“I’m telling you, the property market is overvalued, it’s all gonna crash. Huge bubble. A crash is coming I tell ya, minimum 20%. MINIMUM. Everyone’s” George, my taxi driver turns to face me as he tells me his view on the property market while he swerved erratically in and out of traffic on this particular freezing Saturday night in Sydney.

“What makes you say that?” I asked before opening the window in case I need to throw up some of the Korean BBQ I had consumed earlier.

“Look mate, 1 bedroom apartments now cost $1,000,000. It’s bloody ridiculous mate. Look what happened in the States during the GFC, that’s what’s gonna happen here. Trust me mate”.

As I stared into the night pondering what George had said, it dawned on me that I have had the same conversation with dozens of people over the last 6 months on this exact topic and this probably won’t be the last one. So are we headed for a GFC style property price correction? What even happened in the US property market crash?

The Fuse: Interest rate rises

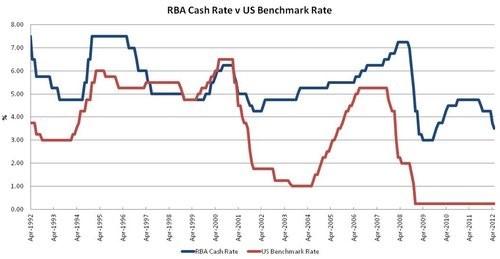

The US had historically low interest environment between 2001 and 2003 following the Dotcom bubble. From the low of 1%, The Federal Reserve implemented 17 subsequent rate rises within two years to hit a cash rate of 5.25% in April 2006 just prior to the housing market correction. This was the start of the end for the US housing market bubble as the rapidly increasing interest rate coupled with ever increasing loan sizes placed an enormous burden on people’s ability to make their loan repayment.

Are we going to see 17 interest rate rises in 2 years in Australia? Even the most extreme economists predict a maximum of 8 interest rate rises in the next 2 years, which had already been factored into the calculations before the bank approves a loan.

Australia 1 : USA 0

The Dynamite: Poor financial regulation

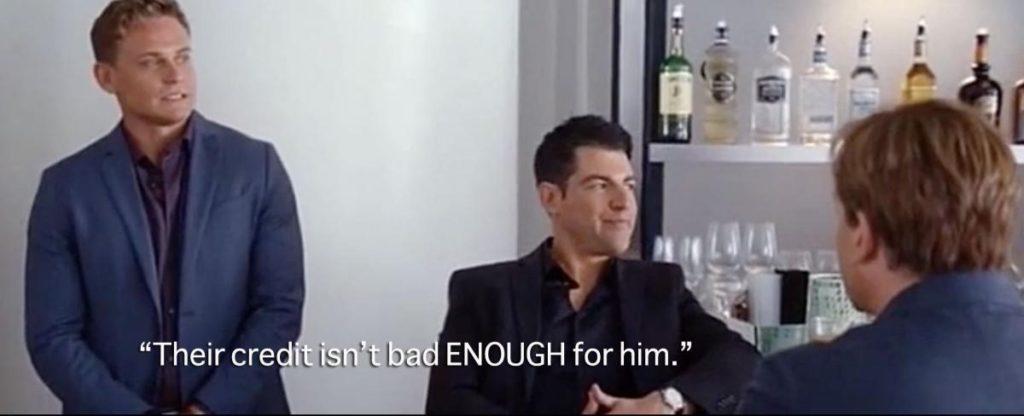

During the low interest environment, banks in the US offered low “honeymoon rates” to consumers which jumped up between 4-6% when the “honeymoon rate” expired; while at the same time they incentivised their staff and mortgage brokers with higher upfront commissions for writing loans with lower documentation requirements, which led to falsifying incomes; low declaration of expenses and a whole swath of other bad lending practices.

So what happened when the honeymoon rates rolled off in 2007-2008? People defaulted on their loans. En mass. Loans they should have never been given in the first place. This then led to foreclosures which then flooded the property market with a mass supply of houses that had to be sold cheaply and quickly, which in turn crashed the property price that made more people default and the rest is history.

Australian banks and financial services industry are among some of the most heavily regulated banks in the world and measures have already been taken to reduce household debt and curb investor lending.

Australia 2: USA 0

As I step out of the taxi, I ask George if he plans to sell his house in Lidcombe. He laughs and says “Nah mate, too much hassle. It’s not like I can’t pay my mortgages. I’m gonna buy an investment property after everything crashes, my mate’s a property developer, you want his contacts?”