As a government’s initiative to help first home buyers purchase their home, the First Home Loan Deposit Scheme (FHLDS) allows eligible Australians to access a home loan with a deposit as little as 5%. The scheme has been in place since 1 January 2020.

Under this scheme the successful applicant will not have to save up for a 20% deposit before they can enter the property market. For home buyers who do not have a 20% deposit, banks would otherwise require the borrower the take out Lenders Mortgage Insurance (LMI).

The government is committed to ‘backing’ the additional loan amount taken, being the difference between the deposit paid and up to 20% of the value of the property. The 15% shortfall is guaranteed by the National Housing Finance and Investment Corporation (NHFIC), established by the government to reduce pressures on housing affordability for Australians.

Which lenders are participating?

Following a competitive procurement process, two major banks, NAB and CBA, together with 25 other non-major lenders (including Teachers Mutual Bank), have been appointed to be on the panel of lenders for the scheme.

The quota of home loans has been capped at 10,000 per financial year, with the 2 major banks being allocated 5,000 between them, (ie. 2,500 each), while the remaining quota is allocated across the 25 non-major lenders.

Who can apply to the FHLDS?

To be eligible for the scheme, these are the key criteria:

- No prior property ownership – whether owner occupied, investment, single or joint

- Citizenship – only available to Australian Citizens (no Permanent Residents); both applicants must be citizens if the applicant is a couple

- Deposit requirement – 5% of genuine savings. You will not be eligible if you have enough savings for a 20% deposit

- Owner occupier requirement – the applicant must move into the property within 6 months and live it in for as long as the guarantee is under the scheme

- Loan documents signed and settled on or after 1 January 2020

The types of property eligible are not limited to an existing dwelling, however, different requirements are applicable.

- the purchase of an existing dwelling

- house and land package

- land and separate contract to build a home

- off the plan purchases.

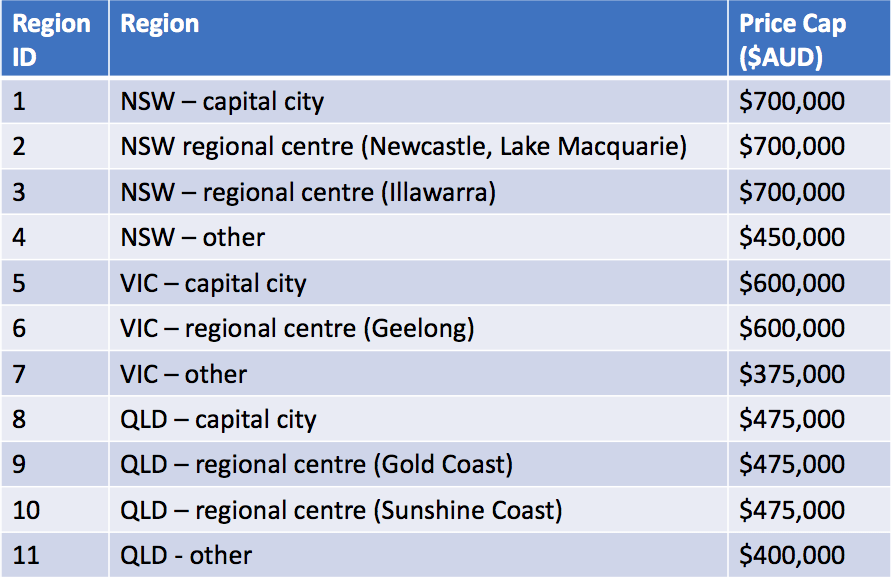

Property Price Thresholds

Maximum purchase price thresholds apply to the suburb and postcode of the property, categorised according to each state’s: i) capital city; ii) large regional centre; or iii) regional area.

Outlined below are the price caps for NSW, Victoria and Queensland.

The thresholds are in place to ensure the scheme benefit will goes towards a ‘modest home’ in the respective states and regions.

Please note that existing lender postcode restrictions (maximum LVR) would override the property price thresholds under the scheme.

Process

The scheme operates on a ‘first in best dressed’ basis. However, each bank will have slightly different requirements when requesting to reserve a spot in the scheme.

For most banks, an allocation can be reserved in advance and if a spot is not taken up by a certain date, it will be given to the next applicant in line; whereas other banks may take applications as they are until all spots have been exhausted.

Contact us for more information

If you are thinking of accessing the FHLDS to purchase your first home and would like to discuss your finance requirements, feel free to get in contact with the SF Capital team.