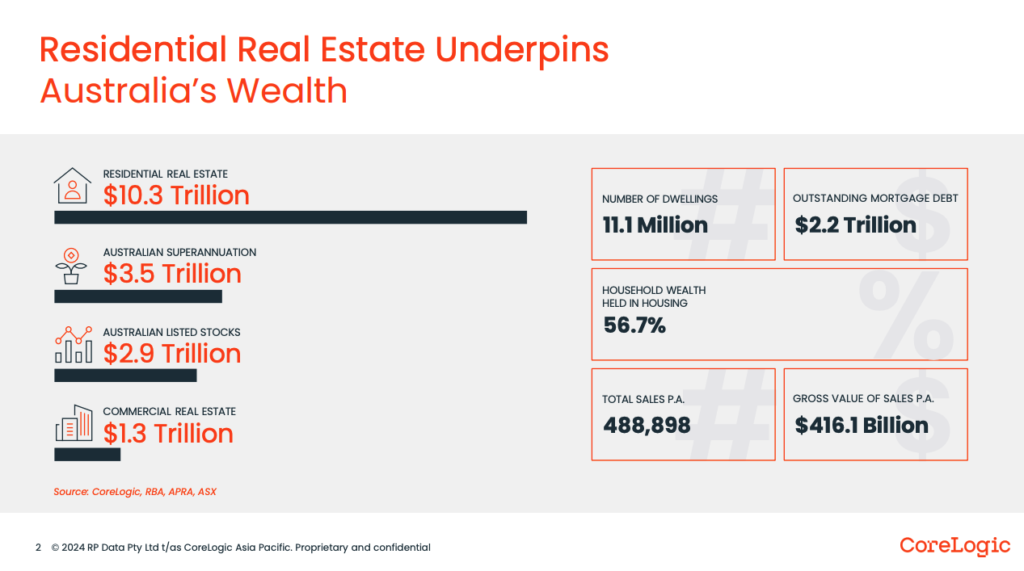

The latest Corelogic Monthly Housing Chart Pack has revealed new data for how the market performed over the past year. Residential real estate continues to be the pillar of the country’s wealth, with 56.7% of household wealth held in housing. In Australia, around 35% of homes are owned with a mortgage and the magnitude of the outstanding mortgage debt totalled $2.2 trillion.

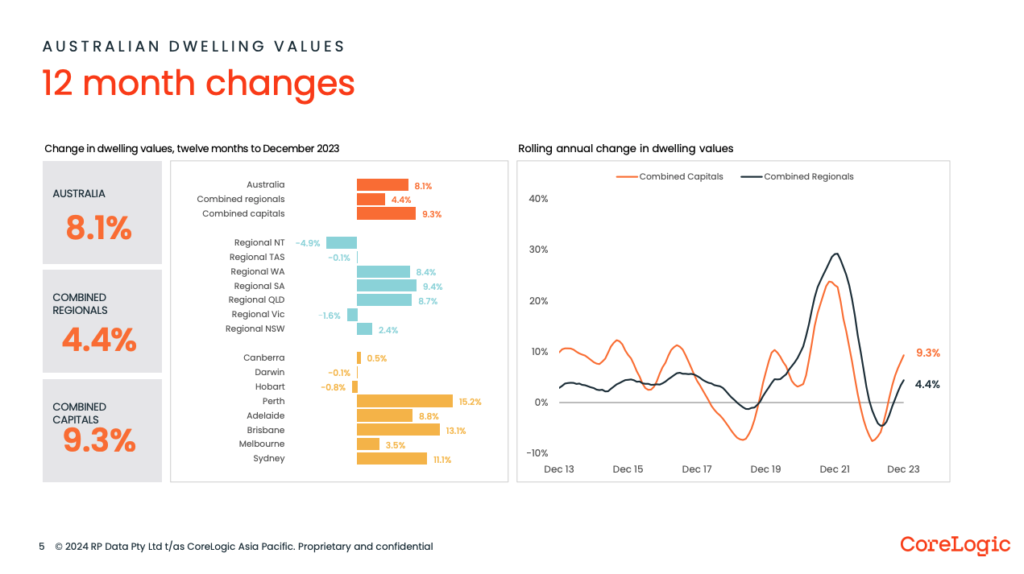

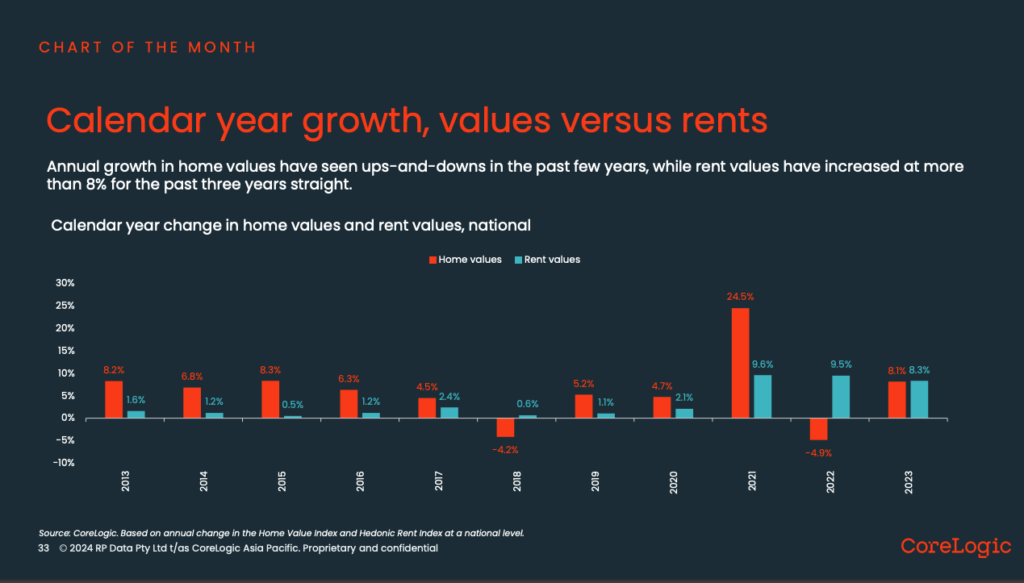

CoreLogic data reveals that dwelling values has increased 8.1% in the 2023 year (or 9.3% for combined capital cities and 4.4% for combined regionals), which represents a strong turnaround from the -4.9% fall in 2022. However, this annual growth was lower than in 2021, when home values increased 24.5%.

Since 2018, the annual growth in home values have fluctuated somewhat, with declines in both 2018 (-4.2%) and 2022 (-4.9%), and a strong growth at the height of the pandemic in 2021 (+24.5%). Unit values, however, have seen increases at more thatn 8% for the past three consecutive years.

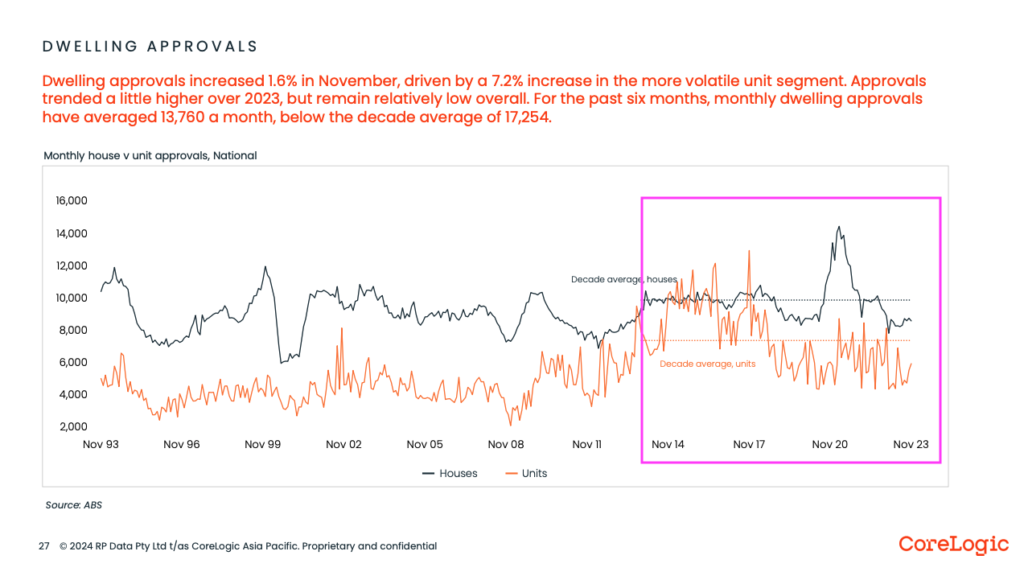

Dwelling approvals across Australia increased 1.6% in November 2023, which was driven by a 7.2% increase in the more volatile unit segment. Overall, approvals did trend higher over the past year. However, this level is still relatively low. The monthly average of 13,760 dwellings (over the past 6 months) is still significantly below the decade average of 17,254.

The above chart highlights the housing challenge we are continually facing, and dwelling approvals are only one piece in the puzzle. As we saw previously in our “Australia’s Housing Crisis” research, despite significant new land releases in 2023, the nation is still facing an alarming shortfall in dwellings because demand is still overtaking supply.

At the end of 2023, it took an average 275 days in NSW (and one year in VIC) to settle on a vacant block. The volume of settlements on new residential land also dropped 13.6% over the past financial year to 73,901 dwellings. The pace of release in land supply (in terms of days to settle and volume) is too slow.

There are many other factors that are at play impacting the housing crisis but our view is that it is probably going to get worse before it gets better.

We will be watching this space closely over the course of 2024, in particular the government’s housing reforms towards delivering more affordable homes for Australians.

Credit: CoreLogic’s Monthly Housing Chart Pack – Unlocking smarter property decisions, January 2024.