Unfortunately, given the history and unique combination of factors, Australian borrowers have nowhere to hide from the Fixed Rate cliff. The period of cheap money is “over” and we are in a new environment of tighter monetary policy. That is, higher interest rates for longer, meaning households and businesses will have to adjust to this “new normal”.

Many economists are tipping the cash rate to hit 4.85% by the end of 2023, which means cumulative rate rises of 4.75% since May 2022. This means Principal & Interest home loan rates in the “mid-6%’s”, and Interest Only rates comfortably with a “7” in front.

So in these testing and uncertain times, what can you do about it?

To be very practical about this, we’ve split our response five courses of action, with a deep focus on the benefits of refinancing.

1. Negotiating with your current lender

2. Basic refinancing strategies

3. Advanced refinancing strategies

4. Proactive Budgeting & Income Generation

5. What to do if experiencing financial distress

We’ll also go through a worked example, to help you get a better handle on the numbers.

Tip 1: Negotiating with your current lender

Negotiating with your current lender is the quickest and easiest way to lower the costs of your home loan once it switches to variable.

Often, your lender is willing to shave off 0.40 – 0.50% from your current interest rate without batting an eye lid. This is because they don’t want to lose you as a customer, and giving you this discount can be cheaper than the costs of acquiring a new client.

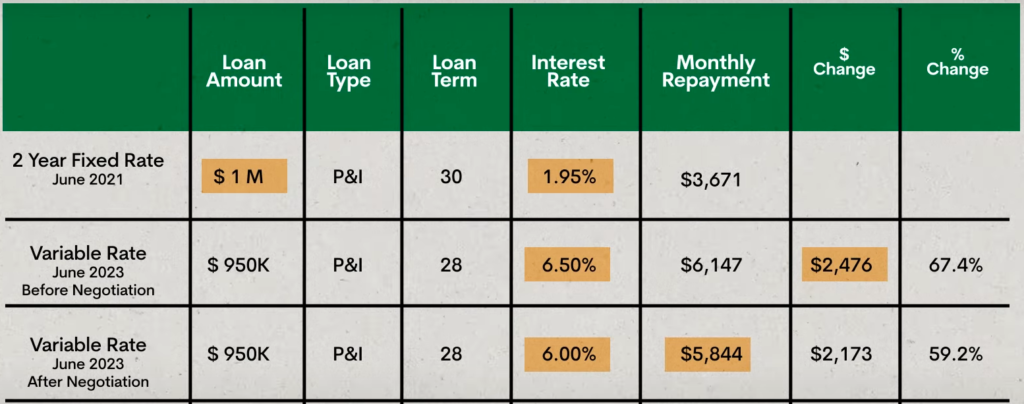

Let’s take a look at an example – say you borrowed $1M and were previously on 1.95% P&I, fixed for 2 years, and your home loan is now reverting to 6.50% P&I variable. The repayments will immediately go from $3,671 to $6,147 per month – and increase of $2,476 per month or 67.4%.

Looking at real pricing examples from our own client base, we find a successful pricing request of 0.50% will take repayments down to $5,844 per month – limiting the increase in repayments to a 59.2% rise or a $303 difference to the status quo.

While this is not that much, it is something from a simple email or phone call, and something that your broker or bankers should be able to process quite easily.

It is important to note that repricing is possibly the only step you can take if you cannot pass a bank’s current serviceability requirements, and thus cannot refinance. In other words, negotiating with your current lender is a valuable lever for “mortgage prisoners”.

Response times really depend on the sophistication of the lender, with some banks approving and implementing the pricing request in days, while others can take weeks.

The negatives are this process is that pricing outcomes can be quite small, and are not that consistent. Unfortunately, bank customers pay what is known as a “loyalty tax” whereby new customers receive a better interest rate than existing customers.

Tip 2: Basic refinancing strategies

When you see bus ads, TV commercials or than flashy sponsored IG post encouraging you to refinance, most of these advertisements are soliciting what is known as a “dollar for dollar” refinance.

This is where a loan is switched over to a new lender for the same loan amount, for the same remaining loan term, for the same repayment type (Interest Only or P&I), rather than pursuing more refinance complex strategies involving cash flow management (see next section),

A “dollar for dollar” refinance – is all about achieving a superior interest rate and nothing else. Reducing interest costs are the primary objective.

Extending our previous example, refinancing may achieve a more meaningful saving than a rate negotiation. In evaluating refinance opportunities, we typically aim for additional rate savings of at least 0.2%, and ideally 0.4% or more.

So in this situation, refinancing does a little better, limiting the repayment increase to $2,053 per month or now 55.9% instead of 67.4%.

Because you are applying to a new lender, a refinance can take longer than a pricing request, and end-to-end processing times can be between 2 – 6 weeks depending on how busy your new lender is. Approval times can definitely blow out during busy periods in the year like Easter and Christmas, or if the lender has a particular interest rate or cash back special to attract more customers.

There are also costs to refinancing, so it is important to ensure that the rate savings outweigh the transaction costs. These costs are not just financial however, and you need to personally weigh up whether the savings are worth the inconvenience of moving your personal banking, which involves setting up new accounts, applying for new cards and instructing new direct debits.

Tip 3: Advanced refinancing strategies

When refinancing, it’s important to consider that while consideration is costs, the other is cash flow.

Refinancing creates a unique opportunity to evaluate whether your loans are truly optimised not only to save you money, but are also set up in a way that helps you effectively manage your cash flow – We believe reveals the skill of an experienced broker, versus a novice.

Modifying our previous example, the steepest of rate shocks would come to those rolling from Fixed Interest Only to Variable Principle & Interest. This would be a common set up for investors holding a rental property, for example, who are trying to maximise their tax deductible debt while paying down their owner occupied home loan as fast as possible (which is non-tax deductible).

We can see the impact of the cliff is more drastic. If the interest rate goes from 2.49% to 6.60% (note investment rates are higher than owner occupied rates) and repayments go from Interest Only to Principal & Interest, repayments increase from $2,075 to $6,535 or a very sizeable 214.9% jump!

The only way to mitigate this is to refinance the loan back to Interest Only, reducing the “repayment shock” to $5,333 per month or a 157% increase.

A middle ground may be to keep the loan on P&I but re-extend the loan to a 30-year term. In this case, repayments would go to $6,060 or a 192% increase. High but still a bit more manageable.

This is particularly important for clients with a portfolio of loans covering their home and investment property. Taking a sanitised example from our own client base we can see the before and after cash flow benefits of refinancing with a very intentional strategy to conserve cash flow:

Tip 4: Proactive Budgeting & Income Generation

With the prospect of recession around the corner, households need to look at how they can boost their cash flow and, where possible, create savings buffers.

There are two sides of the equation:

(i) How can you increase your income?

(ii) How can you cut your expenditures?

In relation to income, ask yourself:

- Does the nature of your work allow you take on more hours?

- Can you take on a second part-time job or side hustle?

- Can you work towards and earn a promotion in your next performance review?

- Can you alter the nature of your income to be more performance based?

- Are there prospects of switching employers for more pay without disrupting your long term career?

- Can you rent out a spare room in your house, or convert an investment properties to shorter term rentals?

In relation to expenses, ask yourself:

- Am I using credit cards to spend beyond my means?

- What can I stretch the life of, rather than buying new? Or can I buy something I need second hand? Think everything from cars to clothing.

- What discretionary expenses can I cut or trim back?

- Eating Out

- Holidays

- Social Memberships

- Recreation and Hobbies

- Unused Subscriptions

- Will my child really thrive in a private school? Or is a public school more appropriate?

- Can I rent out my home and live somewhere cheaper?

- Can you build routines to “shop the specials”, buy in bulk, or seek out less expensive options when shopping for groceries and other household stapes?

- Can you switch utility and other service providers, such as home internet and mobile phone services?

- Can you speak to your accountant to do your tax return earlier, and / or seek out advice as to your eligibility to government subsidies and rebates? e.g. for child care, solar panels

Whether you are in a strong financial position or stuck in your current mortgage, taking steps to boost your income, and cutting waste from your expenditures is a worthwhile exercise.

In tough financial times, preparing a budget becomes a critical tool to see if your income is exceeding your expenses, and you should seek help from a Financial Planner or family budgeting service if you feel you need extra help.

While each of these actions may seem small in isolation, the combination of these initiatives may just get you over the line to refinancing if you are a “mortgage prisoner” who cannot demonstrate servicing. Generating that little bit more income and reworking your household budget may be just the trick to get you out of “mortgage jail”.

Tip 5: What to do if you are experiencing financial distress

This is not a position we want to see any client in, but for some, the shock of going from fixed to variable will just be too much. Lower income households with higher LVR’s and newer mortgages are of particular risk as they have not had sufficient time to build savings and equity buffers to ride out a period of higher repayments.

However, it is not just lower incomes, but forces outside a borrower’s control that may send them over the edge. Household cash flow can also deteriorate or disappear due to unforeseen circumstances such as the death or illness of a primary income earner, a lost job, redundancy or reduced hours, or having to care for a sick or chronically ill family member. There can be cases where there is a significant business downturn, with structural costs that are difficult to cut.

In these situations, while the decisions are perhaps more difficult to make, the choices for action are more clear cut.

- Call the hardship line or speak to your banker about setting up a financial arrangement – making partial loan repayments, or paying at least the interest, is a big step of good faith that can buy you time and allow you to pursue a structured work around.

- Sell Property / Sell Assets – unfortunately, this will be enforced by a lender where you have a secured loan, default on the loan and show an inability to repay. This is especially so for commercial and investment property, however, hopefully it does not happen to your home.

- Non-Bank Lending or Private Lending – for business owners, switching from a bank to a non-bank lender or private lender may help you buy more time. You may be able to switch loans to Interest Only or have interest capitalised to preserve your cash flow while you trade out of the downturn or undertake a measured sale of assets.

In all instances, we recommend seeking help early rather than when you have run out of cash or are being a forced sell a property on terms which you cannot control.

Conclusion

The ensuing shock from Fixed Rate Cliff is set to shape Australia’s macroeconomic landscape for the next few years, impacting property prices, household budgets and thus consumption and economic stability.

While the mass expiry of Fixed Rate loans is unlikely to destabilise the economy and be a sole driver of a recession, the impact will be felt by households differently, with lower income households, first home buyers and those that purchased at the peak of the housing boom suffering the most.

Unfortunately, this has been a phenomenon that is impacting all borrowing households and all banks big and small, and thus there is no escaping the new higher rate environment even when refinancing.

While some savings can be had from negotiating with your existing bank, conducting a dollar to dollar refinance, more material savings can only be realised by restructuring a loan completely (e.g. refinancing from Principal & Interest to Interest Only, or stretching out the loan term), or undertaking strategies to rework household cash flow – by boosting income or cutting expenditures.

Although times ahead will be tough, we are confident that are our clients and followers will have the resilience, creativity and street smarts to come out on the other side more financially savvy and prosperous than ever.

If you are interested in this topic, don’t miss out of Part 1 and Part 2 of this series.

Find out more about this topic

If you have any questions or comments on this topic, you are more than welcome to get in touch with me ().