When getting a home loan, one important aspect to settle on is whether it should be an owner occupied or an investment loan. What is the difference between the two types of loan and why does it matter?

To certain purchasers, the delineation between an owner occupier vs investment purpose is clear. First home buyers who wish to purchase a property to move into will most likely be applying for an owner occupied home loan.

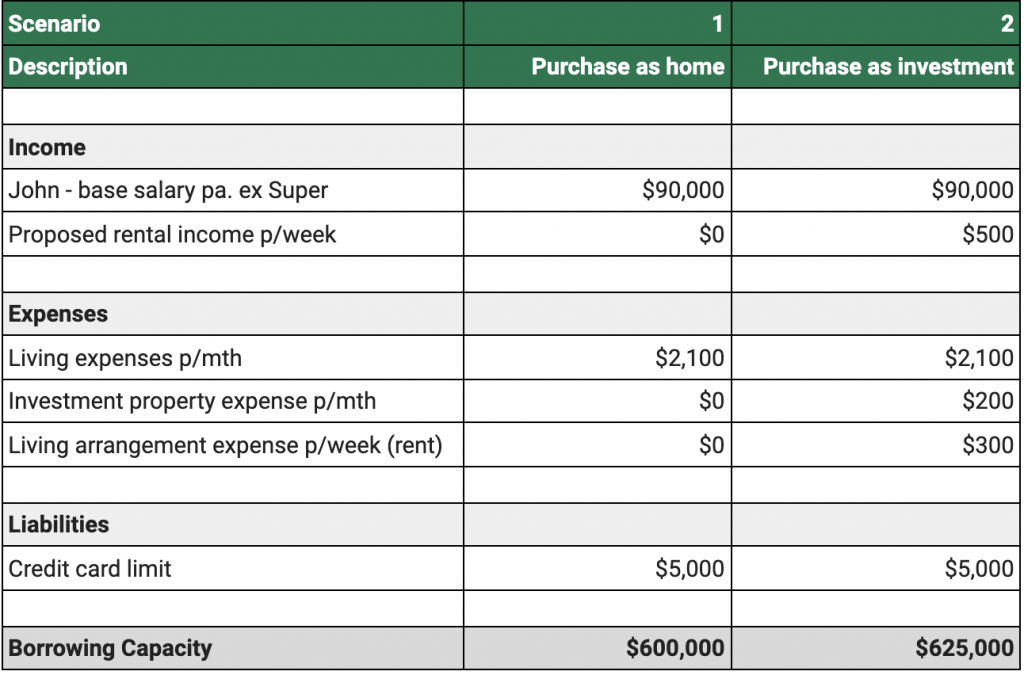

However, to other purchasers, the case for an owner occupier or investment loan is not always straight forward. The biggest lever in this decision hinges on the applicant’s borrowing capacity under the two loan types. Here is an example to illustrate this.

John Smith is single with no dependent earning base income of $90,000 excl. super per annum.

As per mandatory HEM, his living expense is calculated as $2,100 per month, and has a credit card limit of $5,000.

If John purchases a property as his home to live in, he can get a loan of up to $600,000 depending on the lender. If he purchases a property as an investment, he will be earning $500 per week as rent but will also incur investment property expenses and his living arrangement expenses eg: rent. This will still give him a borrowing capacity of $625,000 depending on the lender. The difference between the two loan types is an additional $25,000 in borrowing (around 4.1%).

In recent years, the trend in an investment strategy called “rentvesting” means that homemakers rent out their property to generate rental income, while they move and live in a rental property at a desired location.

If John Smith is keen to purchase a property and enter in the market but does not want to change his current lifestyle i.e. he wants to live in the city due to proximity to his workplace etc. As a rentvester, John can purchase a property as an investment and rent it out.

In this way, John can stay in the location where he is and can also get into the property market. This will enable John to start another income stream (i.e. rental income) and will also give him an opportunity to reside in his own property in the future.

Key differences between an owner occupier vs investment loan

We outline below the key differences between the two loan types.

- Loan Purpose Classification – an owner occupied loan is for the purpose to live in the property (for a minimum of 6 months) whereas an investment loan is for any other purpose except living in the property. For most lenders, a holiday home that is not the usual residence of the borrower can also be classified as owner occupied.

- Borrowing Capacity – as explained above when applying for an owner occupied loan, your borrowing capacity will be lower (and this can differ from case-to-case) compared to an investment loan because you will not have proposed rental income included.

- Loan-to-Value Ratio – applicants can borrow up to 95% of the property value (including LMI) for an owner occupied loan whereas investment loan is capped at a maximum of 90% (including LMI).

- Increase in Cash Flow – a borrower with an owner occupied property can take advantage of renting out a room and increase the cash flow or pay more towards their home loan repayments whereas this is not an option for an investment property as the borrower will not reside in it.

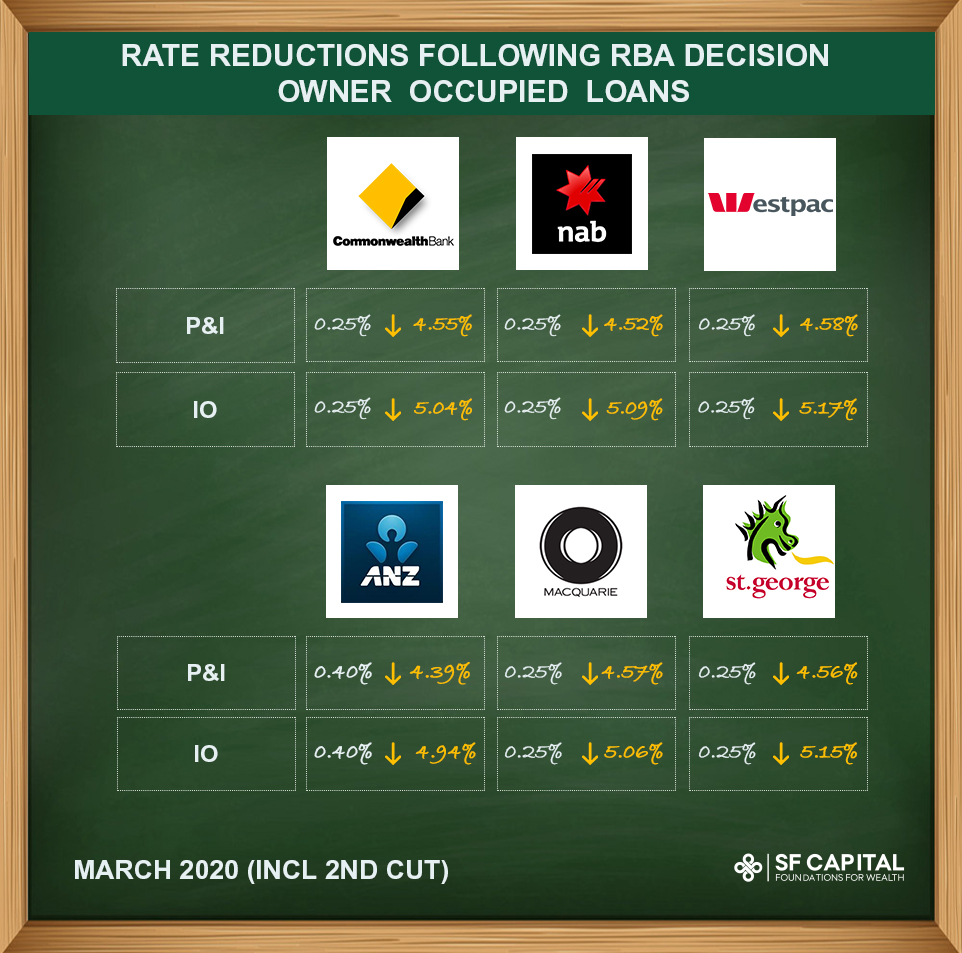

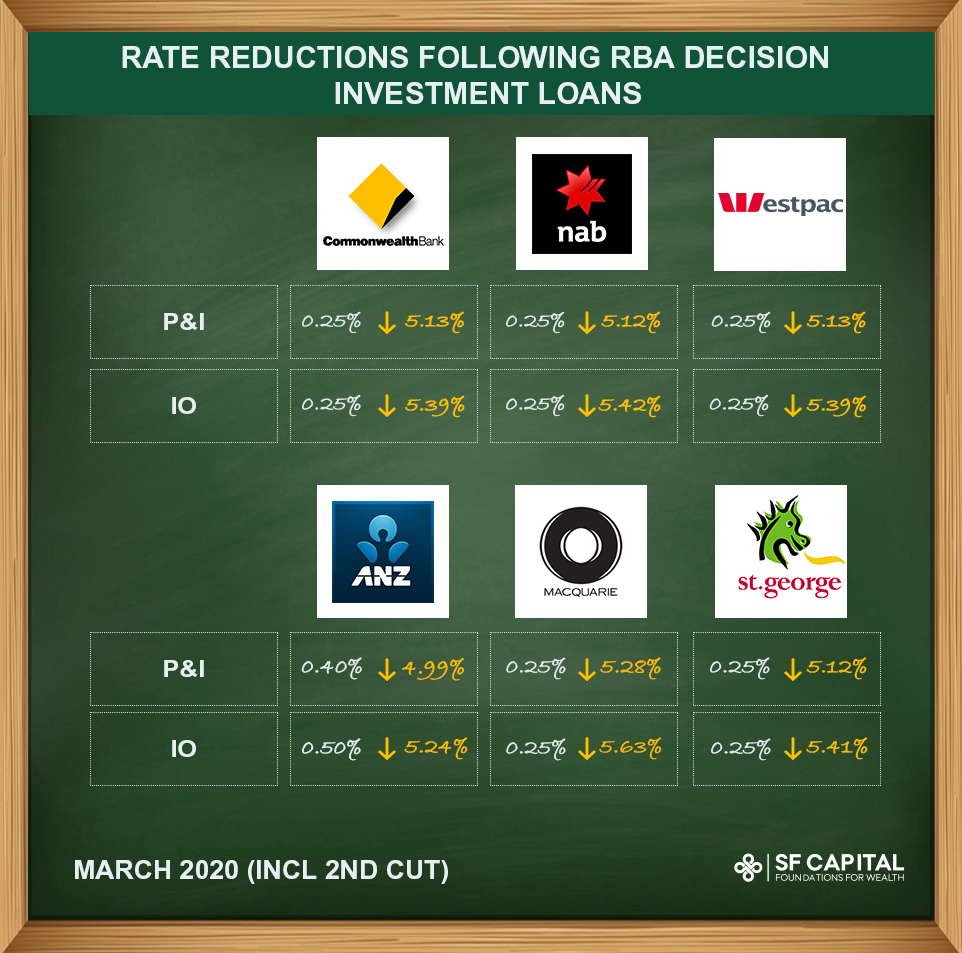

- Interest Rates – owner occupied loans attract lower interest rates compared to investment loans. The main reason for the difference is because banks consider owner occupied loans as low risk due to the fact that they will be the borrower’s principal place of residence. The tables below present the banks’ variable headline rates showing higher investment rates compared to owner occupier rates.

- Interest Rate Concessions – given the headline rates, the interest rate discounts allowed by banks for owner occupied loans will also be greater compared to investment loans.

- Tax Considerations – in Australia, borrowers can benefit from income tax deductions for interest incurred on an investment loan. However, there is no deduction for interest expense for an owner occupied loan.

- Government Grants – the various Federal and State government grants and concessions in place to help first home owners get into the property market sooner through grants, stamp duty exemptions, loan guarantees etc are applicable to owner occupied loans. On the other hands, no benefits are available to borrowers seeking an investment loan. Read our article on the first home owner grants available in NSW.

Loan Strategy

The loan purpose (owner occupier vs investment) plays a crucial role in forming your home loan application and often this distinction can mean whether your loan will be approved (or declined) by your desired lender.

This is where the knowledge and expertise of a mortgage broker can help you make a decision on structuring the loan which best suits your requirement and objective.

‘Going in’ with an appropriate strategy will ensure a successful application and bring you one step closer to acquiring the property you have in mind.

Contact us

If you need assistance with securing a property purchase, please get in touch with our broker team today.