Given the level of hype and media coverage surrounding the Final Report of the Hayne Royal Commission, I felt compelled to write to our valued clients and business partners to share our thoughts.

There is no hiding that the recommendations relating to “Intermediated Home Lending” i.e. mortgage broking are very dramatic, and if legislated, fundamentally change the business model for the broking industry.

In simple language, the key recommendations relating to mortgage broking were:

- A shift in costs so that borrowers (i.e. clients) pay for broking services rather than the lender

- Abolition of Trail Commission for new loans

- Abolition of all other Commissions – namely Upfront Commissions

- Introduction of a “Best Interests Duty” for Mortgage Brokers

For those clients who are detail inclined, you can download the full report here and refer to pages 20-21 and 80-84 for the formal wording and explanatory text.

What does this mean for our clients today?

Business As Usual

We would like to emphasise that despite the media attention it is business as usual for all existing lending and current enquiries with us.

There are NO changes to your relationship with us and how we charge for our services. We remain committed as your mortgage advisers to ensure you receive the very best outcomes for your lending on an ongoing basis.

There are also NO changes to bank fees, interest rates, our fee structure or the way your mortgage works.

In fact, it is one of the most competitive times in home lending with major banks offering generous rebates and fixed rates in an effort to preserve market share and lock in borrowers. This is a testimony to the competitive marketplace that brokers have helped facilitate over time. It also is the reverse of what is being recommended by the Commission – today banks are paying borrowers to join them, whereas in the future a fee may be imposed.

It is nonetheless, a very uncertain environment for property and financial services. The full implementation of Hayne’s recommendations are very much dependent on the upcoming election and this will continue constrain credit and dampen the property market.

What does this mean for our clients in the future?

Shift in Market Power to Major Banks

If fully implemented, Commissioners Hayne’s recommendations would see a considerable shift in market towards major banks. At the extreme, we expect to see:

- Increased interest rates as lenders initially offset no trail with higher upfront commissions;

- Banks to preserve margins and NOT pass savings in trailing commissions onto borrowers as the costs of bank compliance rise;

- The introduction / increased lender establishment fees to create parity between the costs of broker origination and direct origination;

- Smaller lenders to decline in market share as they cannot compete in charging lower establishment costs than the majors;

- Brokers to introduce new fee for service models to remain viable akin to financial planning, accounting and legal firms;

- Brokers to service mainly higher end and commercial clients due to an aversion to fees;

- Higher qualification standards and codes of ethics for brokers to support the Best Interests Duty.

SF Capital’s Response

Again, we would like to emphasis it is business as usual for the firm and our clients.

It is a real shame that that the Hayne Royal Commission was one into Financial Services misconduct and yet there were very limited instances of misconduct discussed in the Final Report in relation to mortgage brokers harming consumers. Whereas the instances of bank harm to consumers was abundantly clear.

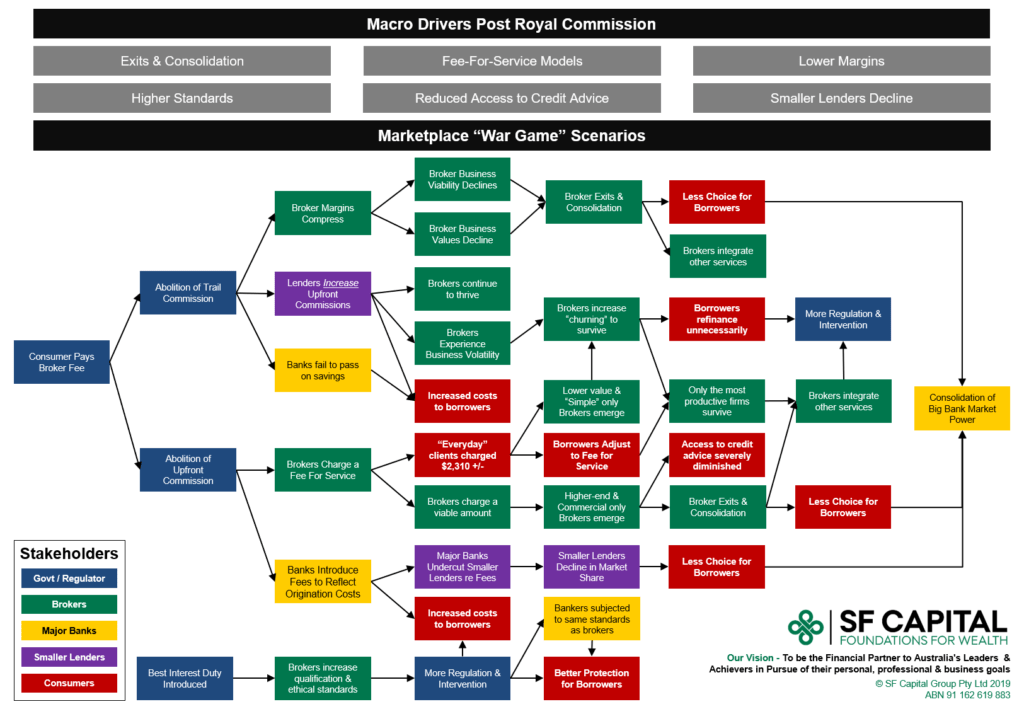

Nonetheless, to ensure that the firm and our clients thrive not just survive, we have begun strategising how broking would work in an environment with no trail and / or a borrower-pays model. If you are interested at a strategic or academic level how we are thinking about this, you can refere to our “war-gaming” diagram.

We are also meeting with as many senior industry leaders and other higher performing brokers to get their thoughts on how the broking profession would adapt to the changes.

At this point, we would like to thank our clients for their continued support. We continue to stand by you, are here to stay, and are committed to your ongoing financial success.

If you have enjoyed our services and would like to see how brokers are remunerated remain competitive in the marketplace, you can sign a fast-growing petition.

Thank you again for your support, and we will keep you posted on any future news or changes.