Are you considering using your Self-Managed Super Fund (SMSF) to invest in residential property but unsure about your borrowing options or the complex lender requirements involved? We are experienced in SMSF loans, helping trustees navigate the lending process with ease. Our expertise ensures your loan application is structured correctly and presented in the best possible light, giving you the confidence to secure the finance for your SMSF property investment. Let us simplify the process for you and help you achieve your financial goals with a tailored SMSF loan solution.

What is a Self-Managed Super Fund?

Like the name suggests, a self-managed super fund (“SMSF” in short) is an alternative to a retail super fund, where the investments in the super fund are controlled by the members rather than a fund manager. Where a retail super fund typically invests in institutional and mainstream investments, such as equities, bonds, and cash, a Self-Managed Super Fund gives their members much more investment choice. As long as certain rules are followed, an SMSF can invest in rare art, classic cars, fine wine gold bullion, cryptocurrencies, and real property.

Because an SMSF is a special form of trust, there are specific legal and compliance requirements that need to be met when setting up an SMSF, so please speak to your accountant or financial adviser for help. If you would like an introduction to a qualified professional, please contact us.

What is an SMSF loan?

An SMSF loan is a loan taken on by an SMSF specifically for the purposes of buying real property.

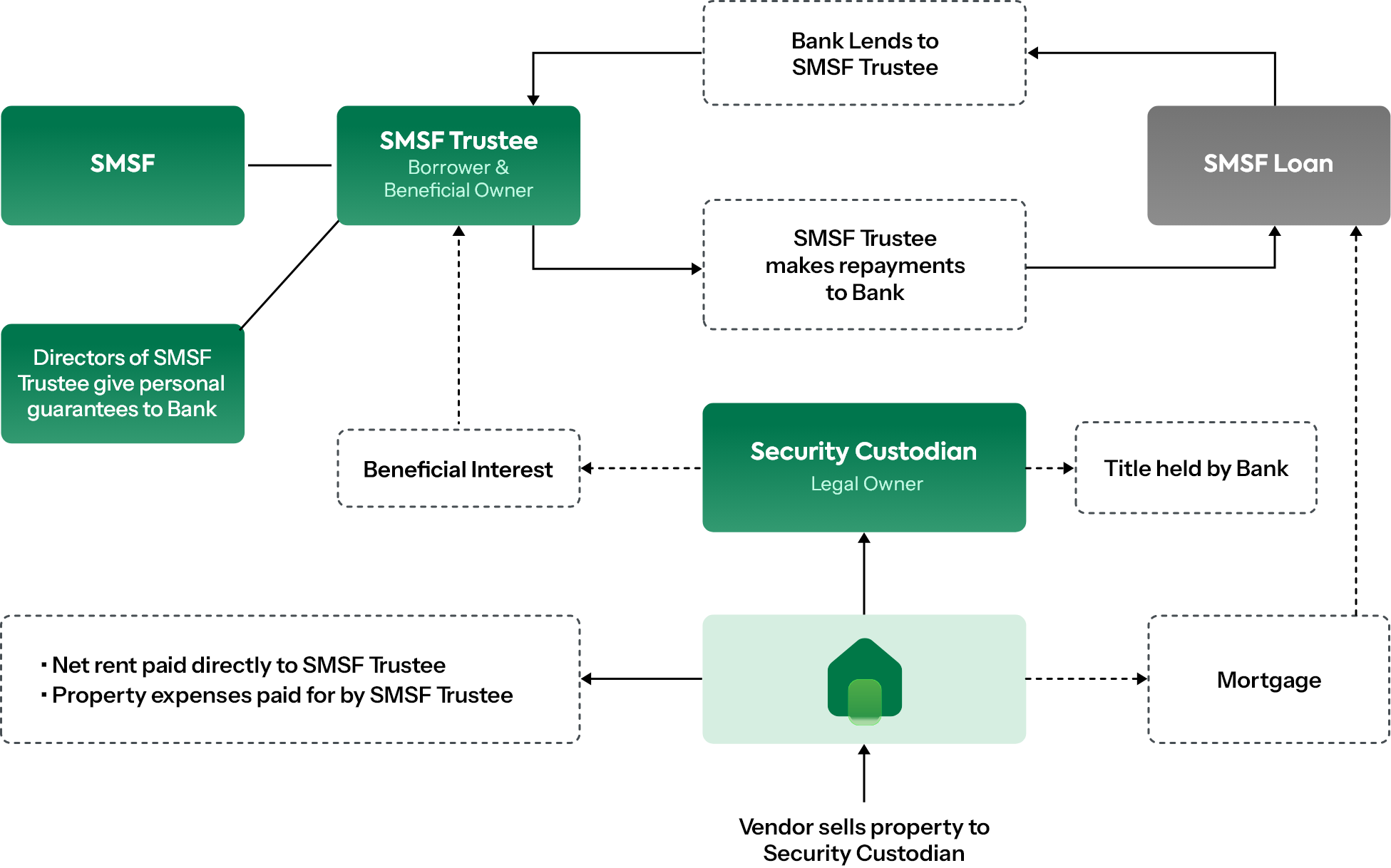

An SMSF loan is typically known as a Limited Recourse Borrowing Arrangement or “LRBA” because if something goes wrong with the loan, the lender can only recover their funds from the sale of the property and cannot go after the other assets within the SMSF.* This is due to the unique structure of an LRBA – see below.

*N.B. While a lender can’t go after the other superannuation assets, it can go after the members / directors of the super fund due to personal guarantees given, which will be a requirement of lending.

How do I know an SMSF loan is right for me?

Firstly, an SMSF is most suitable for investors who have a minimum balance of $250,000 or more. This is because there are additional tax compliance and audit costs, and the fund will need to earn a certain return each year to cover those costs. Secondly, SMSF also works best for individuals who want to be more self-directed and take more control of their investment decisions, rather than be passive about their retirement savings.

Thirdly, an SMSF loan is then right for an investor who wants to buy an investment property within their SMSF and need additional funding to buy a suitable property asset i.e. their cash isn’t enough. They might view buying a property as offering better returns, safer or simpler to understand than the investments chosen by a retail fund.

Because of where property prices, yields, and interest rates are at in Australia, our advice at SF Capital is that an SMSF should have ideally $300,000 as a starting balance and two members contributing to the fund to be worthwhile buying a property in super and taking on an SMSF loan.

What is a typical SMSF loan structure?

A typical SMSF loan or “LRBA” consists of the following elements

- SMSF – The SMSF will be the borrower, and the recipient of all rent for the investment property. However, the SMSF will only become the owner of the property once the SMSF loan is paid off. Typically, a Corporate Trustee will be established to run the SMSF, and is preferred by lenders over Individual Trustees.

- Bare Trust, Property Trust, or Property Custodian – This trust is established for the sole purpose of owning the investment property at time of purchase, hence the name “bare” trust. This trust is the key ingredient for establishing an LRBA because the structure protects the SMSF from recourse to its other assets should something go wrong with the loan. Once the loan is paid off, the property is transferred back to the SMSF without stamp duty.

- Members – the members are the underlying beneficiaries and investors of an SMSF and are the recipients of the retirement benefits of the SMSF. The members also have to be the directors of the SMSF Corporate Trustee and Bare Trust Corporate Trustee for an SMSF loan to be issued. They are also personally liable if something goes wrong with the SMSF as a requirement of SMSF lending.

What are the benefits of an SMSF loan?

There are two primary benefits of purchasing a property in SMSF and taking out an SMSF loan:

- Lower income tax rate – Concessional contributions made into your fund and any income earned are taxed at a lower rate than your marginal tax rate (assuming you are working). This in turn means you can often pay the loan back faster than if you were to borrow for the same property outside of super.

- Capital Gains Tax (CGT) concessions – Complying SMSFs receive a one-third concession if an asset is held for more than 12 months. Additionally, if an asset is sold during the pension phase, the SMSF will have no CGT payable (0%).

Other benefits of an SMSF loan include:

- Preserving borrowing capacity – Borrowing within super typically does not impact your borrowing capacity outside super. This allows you to build your investment property portfolio without impacting your borrowing capacity in your personal name, for example, if you wish to buy a new home. Please note some exceptions may apply, and you should seek expert help from your broker and other advisers that this does not apply.

- Greater choice & control – Retail super simply does not allow you to invest in direct property. This is only possible via an SMSF. Property is an asset which many people understand better (you can “touch and feel”), and you also may have more control over aspects of the property such as increasing the rent, controlling the costs of repair, and making decisions on how you market the property for sale or rent.

- Greater returns through leverage – You may be better off in retirement if you have purchased a high performing investment property rather than investing in shares. This is because leverage gives you greater asset exposure and magnifies your returns. However, be warned leverage can also magnify your losses for a poorly performing investment property.

- Protection from limited recourse – When setting up an LRBA, your other super assets are protected if something goes wrong with the loan. This offers diversification within the SMSF to ensure your other super investments are not negatively affected if you are forced to sell your investment property.

What are the main policy considerations?

There are several important considerations when borrowing in your SMSF:

- Maximum LVR – 80% is the maximum LVR for SMSF loans, although borrowers achieve better interest rates at lower LVRs. Above 90% LVR and Lenders Mortgage Insurance does not exist for SMSF loans.

- Historical contributions – the lender typically looks at the average of the last 2 year’s contributions. Please contact us to consider exceptions to this rule, if you have not made consistent contributions.

- Property & postcode restrictions – SMSFs work best for older, more stable, and standard property types. Lenders do not like off-the-plan properties which can have more volatile market prices, and they are likely to lower the LVR or not lend to risky or unusual securities.

- Minimum fund balance – again, lenders typically require a minimum fund balance of $200,000-$250,000 when starting an SMSF. In practical terms, we recommend a higher balance if you wish to buy a more substantial investment property in your super.

- Liquidity rule – once the property has been purchased, it’s best not to have “all your eggs in one basket”. Some lenders require that 10% of your fund still hold other assets after your investment property purchase, which can be held in cash, shares, or other liquid assets.

- Corporate Trustees – again corporate trustees are much preferred over individual trustees. This is because it is easy to change the directors of corporate trustees should something happen to them. However, it is more difficult to change an individual trustee.

Please speak to a broker about how these apply to your situation.

What are the supporting documents required?

Most super fund loans will require the following documentation:

- ID – Drivers licence and passport

- If New Fund: Last 2 years superannuation statements for all members

- If Established Fund: Last 2 years SMSF tax returns and financial statements

- SMSF and Bare Trust

- Corporate Trustee details (ASIC Search)

- Certified trust deeds

- For Purchases

- Exchanged Contract of Sale

- Rental appraisal letter

- Proof of additional savings outside of super if required as funds to complete

- For Existing Loans and Refinances

- Latest loan details summary

- Last 6 months transaction history

- Completed Lender Application Form(s)

Note: Self-Employed applicants may require additional documentation, please speak to your broker to see if this applies to you.

Are there any risks or other important considerations?

There are several additional considerations when purchasing a property in an SMSF and taking out a loan:

- Double stamping – The bare trustee must be set up correctly and be placed as the legal owner of the property at the time of exchange. If this is not done correctly, it can create a “double stamp” duty event which is very costly.

- Two or more members contributing – successful SMSF loan transactions usually have two or more members making consistent contributions to their super, ideally at the maximum concessional contributions over the last 2 years.

- Sufficient deposit – unlike outside super, there are no LMI or low deposit solutions above 80% LVR. This means you must have a sufficient deposit to settle the property, noting that the set up costs will be higher for an SMSF loan than normal home loan.

- Legal and financial advice – as SMSFs are highly regulated, independent legal and / or financial advice is required to take out an SMSF Loan. This is designed to protect you to make sure you understand the unique loan obligations, as well as the lender to make sure they are lending responsibly.

- GST payable – Commercial properties will have GST payable if there is no lease in place at settlement. GST is only exempt if the property is purchased as a “going concern”. This is covered off more in our page. Residential properties do not incur GST.