For the first home buyer, there is a range of first home buyer grants you may be eligible for. Understanding the government grants and concessions available to you will help you understand the amount of deposit you need.

In this essential guide, we provide:

- An overview in Part 1 of all the government schemes you may be able to access when buying your first home

- The eligibility criteria for each of the government scheme and concession, in Part 2

- The final Part 3 provides a case study to illustrate the maximum grants you can receive, as a first home buyer and borrower, in NSW.

Part 1 – Government Grants & Concessions at a Glance

There are a total of four grants and schemes available to first home buyers, as follows:

#1 – First Home Owner Grant (New Homes) Scheme

If you’re a first home buyer and you’re buying or building a new home, you may qualify for a $10,000 grant under the FHOG if your purchase date was on or after 1 January 2016. The definition of a new home is the first time the house has been sold and no one has ever lived in before you moved in.

You can make a claim for the FHOG if your:

- newly constructed home or a substantially renovated home has a total value less than $600,000

- land for building and any dwelling you intend to build has a combined value less than $750,000.

#2 – First Home Buyers Assistance Scheme

As a first home buyer, you may be eligible under the FHBAS for a transfer duty (or stamp duty as we know it) concession or exemption, depending on the property value.

For a home valued less than $650,000, you can apply for a full exemption so that you don’t have to pay transfer duty.

If the value of your home is between $650,000 and $800,000, you can apply for a concessional rate of transfer duty. The amount you’ll have to pay will be based on the value of your home.

The FHBAS applies to vacant land on which you plan to build your home.

You will pay $0 transfer duty if your land is valued at less than $350,000, or a concessional rate of duty for land valued $350,000 and $450,000.

First Home Buyers Assistance Scheme (Update)

Under the NSW government’s Covid-19 recovery plan, first home buyers in NSW can benefit from a temporary increase in stamp duty concession for new homes commencing on 1 August 2020, for a 12-month period. The indicative tax threshold changes are as below:

#3 – HomeBuilder Scheme

As a response to the pandemic, the Federal government introduced the HomeBuilder Program to assist the construction industry. The intention is to encourage new homes being built or major renovations. This program provides eligible owner occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home.

Read our earlier article on how you can make the most of the HomeBuilder Scheme.

#4 – First Home Loan Deposit Scheme

Eligible first home buyers can purchase a modest home (up to $700,000 in Greater Sydney) with a deposit of as little as 5% (lenders criteria also apply) with the government (under the National Housing Finance and Investment Corporation) guaranteeing up to 15% of the property value.

The FHLDS is a great government initiative to support first home buyers who may otherwise need to save up for a 20% deposit or be made to pay lenders mortgage insurance by the bank.

There are 10,000 spots available per financial year, nationally.

Find out more about the FHLDS here.

Each state or lender will have its own limitations on the property value for each of these grants, so we highly recommend that you consult with a professional before making decision to buy.

The best thing about this is that you’re not limited to the one benefit, but you can take advantage of all these benefits, provided you are eligible. So in this section, we discuss the eligibility criteria you need to check off.

Part 2 – What are the eligibility criteria for each first home buyer grant?

Common Criteria

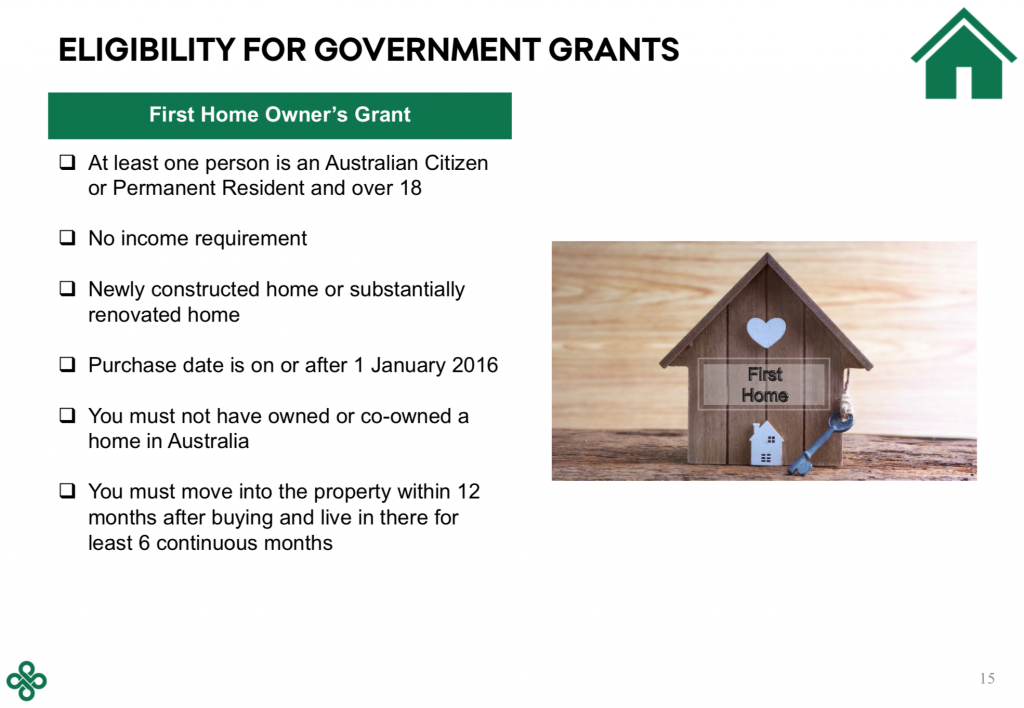

The common criteria against all the first home buyer benefits mentioned in Part 1 are:

- You must be Australian Citizen or Permanent Resident who is an individual over the age of 18;

- Being a first home buyer, you must live in the property for a continuous 6 months; and

- You must not have owned or co-owned a home in Australia.

On top of that, there is a maximum property value for each state – further regulated by individual lenders with their postcode restrictions.

In addition to the common criteria, the following are the the specific criteria that apply to each benefit.

Additional Criteria

For the First Home Owner Grant (FHOG), the only additional criteria is that this must be for a NEW property.

The definition of New home is the first time the house has been sold and no one has ever lived in before you moved in.

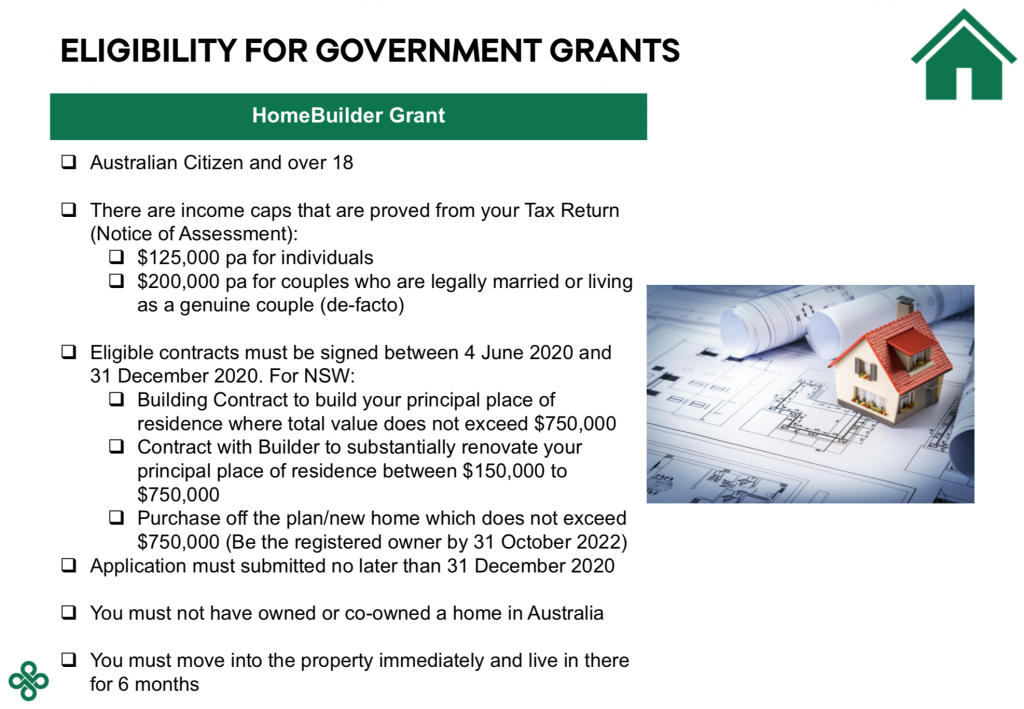

For the HomeBuilder Grant, these are the main things to note:

- Australia Citizens ONLY, this means even for joint applications you both must Australian Citizens for this to apply;

- There is an income threshold for single or joint applications which you need to present your latest tax returns to as evidence; and

- Finally, there is a timeframe to apply for this grant. Eligible contracts must be signed between 4 June 2020 and 31 December 2020, with an application submitted before 31 December 2020.

For the First Home Buyers Assistance Scheme (FHBAS), similar to the FHOG Is that you are restricted by the value of the property. Depending on the property value you can either obtain a full waiver or get a concession.

Last but not least is the First Home Loan Deposit Scheme (FHLDS):

- This is limited to certain lenders only and you need to reserve a spot in the scheme to get pre-approval with the lender;

- Each lender will have its own sets of rules and processes to follow;

Unfortunately all existing FHLDS spots have been filled for the financial year ending 30 June 2021, with no lenders accepting a waitlist anymore. The good news is the government has announced 10,000 new spots to be introduced for new homes with revised maximum property caps.

Now we know what benefits are available and if you are eligible, we can now put this into practice in understanding how much deposit do you actually need by sharing 3 examples (for NSW).

Part 3 – First Home Buyer Case Study

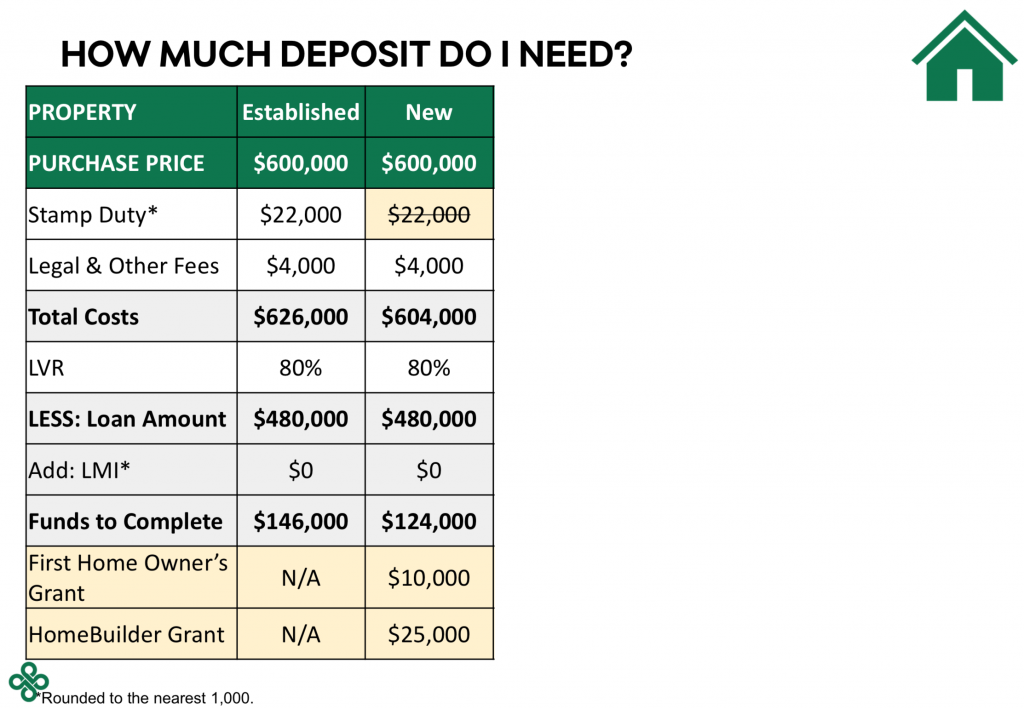

Example 1a – Buying a $600K established property

Let’s take a $600,000 established property as an example.

We know there are other costs involved in purchasing a home. These costs include:

- Stamp Duty – this is a state government charge on all property transactions

- Legal Costs or Transaction Costs – these are the costs of your solicitor and other government charges to register the mortgage

This will then bring the total cost to $626,000.

The bank then calculates your borrowing amount against the purchase price and the bank’s term for your borrowing amount is “Loan to Value Ratio” or LVR.

The bank regards 80% or less to be the safest LVR.

Working with an 80% LVR, if the purchase price is $600,000 then the bank will lend you $480,000, which is simply $600,000 x 80%.

Now, if the bank is lending you $480,000 and your total costs are $626,000, then the amount that you will need to pay towards the purchase is $146,000.

Now being a First Home Buyer, if you are purchasing a new home, your required funds to complete will change.

Example 1b – Buying a $600K new property

Using a purchase price of $600,000 again.

Part of the FHBAS means that stamp duty is waived for purchases at $600,000 and below, saving you $22,000. Hence your total cost will now be $604,000.

If we work with an 80% LVR, then we can calculate your contribution by taking the total cost of $604,000 less $480,000 loan, meaning the contribution will be $124,000.

So we can see an improvement already.

In addition, a NEW property at $600,000 will also mean you’re eligible for the FHOG and HomeBuilder Grant. This is a total of $35,000**, resulting in net contribution of $89,000 for a $600,000 purchase.

IMPORTANT – The reason why the FHOG and HomeBuilder grants is below the funds to complete line, is because lenders are not following a uniform approach so they may not allow you to use funds as part of the purchase.

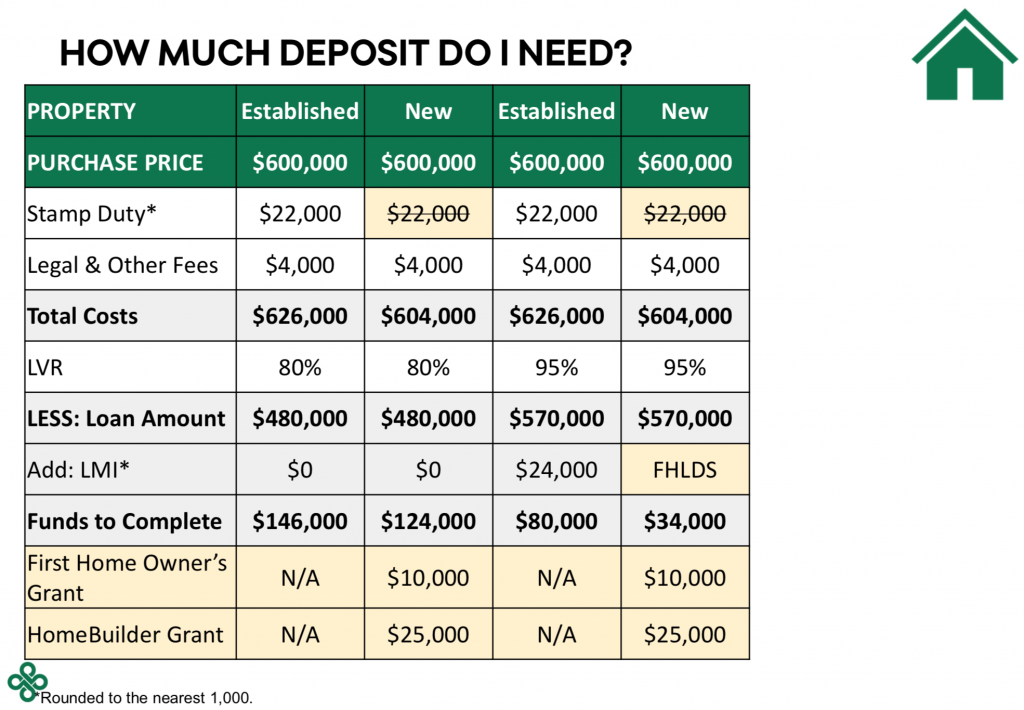

Example 2 – Using a smaller deposit to purchase the $600K property

For first home buyers even a $124,000 can be challenging to save up. So in the next example, we will show you how we use a smaller deposit to purchase the same property.

Previously I mentioned that 80% LVR is considered the safest LVR.

For homeowners we can go into 95% LVR increasing the loan amount to $570,000.

However when we do that, Lenders Mortgage Insurance which we call LMI applies and is a one off fee to cover the bank incase you default on the loan.

The estimate LMI for this purchase scenario is $24,000.

This means your contribution to this purchase will be $626,000 – $570,000 + $24,000 totalling to $80,000.

By opting to pay LMI and borrow more funds, you can again see a decrease in the available deposit you need to contribute.

If the question is, can we avoid paying the LMI? The answer is yes, and this is how it works.

Stamp duty of $22,000 is waived.

Under the FHLDS, you can borrow the additional 15% without needing to pay LMI.

This means the total cost $604,000 less $570,000, meaning you will only need to pay $34,000.

Now again, if we apply for the eligible grants of $35,000, you will receive a $1,000 return in your home purchase!

So you can see from the initial $146,000 deposit required, how we can utilise the benefits to only require $34,000 upfront.

Example 3 – Buying a $800K property

Now as we know, it can sometimes be challenging to find your first home at $600,000. So we have an example of a purchase at $800,000 to demonstrate the deposit you need.

For an $800,000 established property purchase, you will need to include $35,000 in transaction costs of which $31,000 just stamp duty. Hence the total cost for this purchase is $835,000.

If we work with 95% LVR of the $800,000, this is $760,000.

The LMI estimate for this scenario would be $32,000

Therefore, if the bank is willing to lend you $760,000 and total cost is $835,000, after we include LMI of $32,000 your contribution for this purchase will be $107,000.

Now if we take the view of it being a first new home purchase. Based on new government announced changes, a new $800,000 property will have stamp duty waived. Hence the total costs will be $804,000.

Similarly the New Home Guarantee under the FHLDS, have revised their set of property price caps means an $800,000 is eligible for the scheme, allowing 95% LVR with no LMI.

If we take the total cost of $804,000 less the loan of $760,000 your contribution to this purchase is only $44,000. This from a normal home purchase, shows potential savings of up to $63,000.

The above examples should provide a better idea on the deposit you need for your first home purchase, given the government grants and concessions you may be eligible for.

How To Contact Us For More Information

We have helped hundreds of first home owner clients to purchase their new home. We would be more than happy to give you guidance every step of the way. Our role as a broker is to manage the end-to-end loan process. We can also assist with the applications to first home owner government grants you may be eligible for.

To discuss your scenario with an accredited broker, please do not hesitate to contact Priscilla Tan on or +61498880011 or our team at .