Introduction

A split loan is one of the most common ways of structuring a mortgage home loan where the borrower gets the benefits of both a variable rate AND a fixed rate home loan. Borrowers on existing variable rate home loans can also split and fix a portion of the loan.

In the past 18 months, we have helped many clients with existing lending to fix a portion of their loan, due to the historic low interest rates, bank’s fixed rates have fallen to sub-2% level.

In this article, we explain what happens when a loan is split and fixed, as well as the processes involved.

What is a split loan?

A variable rate loan can be split into two (or more) portions, and one of these portions is then switched to a fixed rate loan for terms of between 1 to 5 years. The minimum loan balance for the new loan split is typically $10,000.

Why are borrowers splitting and fixing the loans?

This structure gives certainty to the interest repayments over a period of time because the interest rate is the same throughout the fixed term. By retaining a variable loan split, the borrower can benefit from the usual features of a variable loan. These include:

- Offset feature;

- Redraw facility; and

- Ability to make additional repayments without penalty.

How much are fixed rates lower than variable rates?

Currently, the major lenders are offering, for new business, variable home loan rates of between 2.54% pa to 2.79% pa for Owner Occupied Principal & Interest repayments. Fixed rates on the other hand range from 1.89% pa to 2.14% pa for a similar loan product.

Investment home loan rates range from 2.69% pa to 3.21% pa for P&I repayments, while fixed rates are in the vicinity of 2.29% pa to 2.49% pa.

How do we determine the split ratio?

The determining factor of the split ratio is the level of savings you expect to hold by the end of the fixed term. Therefore, the amount you have in the offset account now, plus expected savings to be deposited into and any lump sum amounts anticipated.

EXAMPLE:

Kaitlyn & Bob have an existing home loan with Yellow Bank and the balance is $675,000 and they are paying Principal & Interest.

They have an offset account with a current balance of $180,000 and expect to deposit $2,000 in the account per month. Bob is also expecting a performance bonus payment of $8,000 in 4 months’ time. They do not expect to be making withdrawals from this account over the next 24 months.

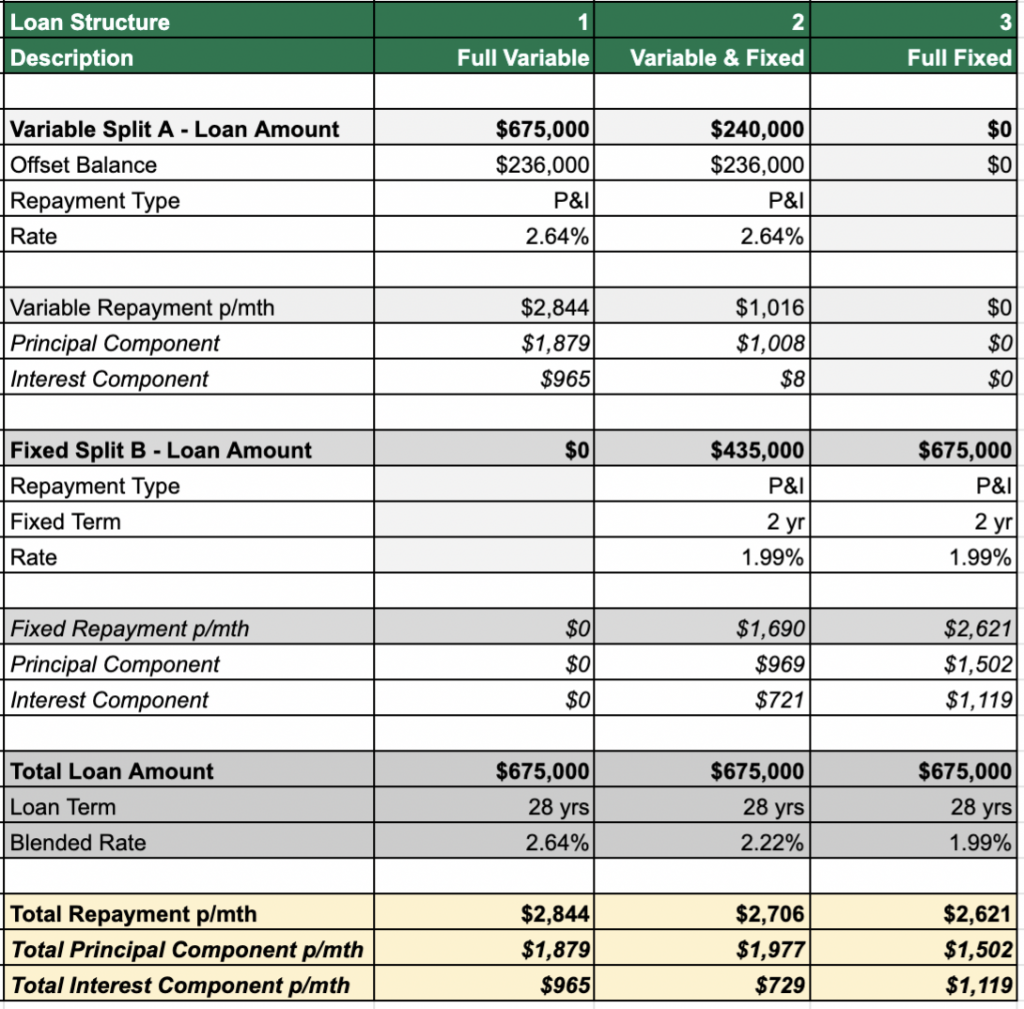

Given the estimated offset balance at the end of 24 months is $236,000, Kaitlyn & Bob can keep a similar amount in the variable portion. The split & fix structure can look like this:

- Fix $435,000 for 2 years

- Existing variable portion balance of $240,000.

How is a loan actually split?

A portion of an existing variable loan is carved out into a NEW loan split that bears attributes particular to the borrower. This new loan split is then drawn down in the amount of the required loan balance.

The new loan typically “inherits” the same repayment methods and frequency although the repayment date will in most cases not coincide with that of the original loan split.

The fixed rate portion

In most cases of split requests, the new loan is then fixed for the required term (1-5 years). The newly created fixed rate portion is a separate loan split with the same loan term remaining as the original loan split.

Once the fixed term expires, this loan will revert to a variable rate. This loan cannot be merged back together with the original loan split, unless an internet refinance process is undertaken.

If fixed rates are lower, why should I not fix the loan fully?

Interest rate alone is not the biggest driver of costs.

While ultra low interest rates mean lower repayment amounts which are fantastic for maximising cash flow, a split loan structure allows you to leverage interest savings from an offset account, where you may already hold a steady amount in accumulated savings.

Case Study

Using the same scenario where Kaitlyn & Bob have an existing mortgage with Yellow Bank for $675,000, with 28 years remaining in the loan term. They have been paying a variable rate so far, and are assessing whether to part-fix (split and fix) their loan or fix the whole loan.

Current variable rates are at 2.64% pa while the two-year fixed rate is 1.99% pa for an Owner Occupied P&I loan product on the wealth package.

- Loan structure #1 – full variable with offset – this structure gives Kaitlyn & Bob full flexibility to pay down their loan whenever they can, as well as discharge or vary the loan without incurring break costs. The monthly repayment amount is highest, at $2,844.

- Loan structure #2 – part variable with offset / part fix – by keeping a portion of the loan variable with offset delivers the lowest interest component i.e. $729. This also means borrowers are paying down the loan faster, because a greater proportion of the overall repayment now goes towards the principal repayment.

- Loan structure #3 – full fixed with NO offset – this structure delivers the most cash flow benefit because of the total monthly repayment is lowest ($2,621). However, the interest amount, because interest is not offset, is highest of the 3 structures, despite the blended rate suggests it is the lowest rate.

When should you not split & fix your loan

You should not split & fix your loan if there are foreseeable changes such as you might be selling the property or refinancing your mortgage.

This is because the new loan split is still tied to the same mortgage. To break the fixed term or make changes to the fixed rate loan will trigger reak costs.

What is a break fee?

The break fee (also referred to as Early Repayment Fee by some banks) is a fee calculated and charged by the bank in the event a borrower discharges or changes the loan prior to the end of the contracted fixed term.

This fee compensates the bank for the loss incurred for breaking the fixed funding facility it would have entered into with a third party to fund your fixed loan.

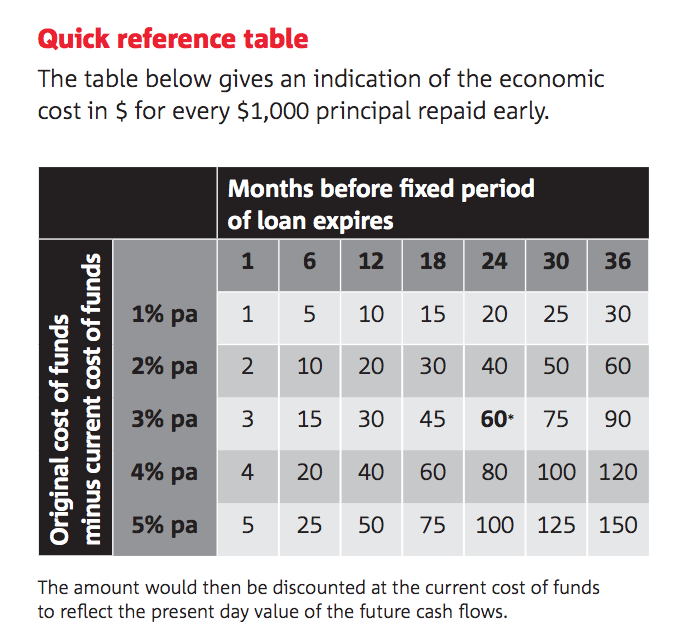

For illustration purposes, say you have entered into a 5-year fixed loan, for $600,000 paying 3.99% pa and there’s still 9 months remaining. Breaking this fixed loan now to enter into another 5-year fixed term at 1.99% pa, would cost you a fee of $9,000. A small admin fee may also be charged by the bank.

Here is a quick reference table from a Big 4 bank to calculate the cost of breaking (or repaying) a fixed loan.

Borrowers can request their lender to calculate their break fee at any point in time. This then is weighed up against the upside of switching to another loan product/lender.

Can I fix my home loan without losing the offset feature?

The short answer is no, because most fixed products do not offer an offset feature.

There are exceptions in the market such as:

- ANZ’s one-year fixed home loam product

- TMB’s fixed loan product and

- Bankwest’s partial offset feature for fixed loans.

What do I need to do before splitting & fixing my loan?

Confirm with your bank or broker that a split structure suits you. Decide on the amount you want to fix as well as for how long. This can be determined by estimating the offset balance at the end of the fixed term (see above example).

In most cases, borrowers on a wealth package will not have to pay a switch fee. However, your bank or broker we will advise you if the lender charges a fee.

SF Capital’s brokers have helped many clients with this process and they can guide and assist you.

Contact us for further assistance

If you have further questions, please get in touch now with our team or email us on to discuss your scenario with a broker or seek assistance with your loan.