As NSW enters into tightened lockdown restrictions and Victoria re-introduces lockdown, the Australia Banking Association reassures banking customers that Australian banks will ‘have their back‘.

This follows an earlier ABA announcement on 8 July 2021 of a national support package for all small businesses and home loan customers significantly impacted by current lockdowns or recovery from recent lockdowns, irrespective of geography or industry.

There is a range of support measures available for businesses, sole traders and households.

For home loan customers experiencing hardship, support is available from the major banks such as:

- temporary loan repayment referrals

- reduced repayment arrangements

- restructuring of loans

- lower interest rates

- fee waivers.

From the first lockdown in 2020, the tranche of borrowers who took up the offer to defer their loan repayments have mostly resumed repayments. Since then the channels have always been open for customers to seek financial assistance with their banks where they have been impacted by the ongoing pandemic. The support measures recently announced by the banks are additional support specific to the current lockdown due to the delta variant outbreak .

The first lockdown

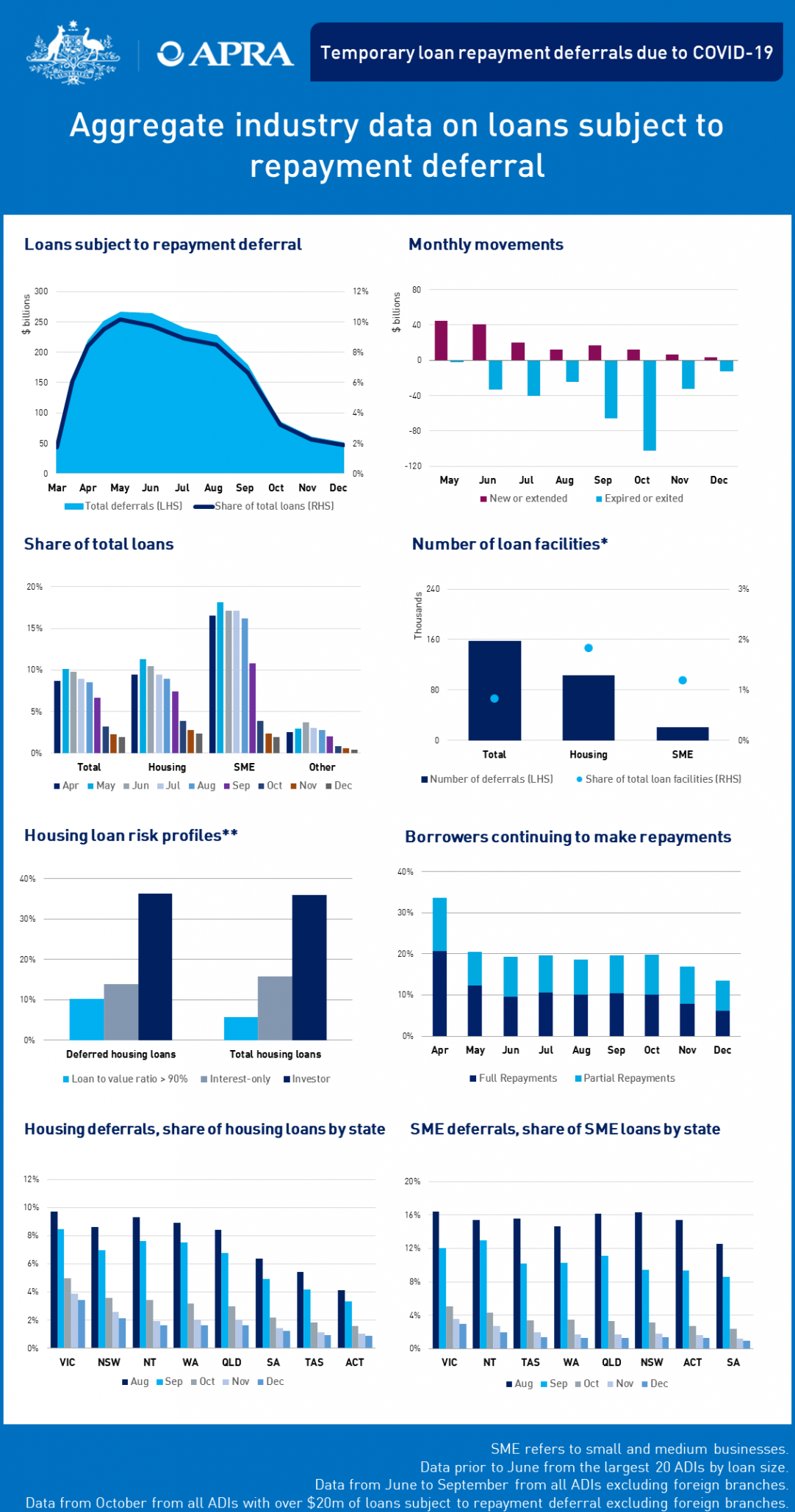

Data published by APRA shows the volume of loans on repayment referral peaked in May 2020 to in excess of $260 billion. By 31 December, this has trended downwards to $51 billion which is a 1.9% share of overall loans. Housing loans make up $42.9 billion of this, while the rest are mostly made up of loans to SMEs ($6.0 billion). The majority of loans subject to deferral are with Westpac and ANZ, followed by CBA, Bendigo Bank and lastly NAB.

The second lockdown

At the onset of the lockdown due to the Bondi cluster outbreak, there has already been an increase in enquiries from affected bank customers, as it has been reported.

Compared to the first lockdown when the banks offered deferrals of 3-6 months, current additional support measures as far as home loans are concerned seem to be marked by a more temporary nature. Nevertheless, help is available from the banks depending on your situation and customers are encouraged to review what their options are if further support is going to be needed.

We outline the support measures made available by the major banks to customers impacted by the lockdown restrictions in NSW and/or VIC.

CBA

CBA is providing a one-month deferral on home loan repayments for customers who have been financially impacted by the lockdown in NSW and Victoria. For affected customers located in the Fairfield, Liverpool and Canterbury-Bankstown local government areas, and in the construction and retail sectors, the bank is offering two-month deferrals on home loans.

In addition, the bank is offering the following options to further help customers:

- accessing money customers may have in redraw in their eligible loan;

- restructuring home loan debt;

- switching to a Fixed Rate home loan;

- reducing repayments to the minimum monthly repayment amount; and

- using money in the customer’s Everyday Offset (if available to them).

In November 2020, the banks announced a freeze on forced sales, which remains in place until September 2021 for eligible customers impacted by Covid who are struggling with repayments.

Customers who require help can contact the Financial Assistance Solutions team by:

- requesting assistance online in NetBank

- calling 1300 720 814, 8am-9pm AEST Monday to Friday, or 9am-2pm AEST on Saturday.

Westpac Group (including St George)

Westpac Group’s have announced support measures to help business and consumer customers impacted by the lockdown restrictions in NSW. Customers in need of financial assistance can access a dedicated support team who will tailor assistance to suit the customer’s circumstances.

This may include the following:

For business customers:

- case management support for our small business customers experiencing financial difficulty

- reduced or deferred repayments on asset and equipment finance and eligible business loans

- business loan restructuring with no fees incurred

- referrals to financial counsellors or other support services

- low interest rate business loans through the Federal Government’s SME Recovery Loan Scheme where eligible.

For consumer customers:

- credit card repayment and interest rate reductions for a period of time

- home or personal loan repayment deferrals or reductions, interest rate reductions and loan term extensions

- fee waivers across a range of products

- restructuring of debt

- referrals to financial counsellors or other support services.

Customers in financial difficulty may contact Westpac Assist on 1800 067 497 or St George Assist on 1800 629 795.

ANZ

ANZ continues to support affected customers with an enhanced array of support measures, including temporarily reducing repayments, restructuring home loan debt or switching to a fixed rate loan, subject to eligibility criteria.

Customers who are identified as suffering financial hardship for any reason (doesn’t specifically have to be as a result of the lockdowns) should be directed to speak to the ANZ Customer Connect team for further support.

Customers seeking financial support should complete an online assistance application through anz.com. This should take 30–45 minutes to complete and customers need to have their personal, account, income and expenditure details available.

Once the application is completed, the customer will be contacted within 5-10 business days by a member of ANZ’s Customer Connect team to discuss any options that the bank may be able to offer.

Macquarie

The bank is providing a range of short-term payment deferral options available for impacted customers. Customers experiencing financial difficulty as a result of recent lockdowns are encouraged to contact the bank so that it can understand your specific circumstances and work together towards a solution best suited to your financial needs.

To apply for assistance, customers may contact the bank using the below numbers.

- Home Loans – 1300 363 330

- Asset Finance – 1300 364 050

- Business Banking – contact your Relationship Manager.

NAB

In line with with ABA’s announcement, NAB’s support measures under the latest lockdown restrictions include:

Business banking support

- up to 3 month repayment deferrals, with loan terms extended accordingly

- offered to all small business customers (business lending less than $3m and a turnover of less than $5m)

- only for loans in good standing (i.e. repayments up to date or engaged in a payment program with their bank).

Home loan support

- a range of support measures, including deferrals on a month by month basis, temporary payment break or restructuring your home loan to suit your situation, where appropriate

- available to both individual and business customers.

Customers ahead of their repayments may also access available funds in redraw and offset if available.

To discuss the best option for you, customers may call NAB Assist on 1800 701 599. Business customers struggling with the impacts of Covid are encouraged to call their banker or the NAB Business Customer Care Team.

Contact SF Capital

Our thoughts are with everyone who is living under the current lockdown situation, and especially those who are in one of the impacted industries. SF Capital’s brokers are standing by our clients and are ready to help in any way we can. Please contact your broker should you need to talk about your situation.