The Reserve Bank Board released it’s first Monetary Policy Decision last Tuesday, 6 February 2024, under its own name, following the recommendations of the RBA Review, rather than a statement delivered directly by the Governor.

No surprise that the cash rate was kept on hold at 4.35% given the uncertainty surrounding the economy. Apart from the standard economic commentary, the RBA Board is striving for a clearer communication style by in two ways.

It is implementing headings. It is also adopting less rhetoric and emotive language. For example, keeping the economy on a “narrow path” or “even keel”, or inflation as a “scourge” that “damages the functioning of the economy” and “costly to reduce later”. It was a much simpler, direct statement.

The key takeaways are the following:

1. Inflation is slowing, but remains high at 4.1%, which is still above the 2-3% target band

2. Goods inflation is in check, but services inflation remains high, “consistent with excess demand in the economy and strong domestic cost pressures… for labour and non-labour inputs”

3. Labour market conditions are easing, but are tighter than what would keep the economy balanced. Wage rises can only be sustained if productivity growth returns to its long-run average

4. Inflation is expected to return to target in 2025 and to the midpoint in 2026, with that unemployment and underutilisation rate will “increase a bit further”

5. The outlook is uncertain domestically (in terms of real income and household consumption growth which are weak) and globally. The global outlook is driven by the Chinese economy and conflicts in Ukraine and the Middle East.

Ultimately, the door was left open for more rate rises, should inflation not be contained. Quoting from the statement: “The path of interest rates… will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out“.

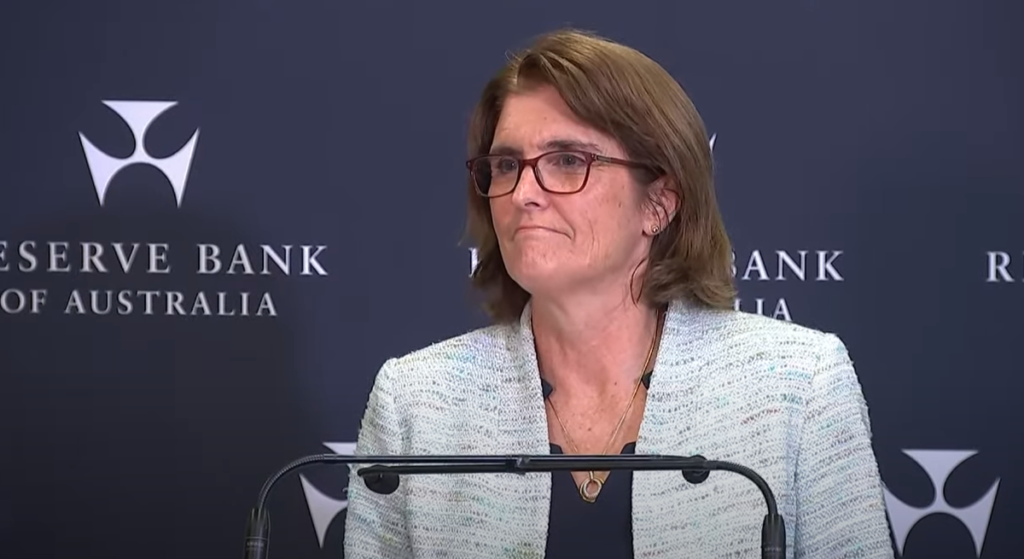

In the press conference following release of monetary policy statement, the Governor added more comments on her outlook on further rate movements.

Importantly, she will not rule out or rule in further interest rate increases. So there is every chance, interest rates will hike again. As mentioned, in the statement, there is much uncertainty that lies ahead. The Governor will not rule out a rate cut or hike either way until there is data that reassures her board that inflation is coming back to the target.

This inflation target is, namely, 2-3% within the timeframe of 2025, and reaching the midpoint in 2026.

From the Governor’s comments during the press conference and Q&A, it is very clear that putting inflation ‘to the background’ again is what the RBA is aiming to achieve, while balancing downside risks from the softening in the economy:

- Inflation hurts all Australians. For many Australians the last two decades prior to the pandemic inflation was about 2%. It was in the background, people weren’t focused on it..

- .. that’s not the case anymore. Everyone is focussing on inflation and for that reason what we’ve seen is a very rapid rise in interest rates over the last 18 months to 2 years.

- It’s (the rate rises) been rapid because .. we had to remove all of that stimulus we had from the pandemic and then we had to .. address inflation which means we had to get interest rates into restricted territory.

- The best thing we can do with our tool is help households deal with the cost of living by getting inflation down. That’s our aim. We want it back in the background again and people are not worrying about it.

While there is still no clear indication on where the cash rate is heading for the rest of the year, the Governor acknowledges by saying that she understands that mortgage holders are “sweating on this”. The message is clear that the negative impact of inflation is a higher priority to solve than the impact on the one-third of home owners who are carrying the burden of a mortgage.

The next monetary policy board announcement will be on 19 March 2024.