We understand that it can be challenging to save a full 20% deposit, especially how property prices have played out in recent times. Paying Lenders Mortgage Insurance is one way of getting into the market sooner, and is beneficial if you understand the risks and costs. Reach out to us to explore your options.

What is Lenders Mortgage Insurance?

Lenders Mortgage Insurance or “LMI” is an insurance policy that the bank requires you, the borrower, to pay when borrowing above a certain Loan-to-Value-Ratio (LVR).

Typically this is an 80% LVR, but can be lower for more risky security e.g. types of apartments in certain areas. You may have to pay LMI if you cannot cover a full 20% deposit plus other transaction costs like stamp duty and conveyancing fees.

The role of LMI is to pay out the bank should something go wrong with a high LVR loan and the bank makes a loss on the loan, even after selling the property. Therefore, LMI is designed to protect the bank, not you as the borrower, even though you pay for it.

When should I consider paying for LMI?

Paying LMI is suitable when the expected gain you will make and / or benefit from owning the property exceeds the cost of the LMI Policy.

For example, for an investment property, if you believe the property will increase by $50,000 over the next 12 months and the LMI cost is $10,000, then you may think it’s worthwhile paying LMI. This may be the case in high growth areas or for a lucrative purchase that is too good to miss.

For an owner occupier, it may be worth paying LMI if it will take too long to save up the remainder of a 20% deposit, and you would like to buy a home now. Perhaps because you have a growing family, need to move out of a rental property, or have found an ideal property that you don’t want to lose.

How much does LMI cost?

The cost of LMI can range from a short holiday to the cost of a family car, and more! It increases in a few dimensions:

- The higher the loan amount, the higher the LMI

- The higher the LVR, the higher the LMI

- Investment properties also incur higher LMI than owner occupied properties

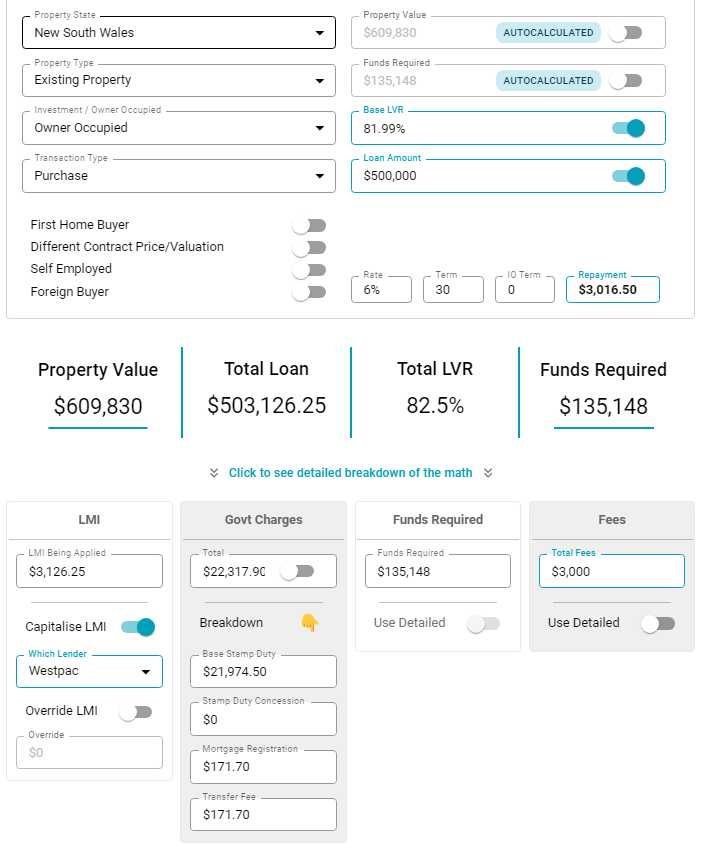

| $Loan %LVR |

82.5% | 85.0% | 87.5% | 90.0% | 92.5% | 95.0% |

|---|---|---|---|---|---|---|

| $500,000 | $3,126 | $5,535 | $6,252 | $8,200 | $12,197 | $14,042 |

| $750,000 | $5,688 | $9,071 | $11,146 | $15,375 | $18,600 | $26,983 |

| $1,000,000 | $7,585 | $12,095 | $14,862 | $20,500 | $24,750 | $36,080 |

| $1,250,000 | $11,915 | $16,656 | $20,300 | $23,850 | $34,100 | $46,765 |

| $1,500,000 | $14,298 | $19,987 | $24,300 | $28,600 | $40,900 | $56,118 |

What does it mean to capitalise LMI?

You do not need to pay LMI out of pocket yourself. The cost of LMI can be added to your loan amount. In other words, you can borrow the LMI charge, which is known as “capitalising LMI”. It’s important to note that capitalising LMI increases your total LVR by the base loan amount and the costs of LMI (example below). This is important as the higher the LVR, the more likely a lender is to increase the interest rate charged and make it harder to approve the loan.

Are there any loan size & LVR restrictions for when LMI can apply?

Yes, there is a limit to what is insurable under Lenders Mortgage Insurance, and different limits apply for different lenders.

- For larger lenders, such as the major banks, the maximum loan size where LMI can apply tends to be $2.5M at a 95% LMI, including LMI capitalised

- For smaller lenders, the maximum loan size tends to be $1.5M at 95% LVR

These thresholds can change in certain cases where:

- Security changes, such as for smaller apartments or non-metro properties

- The loan is for an investment property rather than an owner-occupied home

- Luxury or prestige properties, where lower LVRs apply in general

Who are the providers of LMI in Australia?

Two main LMI providers dominate the market:

- Helia – helia.com.au (which was formerly known as Genworth)

- QBE – www.qbe.com/lmi

Other lenders “self-insure”, by letting you borrow above 80% LVR, but then charging a “risk fee” to do so. In these cases, there would typically be a cap of 85% to 90% LVR.

Are there any checks or documentation to consider?

Because an LMI loan is riskier, a lender will run a more rigorous loan assessment before approving the loan. This may include:

- Proving you have genuine savings

- Proving your employment history

- Limiting types of income e.g. casual income

- Accepting a minimum credit score

- Accepting only certain types of properties or locations as security

Note: Showing ”Genuine savings” means proving to the lender you have saved a certain percentage of the property value up yourself, paid the equivalent in rent, or have held this amount for a certain amount of time.

Some banks will be able to approve an LMI policy in-house under what is known as “Delegated Underwriting Authority” (DUA). This is typically for loan amounts under $2M and is a relatively smooth process.

For LMI approvals above this amount, issuing LMI must be approved by the Insurer. This is typically a slower process as the loan requires a second layer of approval. The Insurer can also apply stricter rules than the bank, which can lower the chances of approval for riskier loans.

If I refinance, do I need to pay LMI again?

If you refinance, you typically do not need to pay the costs of LMI again, especially if the underlying insurer is the same (Helia or QBE). However, you may need to pay a ‘top up’ amount if you increase your loan even further, if the LVR increases (or both). Generally, topping up an LMI loan is not recommended unless there is another lucrative investment opportunity presented or a strong personal need.

Are there alternatives to paying LMI?

The common alternatives to paying LMI are:

- Applying for a [link to Family Guarantee Page]

- Accessing LMI waivers for certain professionals

- Doctors

- Nurses & Allied Health

- Accountants

- Actuaries

- CFA’s

- Lawyers

- Lowering your property budget

- Saving more and waiting

Lenders realise these alternative options are not available for everyone, hence why LMI is also available as an option.

Are there any other considerations to paying LMI?

Undoubtedly, LMI is an added cost that mainly benefits the bank rather than you, as the borrower. The costs also rise significantly if the loan’s LVR increases.

In our experience, most clients choose to avoid LMI seeing it as an unnecessary cost, and would rather save the money. However, used wisely, it can get you into the property market sooner, especially when the property market is rising in your desired area.

Please feel free to reach out to us to see if LMI is right for you by completing an Assessment Form below.