Introduction

RBA Governor Philip Lowe put it best when he said that banks are acting as “shock absorbers” to the economic impact of Covid-19, making available loan deferrals, discounted fixed rates and small business loans.

However due to spiking unemployment and closure of businesses, banks are expected to be facing increased loan defaults in the months to come, especially as 3-6 month loan deferrals expire.

As a result Banks have given with one hand, but have had to take away with the other. They are tightening credit policy to protect against these losses, as well as guard against borrowers’ changing employment circumstances.

This article covers some of the most recent changes for home lending. We are expecting many of these policies to be in place for at least the next 6 months.

#1 – “Have you been impacted by Covid?”

This is the million dollar question.

All Banks want to know is if you have been financially impacted by Covid-19.

ANZ is now requiring brokers to ask the applicant “has your income been negatively affected by Covid-19?”; if the answer is ‘Yes’ then a Covid-19 checklist is completed for each impacted applicant.

CBA is now mandating questions regarding any changes to the applicant’s situation that may impact earning capacity, and any changes to employment or income that will affect the ability to meet existing expenses and debts.

Similarly, NAB in considering responsible lending requirements, asks for a “Covid-19 discussion” with the client to be documented. What goes on file covers understanding their financial position and foreseeable changes, and for self-employed applicants, the client’s current situation and Covid-19 impacts on business.

How you respond to this question is critical as you go through a new application process.

However, it’s important to know that answering this question is not required for staying with your existing lender and simply negotiating the rate, or requesting a change in loan structure.

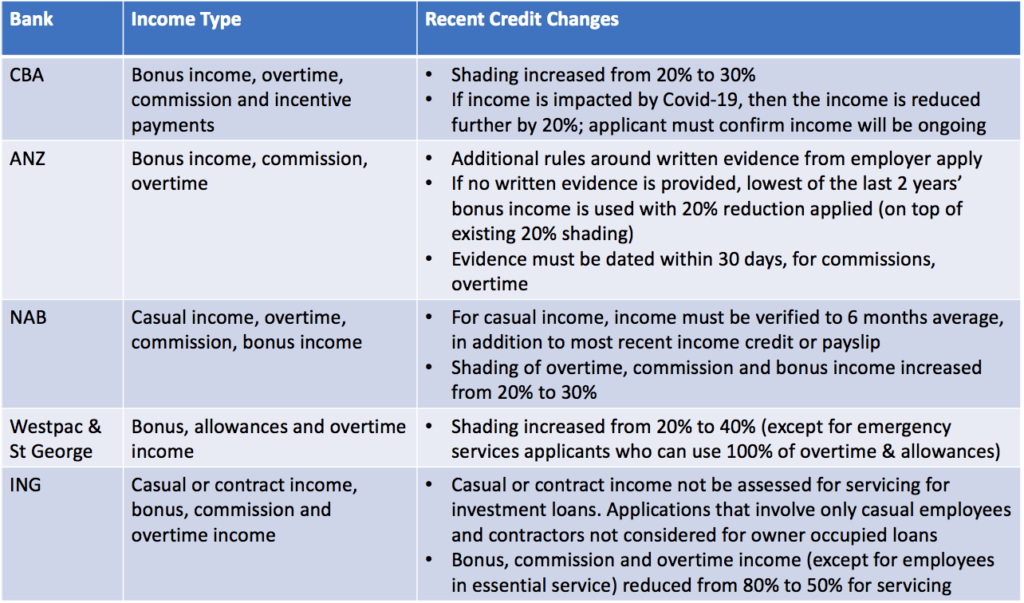

#2 – Tightened policies for PAYG employees

When the economy shrinks, business profits are smaller (even negative) and labour hours worked reduced.

This directly impacts forms of discretionary and variable income paid to employees, which include bonuses, commissions, overtime. Casual employment also suffers as casual staff are usually the first to be impacted when a business declines.

Banks are aware of this and have tightened their policies for PAYG applicants who receive forms of discretionary and variable income.

The specific restrictions for each bank are outlined below:

In the current environment, banks are also not accepting salary credits and payslips older than 14 or 21 days.

Macquarie applicants within affected industries will have to provide bank statements showing salary credit no older than 14 days matching payslips. Alternatively, the credit assessor would need to speak to the employer to confirm employment status and current income.

The 14 days old rule (or 1 month for monthly pay cycles) also applies to payslips of Westpac and St George applicants who are PAYG or casual employees.

PAYG income credits for NAB applicants can not be older than 30 days for monthly repayments or 21 days for weekly/fortnightly/bi-monthly payments.

In the case where an applicant has been stood down with no income, ANZ has introduced specific rules where an employee letter is important, otherwise evidence of savings will be required. The employer letter needs to demonstrate the intention to reinstate the applicant.

#3 – Changes to Self-Employed Policies

Small business is the life force of the Australian economy contributing 34.2% to Australia’s GDP and employing 2.2 millions workers.

Small business can be just as impacted as big business however the impact on an individual i.e. the business owner is more severe.

Banks want to see if your business performance has suffered due to Covid-19, and are testing this in various ways:

- Requests for BAS, transaction accounts

- CBA is allowing forecasts

Applications to Macquarie must now include the normal two years financials plus BAS covering the period from the most recent financial statements to the application date. From 1 April 2020, March quarter BAS, bank statements from at least 1 March 2020 onwards (and no older than 14 days) evidencing consistent trading income are required.

Income from borrowers involved in industries directly impacted by Covid-19 (e.g. airlines, tourism, hospitality, retail) will not be assessed by ING for servicing. The bank is also requesting March quarter BAS to demonstrate alignment of current revenue to the most recent financial years.

Westpac and St George are also requiring additional supporting documents to include BAS no older than 120 days old, corresponding BAS covering the same quarter last year, and last 3 months bank statements/transactions.

CBA offers an alternative option to test income based on accountant-prepared business projections for 12 months, while the normal two years financials/tax returns are still required.

For self-employed applicants Banks want to know more than the extent to which a business has been impacted by the lockdown rules, but also how the business plans to recover.

NAB’s suggested questions dig deeper into the strategy that might be in place to keep the business running in the short term and to get it back on track beyond that.

IMPORTANT – Also see below for restrictions to cash outs for business owners.

#4 – Changes to LVR Thresholds

Apart from extra checks, Loan to Value Ratios are another lever Banks can adjust to protect themselves in the downturn.

Macquarie introduced an additional lever where LVR is greater than 70%, a maximum debt to income ratio of 6x will apply. Going above 70% LVR will trigger additional income and employment verification requirements regardless of industry.

For applications involving equity releases and cash outs, maximum LVR is 80% for the purchase of a property, construction of a new property or renovations to an existing property.

Westpac and St George are capping maximum LVR at 80% on all self-employed home loans. The maximum LVR to qualify for LMI waiver has been reduced from 90% to 95% for industry specialisation, sports, entertainment and medico sectors.

For some lenders, 70% LVR has become the new 80%, with Macquarie creating a new pricing tier for 60% LVR’s which has been unheard of before.

#5 – Restrictions to Cash Outs

Banks are also concerned about businesses using home equity to fund themselves through Covid-19.

Some banks have also responded by stopping cash outs completely unless you can prove you have an impending property purchase.

Macquarie is restricting cash outs (and equity releases) by raising the maximum LVR from 70% to 80% AND limiting the purpose to the purchase of a property, construction of a new property or renovations to an existing property.

For business owners, some banks are RESTRICTING OR PREVENTING CASH OUTS. One example is ING which has put a stop on all cash outs for self-employed applicants.

#6 – Tightened Policies on Rental income

Finally, banks are concerned about the flow on effects of Covid-19 lockdown and income reduction on the rental market.

Temporary policy changes include not accepting holiday rental income (such as AirBnB), an increase in rental shading to reflect the increased risk, and confirming whether rental reduction has been provided to tenants.

Supporting documents will need to evidence the most recent rental income from bank statements.

Summary

This is a fast changing environment. We will provide any future updates as the market evolves.

Banks are well aware about adhering to responsible lending obligations and have been warned by the regulators that those rules apply during the pandemic.

Please don’t automatically assume you can borrow given your past history.

We recommend that you seek the advice of an experienced broker or credit adviser who can run an assessment for you applying the most up-to-date policies.

Contact us for more information

If you would like to discuss your scenario in light of Covid-19 changes, feel free to get in contact with the SF Capital team.