This article serves as an important update for business owners looking to obtain any form of commercial funding during Covid-19. In preparing this piece we surveyed a selection of banks (ANZ, CBA, NAB and Suncorp) and non-bank lenders (RedZed, ThinkTank, Liberty & La Trobe) to understand their current deal flow, credit appetite and changes to policy.

The most important thing to note is that banks are asking further questions to understand if your business has been impacted by Covid-19 and requesting additional supporting documents to evidence continuity of cash flow to repay a loan. It’s important to be forthcoming with this information to get a loan in the current environment.

Are business banks still lending during coronavirus?

Yes, business banks are still “open for business” and considering new lending opportunities. While there was a temporary pause in new lending when Covid-19 first hit Australian business, and banks were inundated with loan deferrals, policies and credit appetite have begun to relax again. It’s important to note however that lenders are enforcing enhanced due diligence before approving a loan, in particular, industries viewed as being directly impacted by Covid-19.

What applications are banks seeing at this point in time?

Banks have seen an uptick in business loan applications since the turn of the new financial year (July 2020). Most of these enquiries are oriented towards industrial purchases (warehouses and factories), and business owners looking to buy rather than rent – in other words Commercial Owner Occupied purchases. Fewer enquiries are being made for retail property and offices, which are forecast to be declining segments of the commercial property market. There is some opportunistic buying of commercial investment properties, but this is being dampened by higher deposit and loan servicing requirements (noted later).

For Commercial Property winners and losers see AFR report by Larry Schlesinger.

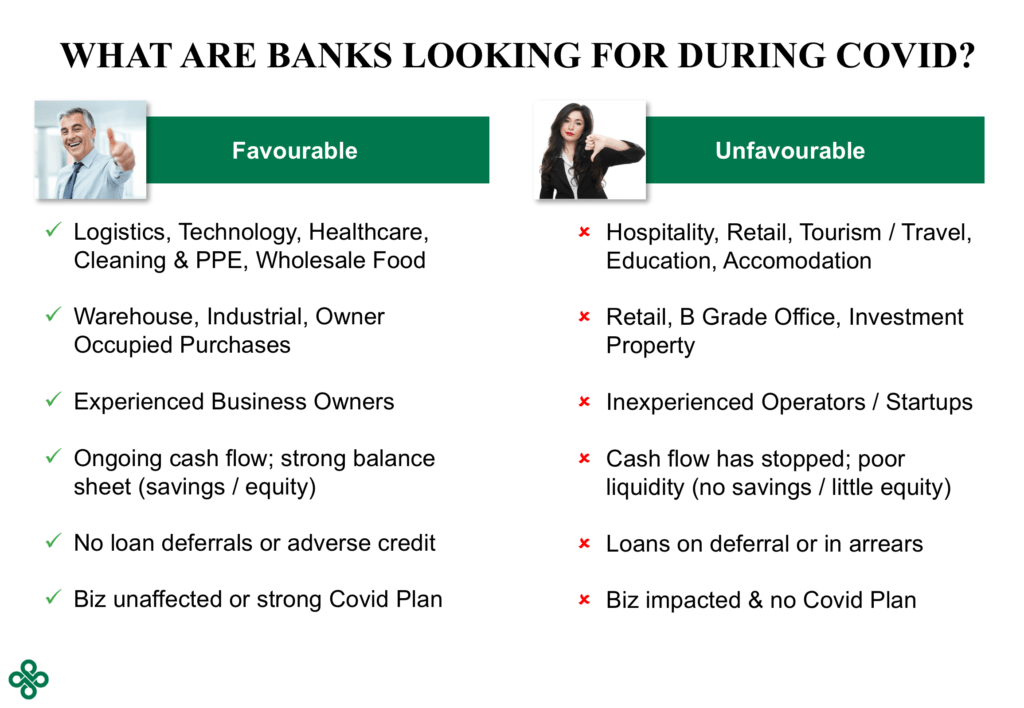

What industries are banks viewing negatively and positively in the current market?

Banks are placing more scrutiny on the following industries:

- Retail

- Hospitality

- Tourism / Travel & Leisure

- Education

- Businesses tied to airlines

- Hotel & Motel Accommodation

- Pubs and Clubs

While there are no specific ‘in favour’ industries, several segments have benefited from changes in consumer behaviour arising from Covid-19. Such industries include healthcare, technology, logistics, clearing and PPE, online businesses, wholesale food and local businesses that have been able to pivot towards takeaway and delivery models.

It is still worth considering the $250,000 Government Small Business Loan?

In our experience and that of our bankers, many of these loan applications did not get approved. There was a mismatch between the Government’s intentions for these small business loans and how they were being assessed and by the banks.

Many business owners were required to demonstrate they could pay back the loan within a 2.5 year time frame using historical FY19 financials. This did not work for many businesses leading to loan amounts to be scaled back to what the bank believed a client could afford. For example, many requests for $250,000 lead to maximum loans of $100,000 being issued. Lenders also had a strong preference for existing clients, turning away many applicants from other banks.

Furthermore, many clients thought they could use this money to fund new businesses, make investments into their business, or resuscitate businesses that had been failing prior to Covid. By contrast the purpose of the Government Backed loans was to tie over basic working capital and cash flow needs to ‘survive’ Covid. These more speculative related loan applications were outrightly rejected.

The nature of this Government initiative is changing however with (1) loan sizes increasing to up to $1M and (2) a relaxation of responsible lending requirements. This means that a $250,000 loan may become much more readily available, with stricter tests at higher loan amounts, and growing your business becoming an eligible purpose rather than simply surviving.

We will report more on these new $1M government backed loans when more information is announced.

Are many clients still on loan deferrals?

When Covid-19 first hit, many business owners ‘panicked’ immediately seeking loan deferrals as a precautionary measure without understanding the cost implications of their request. Some banks offered 3 months, others up to 6 months, with most lenders finding 10-15% of their client base on loan deferrals. CBA was an outlier automatically freezing business loans for all clients, with borrowers having to opt out if they would like repayments to commence again.

As businesses completed the first 3 months of the loan deferral period, many businesses found the impact of Covid-19 to their income not as severe as originally anticipated, opting to recommence repayment of their loans. However many businesses in the affected industries above, and many property investors, continue to have loans on deferral.

What is credit appetite at the moment?

Credit appetite during the June Quarter 2020 was extremely tight as all credit departments wrestled with understanding the impact of Covid-19 on borrower creditworthiness, and how to best evaluate this impact through supporting documentation.

Outlined below, credit policy immediately changed with lower permissible Loan to Value Ratios (LVR’s) and higher serviceability criteria. Since the relaxation of social distancing rules (apart from Victoria more recently) credit willingness to approve deals has improved.

Nevertheless, “case by case” assessment has become the go to phrase, which is the bank’s way of saying that while policies exist it will want to dive deeper to understand how a business is currently performing and what it’s plans are. It is also another way of saying the bank reserves the right not to lend if it feels uncomfortable with a deal presented.

How have commercial lending policies changed in response to Covid-19?

When Covid-19 first struck, LVR’s dropped ~5% across all lenders across all commercial property types, whether officially announced or as an unspoken policy change. This was necessary for banks to protect their balance sheets in a time of uncertainty and while they worked out the impact of Covid across their customer base. Non-banks also reduced LVR’s to demonstrate to their funders that they were being proactive in managing risk in response to Covid.

Commercial LVR’s have since normalised. However, the following commercial lending policies have remained changed for an indefinite period.

- Commercial Owner Occupied Property – policies have returned to normal for major banks, however enhanced due diligence is being undertaken as outlined below

- Commercial Retail Investment Property- Bank

- Maximum LVR is 55% for major banks, down from 65% LVR

- Net Interest Cover Ratio or “ICR” is now 2.5x, previously this was 2.0x. This is the multiple which net rental income covers the interest costs at actual loan rates.

- Maximum LVR is 55% for major banks, down from 65% LVR

- Commercial Office Investment Property (B-Grade and Below) – Bank

- Maximum LVR is 55% for major banks, down from 65% LVR

- ICR is now 2.5x, previously 2.0x

- Maximum LVR is 55% for major banks, down from 65% LVR

- Commercial Industrial Investment Property (Warehouses, Factories) – Bank

- No change to Maximum LVR at 65%

- ICR is now 2.5x, previously 2.0x

- No change to Maximum LVR at 65%

- Residual Stock Property (5+ units in the same development) – Bank

- No change to Maximum LVR at 65%

- ICR is now 2.0x, previously 1.75x

- No change to Maximum LVR at 65%

- For Non-Bank Lenders across Commercial Owner Occupied & Commercial Investment property, as a general rule of thumb, ICR requirements have increased from 1.0x to 1.2x and Debt Service Cover Ratio (DSCR) has increased from 1.5 to 1.7x. DSCR is the multiple which total income covers all loan repayments, calculated as principal & interest, tested at actual rates.

- Medical Clients continue to have favourable policy outcomes, with no major changes to policy

- 75 – 80% LVR’s continue to apply with certain lenders for loans $1M and below, in both Full Doc and Lo Doc lending, although enhanced due diligence applies.

Please note that these are generalisations, and specific policy will differ by bank.

What Covid specific questions are banks asking?

Lenders are asking clients to complete a Covid Impact Statement as part of their loan application, or at the very least, answer a series of questions to understand the effect of Covid-19 on their business.

An example of questions in a Covid Impact Statement or Covid Questionnaire is as follows:

- From a major bank

- How has cash flow been impacted by COVID-19?

- What actions are being taken to preserve cash flow?

- Is there opportunity to diversify? If so, what is the impact(s)?

- Is there reliance on another industry to supply goods and services? How is this impacting the customer and are alternatives available?

- Does the request make sense given current environment?

- From a leading non-bank

- Please provide an impact statement in relation to any effect of Covid-19 on the applicant business

- What contingency plans does the applicant have?

- How will the applicant manage existing fixed business costs from current cash flow?

- What level of cash reserves do they have to meet wages and loan repayments?

Where the security is an investment property, and the tenant’s business has been impacted by Covid-19, the lender will look to evaluate the underlying strength of the tenant and their strategy to manage this period. Lenders have been checking Facebook to understand if what the applicant or tenant is advising is true and accurate.

Furthermore, if asking for a cash out, lenders want to understand the true purpose of funds and may restrict the cash out if they do not agree with the purpose.

Do I need to provide any additional supporting documents?

The supporting document requirements in a Full Doc (short for Full Document) loan application have not substantially changed, apart from answering the Covid related questions above. Typically this supporting document list would include:

- Identification of the Borrowers / Guarantors

- Last 2 Year’s Financial Statements & Tax Returns for any trading entities or income streaming entities i.e. trusts

- Last 2 Year’s Individual Tax Returns & Notice of Assessment for Borrowers / Guarantors

- Last 6-12 month company trading account

- Last 12 month BAS Statements

- Last 12 month ATO Tax Portals – Integrated Client Account & Integrated Tax Account

- Schedule of Personal & Company Debts outlining loan amount, monthly repayment, loan term, interest rate, and balloon payment if applicable

- Statements evidencing Assets & Liabilities

Given at time of writing (August 2020) the FY20 financial year just passed, banks will also be requesting a draft of a borrower’s FY20 Profit and Loss Statement to understand the extent to which the FY20 financial year was impacted by Covid. Arguably this would have been requested any way as part of responsible lending.

In a Lo Doc (short for Low Documentation) loan application, lenders are starting to request additional documentation that give them more insight into the current cash flow of the business. Where a prior Lo Doc application may have only required a business’s BAS OR company trading accounts OR accountant declarations, even applications relying on accountant declarations now also require a BAS, 1-6 months statements of a company’s main trading account and even a schedule of debtors and creditors to be provided. So essentially a Lo Doc loan is now slightly stricter to get approved as lenders want to see you have the cash flow and cash reserves to get through the next 3-6 months, and any loan arrears or loan deferrals may be viewed adversely.

What are some tips when submitting a new business loan application?

Again, commercial banks are emphasising they are open for business.

To unlock a loan approval you must be deliberate in explaining the impact of Covid-19 on your business, even if you have experienced a positive outcome from the pandemic. If your business performance has been negatively impacted, then you must explain the measures you have taken to manage the impact of Covid to your business (e.g. accessing Government stimulus measures, cutting costs, pivoting your business model) as well as your strategy to improve business performance and trade through Covid. It is better to anticipate these questions and address them upfront rather than have a credit officer second guessing your responses in a negative way.

Banks are still there to support good businesses, and businesses that will perform well again once Covid-19 is over. However, there is little to no appetite to support a business that was not performing well prior to Covid-19 and are looking to the bank to keep them going, so called ‘Zombie’ businesses.

How to contact us for more information

If you are in need of assistance for a business loan, please do not hesitate to contact us on 02 8004 1888 or via e-mail .

Request an assessment with SF Capital here: https://www.sfcapital.com.au/online-assessement-form/