You shouldn’t have to necessarily give up your first home, if you don’t want to, when looking to buy your next home. However, if you are keeping your first home, then you need to ensure that you will be able to fund the purchase of the next home.

Having a disciplined framework when making your next purchase could be the difference between preventing you from buying a home you simply can’t afford or letting go of an attractive investment property you should have kept.

In this post, we will explain the four key criteria to consider when making this decision.

Criteria #1 Having a Sufficient Deposit

Do you have the savings today to make your next home purchase work, or do you need to sell your home so you have enough of a deposit.

Let’s take a look at this through an example

Say your home is worth $1 million today, with a $500K loan against it, and your goal is to upgrade to a $1.8 million new family home

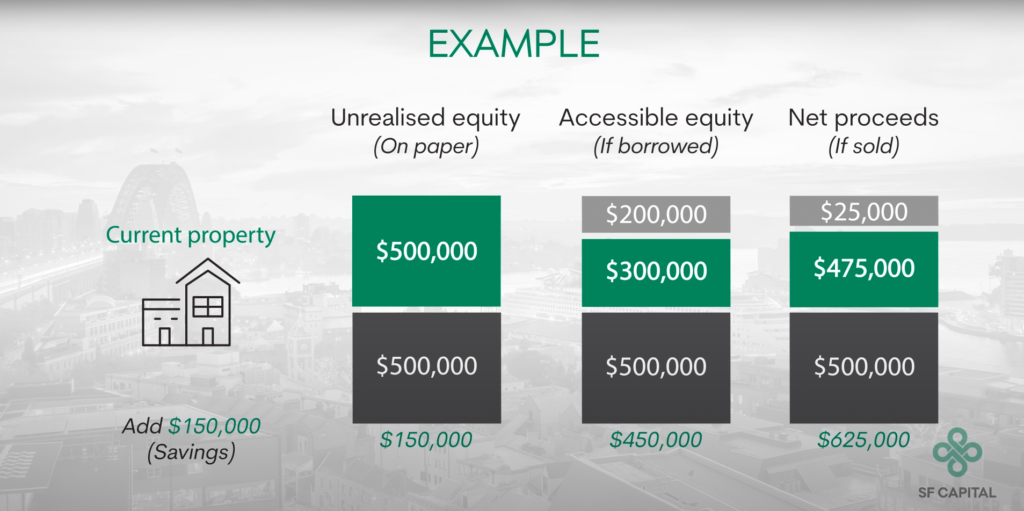

With your current home, there are two ways to look at this property in terms of helping you with your deposit:

1. First, there is $500K in unrealised equity in the property. We say “unrealised” because the equity is only on paper. You cannot tap into it unless you undertake a “cash out” or sell the property.

2. Secondly, there is $300K in accessible equity. This is if you choose to borrow against the property and conduct a “cash out” to bring the Loan to Value Ratio to 80%

3. Thirdly, there is approximately $475K in net proceeds of sale if you choose to sell your property on the open market.

So why only $475K and not $500K? This is because we assume you will incur agent fees, marketing expenses and legal costs to prepare your property for sale, totalling around 2.5% of the property value.

Now, let’s look at what it takes to buy a $1.8M home.

If we assume stamp duty, legal costs and other set up fees come to around $90,000, a $1.8 million property actually costs you $1.89 million once transaction costs are added.

If you are borrowing at an 80% Loan to Value Ratio, or a $1.44 million loan, this means that your contribution is roughly $450,000 to purchase a $1.8 million property, calculated as $1.89 million minus $1.44 million equals $450,000.

So, you can see in this example if you have $150,000 in savings or more and can access another $300,000 in equity from your current home, you will have enough to make up a $450,000 deposit.

However, anything less than this, you may need to sell your current home to have to have sufficient funds.

Criteria #2 – Your Ability to Afford The Loan Repayments

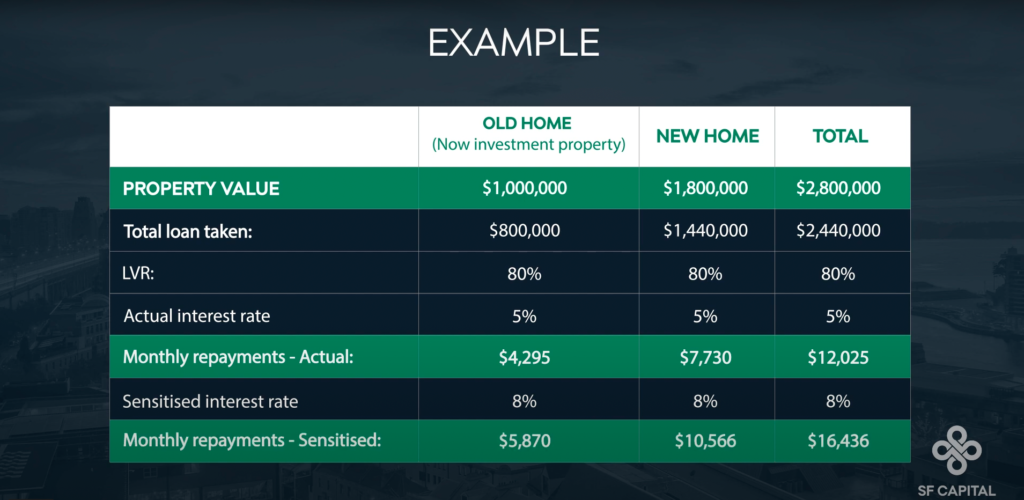

Let’s assume from the previous example you did access an additional $300K in equity, considering the outstanding loan of $500K, this takes the total loan on your existing home to $800K.

You also intend to apply for a new loan of $1.44M to purchase your next home, taking your total debt to $2.24M.

Based on these amounts, assuming a 5% interest rate and 30 year term with Principal & Interest repayments, you would be paying:

– $4,295 per month on the $800K loan

– $7,730 per month on the $1.44 million loan

– $12,025 in total.

Now, it’s important to remember the total repayments are not the income per month you need, but the amount you will need to afford based on your net income – which is income after all your taxes, living expenses and any other loan commitments are paid.

Also, while this is the amount you will actually pay, interest rates can rise, and banks will test you on a higher rate called the Assessment Rate which is roughly 2 to 3% higher than the going rate.

So, assuming an assessment rate of 8%, you will need to convince the bank that you can actually afford loan repayments of $16,436 per month based on your net income.

Criteria #3 – Consider Your Investment Goals, Whether Short, Medium or Long-Term

Conventional wisdom is that property is a long term investment, so holding onto your current home may be part of a broader plan to have a portfolio of properties that help you to generate income in your retirement.

Assuming your deposit and loan affordability is checked off, another way to think about this question is to ask what the opportunity cost of holding the property is. In other words, can you earn a higher rate of return by selling the property and investing the money somewhere else?

For example, depending on market cycles, holding a property may be more attractive than “putting your money in the bank”. However, it may not be as attractive as buying shares in a bull market or even investing in your own business.

You also need to remember that this may also be driven by the condition and characteristics of the property itself. A well-chosen first home in a growth area that is easy to rent out, and is easy to maintain, could make an excellent investment property.

On the other hand, if you already live in a house and are upgrading to a bigger one, then you may think the rental yield is too low, or the costs of maintenance too high to justify holding the property long term.

You also need to keep in mind that keeping your home will help you avoid the transaction costs of selling (such as agency fees) and buying a new investment property (such as stamp duty) that may have generated the same investment return anyway.

Criteria #4 – Consider Your Risk Appetite

This last consideration is about your personal comfort level around debt.

So even if you can afford the loan repayments shown before, you may not be comfortable with knowing you have to make them each month.

Your risk appetite can change and is often a function of your Personal Outlook and Market Outlook.

For example in terms of Personal Outlook, receiving a promotion, or knowing you are doing really well in your job may make you feel comfortable with taking on more debt.

But if you are planning to have a family, and your household income will be reduced to one income, it may make you less comfortable with higher levels of debt.

In terms of Market Outlook, the higher interest rates may make you more risk averse, while the knowledge of a rising property market in a specific area may make you less risk averse.

So as you can see, this last criteria is very personal for each person to evaluate given their own unique circumstances and views on the market.

Summary

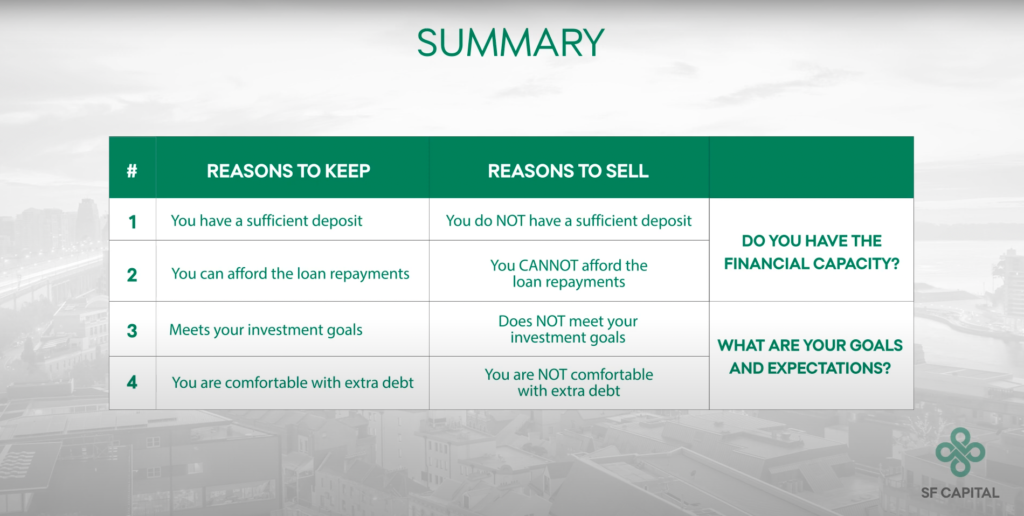

When thinking about keeping or selling your existing home, we can see that the four reasons to keep the property are that:

One, you have a sufficient deposit without selling.

Two, you can afford the actual property and loan repayments.

Three, keeping the property meets your investment goals of building a property portfolio and earns a satisfactory rate of return.

And four, you are comfortable with extra debt, and you have a positive outlook on the future.

The reasons to sell are the opposite of this, and you can see from this table that Criteria #1 & #2 relate to your Financial Capacity, while Criteria #3 and #4 look at your Personal Goals & Expectations.

Speak to a Broker

Hopefully, this post has helped you decide whether you should keep or sell your property when searching for your next home.

If you have any questions or comments on this topic, you are more than welcome to get in touch with me () or anyone in our broking team.

For more tips on getting your next home, please stay tuned or head to our Youtube channel – “The Next Home Series“