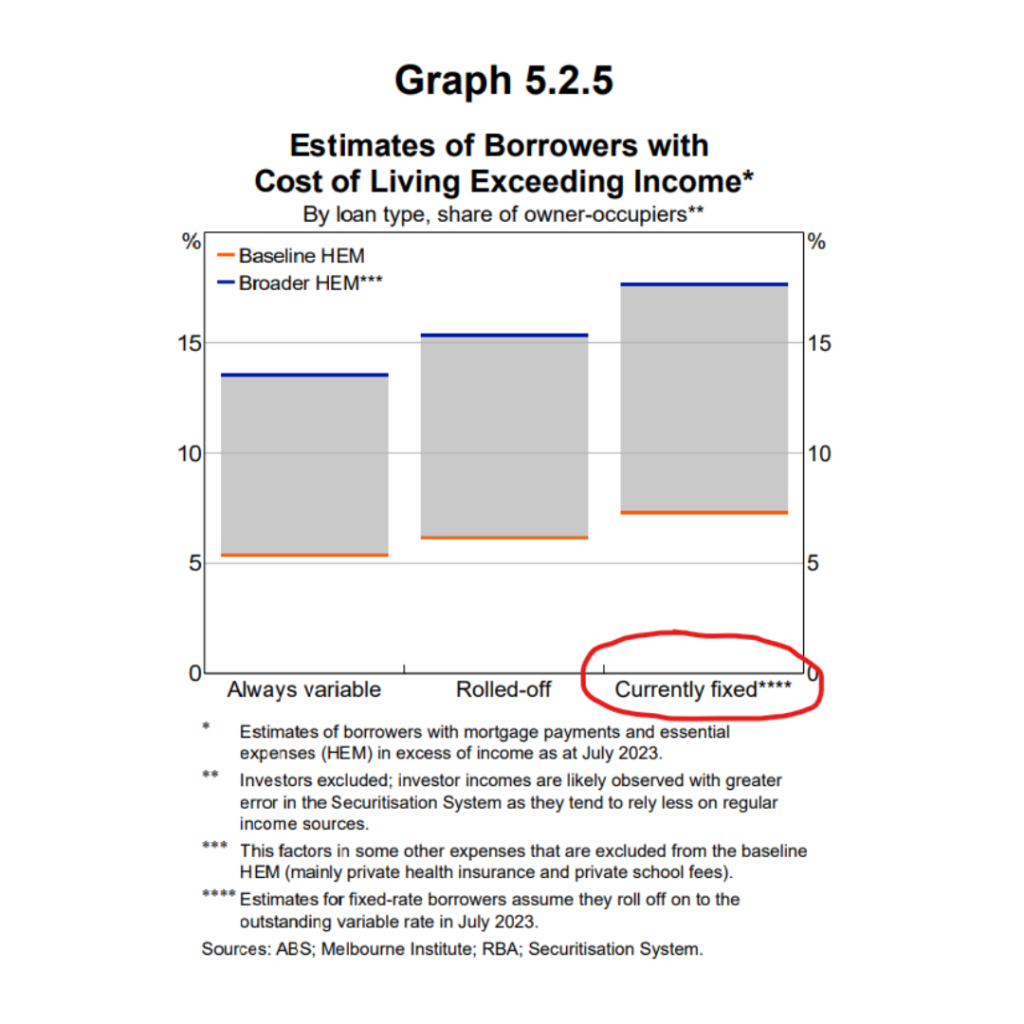

The majority of current fixed rate borrowers are estimated to have sufficient income to continue meeting their repayment obligations once they move onto higher payments.

Fixed rate loans yet to roll off do not appear materially riskier than those that have already rolled off. This group contains a slightly larger share of higher risk borrowers; however, these borrowers have also benefited from low rates for longer.

The full RBA review can be viewed here but here are the key takeaways.

- 14% of current fixed rate borrowers are expected to face an increase in mortgage payments of more than 60% when they roll off, based on variable rates as at July 2023

- 7-18% of fixed rate owner occupier borrowers are estimated to have their required mortgage payments and essential spending rise to be above their incomes after rolling off their fixed rates

- 15-18% of fixed rate borrowers will roll off onto higher interest rates with much lower savings buffers, equivalent to less than three months of scheduled mortgage payments.

Information and Graph are Sourced from: The Reserve Bank of Australia’s Website

Speak to a broker

Contact us ff you would like to speak to an experienced broker about your upcoming fixed rate expiry. If you are already on higher interest payments and would like to negotiate onto a lower rate, please also feel free to get in touch with us and we will do our best to help you.