Success Factors

- Earlier this year, the major banks have all pulled out of SMSF lending in an aim to de-risk their loan books and “simplify” the bank

- Non-banks have filled the void to provide SMSF Lending. In our experience pricing is competitive, policies are reasonable and processes are efficient

- Seek advice before making a purchase within your SMSF. A complex SMSF loan will be a 4-way interaction between your Accountant, Financial Adviser, Lawyer and Broker

- A large existing fund balance, and steady historical contributions are the keys to unlocking an SMSF loan

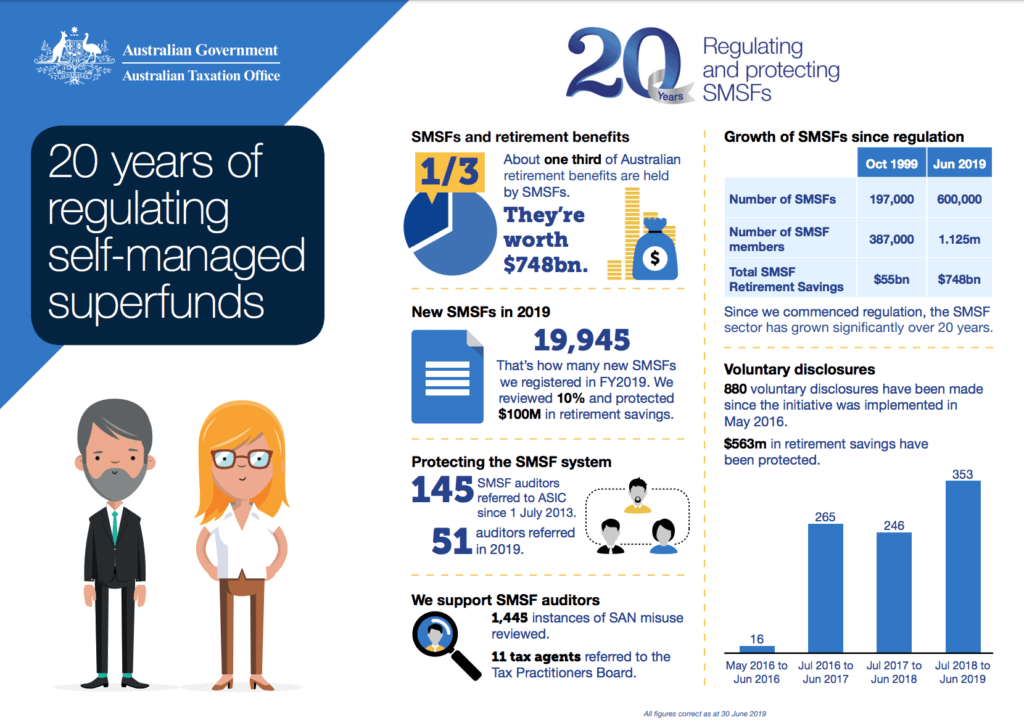

What is a Self Managed Super Fund (SMSF)?

SMSFs are in essence private super funds set up as a way of saving for your retirement.

For the last 26 years, Australian employers have made compulsory contributions towards the super funds of employees to support the financial needs upon retirement.

The Keating-Labor government’s wider reform package made way for working Australians to make further super contributions, where the age pension would become the last resort in providing for retirement income.

Not long after this, in 1999, legislation was passed which put into effect the SMSF that has now become the biggest super sector in Australia.

Today, more than 1.1 million Australians have an SMSF, with assets making up 26% of the $2.87 trillion super sector. The investments will provide retirement benefits for the fund’s members and dependants.

The regulation of SMSFs for the past 20 years has been the responsibility of the Australian Taxation Office.

A SMSF can have up to four members, who must be trustees (or directors, if there is a corporate trustee). Members are in charge of the investment decisions, as long as an SMSF is run for the purpose of providing retirement benefits.

Within this framework, SMSF trustees have added millions of dollars of jewellery, artworks, gold bullion, boats, wines etc to their SMSF investment portfolio.

The SMSF game changed in 2012. The rules around borrowing for certain asset classes were loosened and members could leverage on their super to buy investment properties.

What is an SMSF Loan? How does it work?

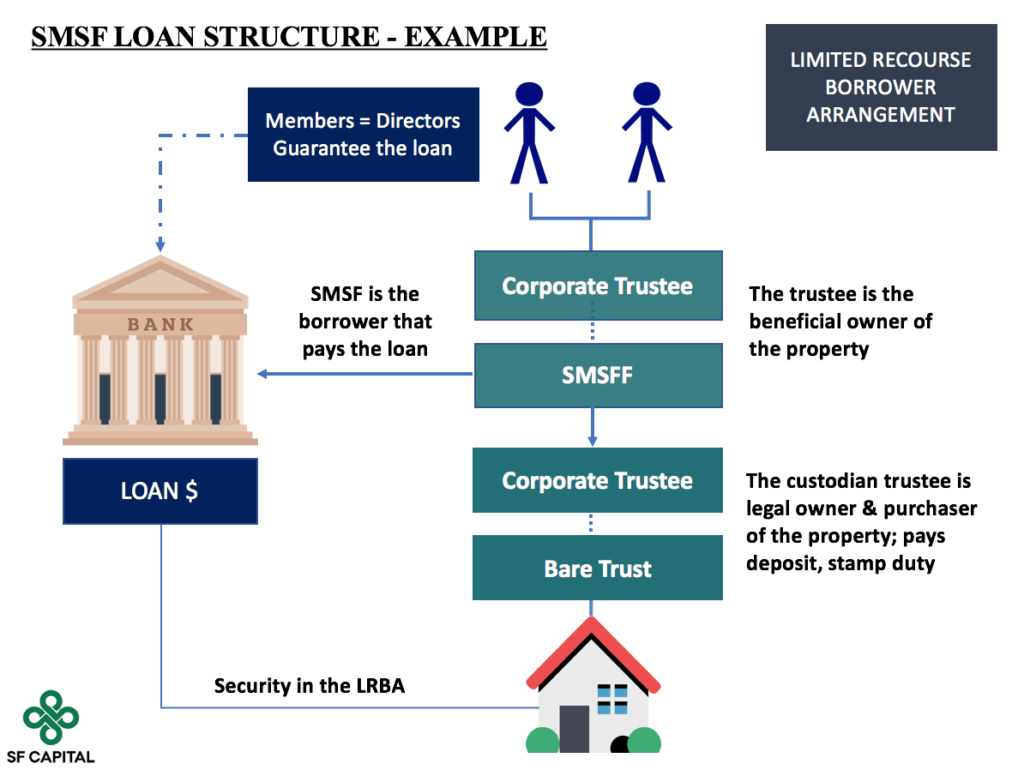

An SMSF loan is known as a Limited Recourse Borrowing Arrangement or LRBA.

The recourse (i.e. the security) is limited to the property itself, and the assets in the remainder of the super fund are not up for grabs if anything goes wrong with the loan.

There are several key requirements that set up an SMSF loan and make an LRBA:

SMSF and Corporate Trustee of the SMSF

The SMSF is the borrower and beneficial owner of the property. The loan documents will be issued in the name of the SMSF, and the SMSF will be responsible for making loan repayments from a bank account in its name.

Most lenders now stipulate that an SMSF must have a Corporate Trustee rather than Individual Trustees, as it gives greater protection to both the lender and the members of the SMSF.

Bare Trust and Corporate Trustee of the Bare Trust

The Bare Trust is the legal owner of the property, and holds the property for the benefit of the SMSF. The Bare Trust is therefore the legal purchaser of the property and its details are put down on the contract of sale.

It is the Bare Trust that sets up the “Limited Recourse” nature of the loan, as it cannot hold any other assets except for the property in question. This sole purpose is what makes the trust “bare”, as it must transfer the property back to the SMSF once the loan is paid off.

The Bare Trust can also be called the Property Custodian or Security Custodian.

Members

These are the ultimate beneficiaries of the SMSF. For an LRBA, the members of the fund must be the same as the directors of the Corporate Trustee of the SMSF.

The members must also personally guarantee the loan from their assets outside of super, therefore adding another layer of protection for the bank. So while the lender has limited recourse to the other assets of the SMSF, they can go after the assets of the members personally should something go wrong with the loan.

Please note this is a high level overview only. It is important to seek advice directly from your broker, lawyer, accountant and financial planner prior to setting up these structures.

What happened to the majors?

The idea of using SMSF borrowing to fund property investments was ‘super’ popular amongst investors. In 2018, borrowings are reportedly to have ballooned to $25 billion from only $2.5 billion in 2012.

As the magnitude of borrowings snowballed, banks also had to deploy more human resources to handle SMSF loans which are more labour intensive to process.

On the other hand, banks are facing increased capital requirements for niche investment loans like SMSF loans.

The sums didn’t add up after weighing up the risks and additional business SMSF loans were bringing in for the big 4 banks.

From the regulator perspective, investors using SMSFs to invest in a single asset class, namely, property, were in effect putting all their eggs in one basket.

There were also reports of promoters encouraging investors to roll their existing super into an investment property through a fund. Those investors would have to pay a penalty for early release of their retirement savings.

As the property market peaked and turned in 2017, falling house prices and stalling rental returns began triggering alarm bells.

SMSFs were facing capital loss and loss in earnings as it was difficult to find tenants.

The major providers of limited recourse borrowings to SMSFs have gradually exited the market.

By October 2018, the big three lenders have ceased offering SMSF investment loans, noting ANZ has not been active in this space. AMP then followed suit. Macquarie Bank also stopped offering its SMSF lending product in March 2019.

Who is still in the market for SMSF Loans?

When there is a risk, there is an opportunity. As the major banks existed the game, there left a huge void for smaller lenders, non-banks to fill.

The thousands of SMSF trustees that have purchased off-the-plan will need to find a lender or risk losing on their initial commitment if they can’t settle.

Some trustees are also left with a shortfall in completion because they bought at the peak of the market and the property value has fallen by up to 5% by now.

Non-bank lenders have largely filled the void to meet SMSF borrowing requirements where banks have pulled out.

They are simply alternative institutions to the banks who source their funds from a combination of the equities market, private equity, institutional investors and private (usually wealth) individuals.

Importantly, many large banks (including Australian Banks) provide funds to non-bank lenders to lend out to borrowers on their behalf. They do this to make a higher return on their money and to avoid any reputational damage if something goes wrong. This is a process known as “shadow banking”.

One key difference of non-bank lenders is that they price for risk, rather than offering a blanket interest rate to every client. Many of these non-bank lenders are very established, have long trading histories, low arrears rates and even listed on the ASX.

Lenders that are now active in providing SMSF loans for residential investment properties include:

- Liberty Financial – https://www.liberty.com.au/

- La Trobe Financial – https://www.latrobefinancial.com.au/

- Better Mortgage Management – https://www.bettermm.com.au/

- Australian Secured & Managed Mortgages – https://asmm.com.au/

- ThinkTank – https://www.thinktank.net.au/

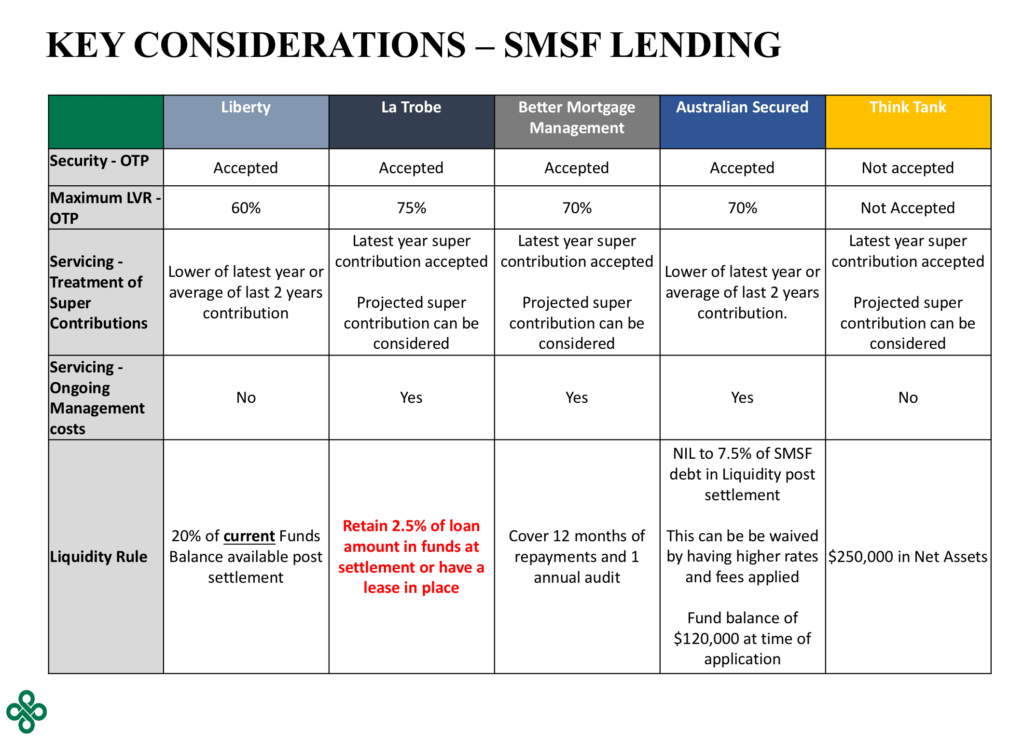

So, What do these lenders look for? Key policies explained

An SMSF loan has many additional policies to a standard home loan outside of super. A key one for example, is the Loan to Value Ratio (LVR) is much lower to make sure the fund members and the bank have extra protection if property prices fall, and the rental income can substantially cover the loan repayments i.e. the property is positive cash flow and self servicing.

Here is a summary of requirements across each lender that is still providing SMSF loans today.

Some key criteria that are in addition to normal home lending include:

Liquidity Rules – The Superannuation Industry Supervision (SIS) Act requires super funds to be diversified in their investments. This means that SMSF’s cannot put all their eggs in one basket and cannot be 100% in property investments.

To overcome this, banks stipulate a “Liquidity Requirement” which typically means that once the property purchase is complete, the SMSF must hold some funds in liquid assets to keep the SMSF diversified and therefore safe. Liquid assets are typically cash, but can also be direct equities or managed funds that can be redeemed at short notice.

This also helps the SMSF stay afloat to meet any loan repayments while the property is on the market waiting to be rented out.

Each lender has its own liquidity rule, as shared in the table above.

Acceptability of Off the Plan Security – In a falling market, Off The Plan properties can be perceived as a risk as there are very few comparable sales available and the market for resales are untested. This is especially so for apartment dwellings in concentrated areas.

As a result, some banks will not accept off the plan properties as acceptable security, or will require other mitigants to be presented in order to approve the loan.

Servicing Treatment – For most lenders super is treated as its own mini ecosystem for servicing. That is servicing is assessed inside the SMSF alone.

Income consists of historical super contributions, rental income, and investment income that will remain after the property has settled.

Expenses consist of the interest costs of the loan, property related expenses and any other running associated with the fund (accounting fees, auditors fees, life insurance premiums).

The difference between income and expenses determines a client’s ability to service a loan and the borrowing capacity within the SMSF.

Most lenders view a client’s income conservatively, and look to average or take the lower of historical contributions to take determine income for servicing. However, this approach does not work for some clients where they have only started implementing a retirement savings strategy or were unaware of their historical contributions for loan servicing.

Some lenders will therefore assess servicing outside of super to determine if the client has the capacity to make additional contributions into super from their personal net cash flow. This in turn allows a client to project and propose a higher income figure to be used for the SMSF’s servicing assessment.

Not every lender allows this strategy, and it takes skill & experience to do the analysis and present servicing in this way, so please talk to us first if you would like us to assess the serviceability inside and outside your SMSF.

Consideration of SMSF Management Costs – An SMSF can be more costly to maintain than holding your super within a large established, publicly available super fund. A typical additional cost is the extra fees to your accountant and an SMSF auditor to make sure your fund is compliant each year. Some lenders will factor these management costs into servicing while others will not, and these figures can tip the scales when servicing is tight.

Conclusion – What does this mean for me?

There are still a hand full of lenders in the market that offer SMSF lending. So all is not lost – there are very good options.

Before taking out lending with any lender, it is important to test your scenario first because not everyone is suitable for an SMSF loan.

Non-bank lenders do not have a direct channel to the SMSF borrower and can only be accessed through a broker.

If you are thinking of purchasing a property in your SMSF and would like us to test your scenario, feel free to get in contact with the SF Capital team.